A new theme has emerged recently; many companies have disclosed that 1H22 is shaping up to be a difficult period, in a sense continuing 2021’s woes, with relief only expected later in the year.

The latest company to bear this trend out is General Electric (GE). In last week’s investor newsletter, the industrial giant said supply chain tribulations, labor availability, and inflationary pressures will make their presence felt in 1H22 more so than typical seasonality and what had already been taken into account when the company provided guidance on January 25. Renewables, Healthcare and Aviation were all singled out as segments which will be most affected by current headwinds.

The company did not go as far as to alter any 2022 guidance metrics, but RBC’s Deane Dray thinks it would be prudent to make some adjustment to his 1H22 estimates. “This development is disappointing but not surprising, especially given the rash of second-half-weighted earnings stories we are seeing across the sector,” the 5-star analyst went on to say.

Accordingly, the analyst has “trimmed” 1H22 organic growth and margin forecasts for Renewable Energy, Healthcare, and Aviation, resulting in the 1H22 overall organic growth estimate falling from 6.6% to 4.4%. That said, the analyst has also increased 2H22’s organic growth forecast to 9.7% from the prior 9.2%.

Dray estimates the sudden update amounted to a proactive move from CEO Larry Culp to “get this message into the market” ahead of presentations at two “competitor” conferences this week.

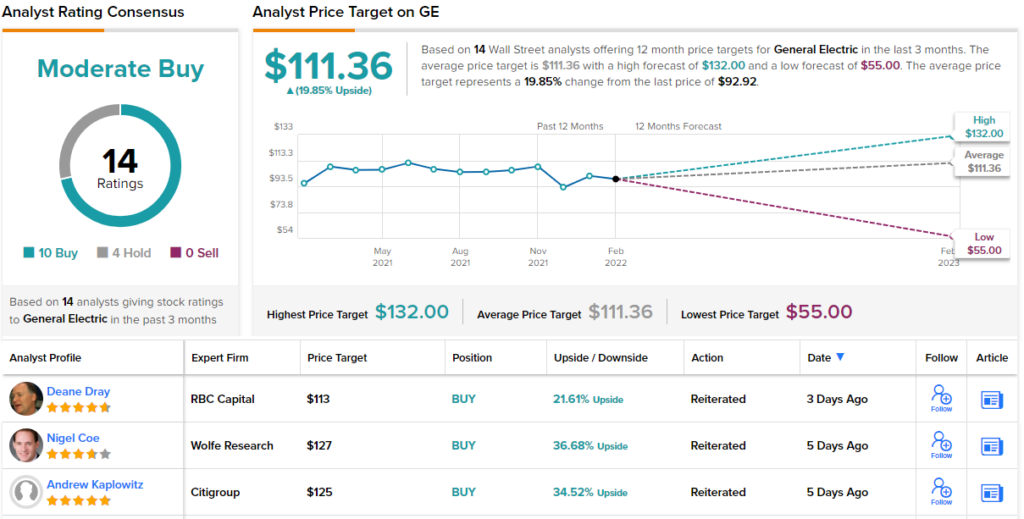

For Dray, however, the warning is disappointing but in “no way thesis-changing.” The analyst reminds investors that GE is a “break-up story not a 2022 earnings story.” In fact, to account for “higher peer multiples and modestly increased street-low 2023 estimates,” the analyst raised the price target from $108 to $113, which now suggests room for 22% growth over the coming year. Dray’s rating remains an Outperform (i.e., Buy). (To watch Dray’s track record, click here)

Turning now to the rest of the Street, where the average price target is very similar; at $111.36, the figure implies shares will climb by 20% in the year ahead. Rating wise, based on 10 Buys vs. 4 Holds, the analyst consensus rates this stock a Moderate Buy. (See General Electric stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.