Garmin (GRMN) is an international designer, manufacturer, and marketer of electronic devices, primarily geared towards fitness and outdoor applications.

The company’s products include smartwatches, air, land, and sea navigation, communication devices, and more.

Progressively gaining in popularity due to excellent product quality and practicality, Garmin has seen revenue steadily expand over the past decade. I’m bullish.

Recent Stock Performance

Caught in the middle of the broader market pullback, GRMN has seen a -12.2% year-to-date return, erasing the majority of 2021 gains.

While the recent retreat could even be seen as small compared to most technology names, the fact is that Garmin is facing some serious selling pressure.

The current stock price of $116.5 represents a 34.8% drop from 52-week highs. The stock has returned 143.8% over the past five years and 138.3% over the last 10, underperforming the Nasdaq composite index.

The Business

Garmin has been a pioneer in the wireless device industry for the last 30 years, as the company name has become a synonym for the use and commercialization of GPS services. Today, the usage of global positioning (GPS), global navigation satellite (GNSS) and other global satellite receivers, lies at the heart of the vast majority of the company’s offerings, providing accurate and reliable navigation information to users.

Garmin offers a broad range of solutions across five major business segments: Fitness, Outdoor, Aviation, Marine and Auto.

The company is also investing in its subscription plans, looking to create a recurrent revenue stream. In addition to the boost in revenue, subscription-based sales also help expand margins and create an ecosystem for customers.

Garmin’s subscription, hardware, and software-based revenue stream provide an optimistic growth outlook for the company.

Macroeconomic Factors

Beginning with an apparent value/growth rotation caused by elevated inflation and valuations that had arguably stretched too far, investor fear is now expanding due to the Russian invasion of Ukraine.

Markets hate uncertainty and a threat to world peace, and soaring oil and commodity prices are fueling a broader-market bearish sentiment.

As technology stocks face the most pressure, Garmin will struggle to find its footing, unless the macroeconomic outlook somewhat improves.

Financials

Garmin has grown revenues at five and three-year CAGRs of 10% and 14%, respectively, while net income is increasing a bit more aggressively, at five and three-year CAGRs of 16%.

Both revenue and net income are projected to continue growing, on track with historical rates, for the next few years.

In a highly competitive industry, Garmin has managed to maintain strong profit margins. The company reports an impressive 58% gross margin that has steadily hovered above 50% for the last decade. EBITDA and net margins of 27.5% and 22% reinforce the impressive profitability outlook Garmin displays, beating handily sector and market averages.

What is more impressive than the size of Garmin’s margins, is their consistency. Considering that increasing subscription revenue can also help increase profitability, the company is well positioned for the future. Even though free cash flow margins hover lower, around the 10% range, they are still far from concerning.

For the 2021 fiscal year, the company brought in $1 billion in cash from its operating activities. Increasing cash flow efficiency will be key as the company seeks more investor attention and looks to improve its value proposition.

On the balance sheet side, Garmin displays a very healthy outlook. An increasing cash and equivalents stockpile is now almost $2 billion, while at the same time the company carries virtually no debt.

Current and quick ratios of 2.9 and 1.9 should put to rest any short-term liquidity concerns as well. Garmin has also managed to maintain and even expand inventory levels, despite significant supply chain disruptions.

Dividend

Garmin offers investors an attractive 2.4% dividend yield, higher than the sector and market average.

Income distributions are growing at five and three-year CAGRs of 10% and 16%, outpacing even the current abnormal inflation rate. Garmin currently displays a 46.1% payout ratio.

Finally, the company’s share count has stayed flat over the past decade at around 193 million shares.

Valuation

By most accounts, Garmin trades at a mostly fair valuation. A P/E ratio of 20 seems reasonable, even during the current market conditions, while a 4.3 P/S ratio does appear a bit pricey.

Especially when considering that Garmin does not offer any aggressive sales growth outlook.

Wall Street’s Take

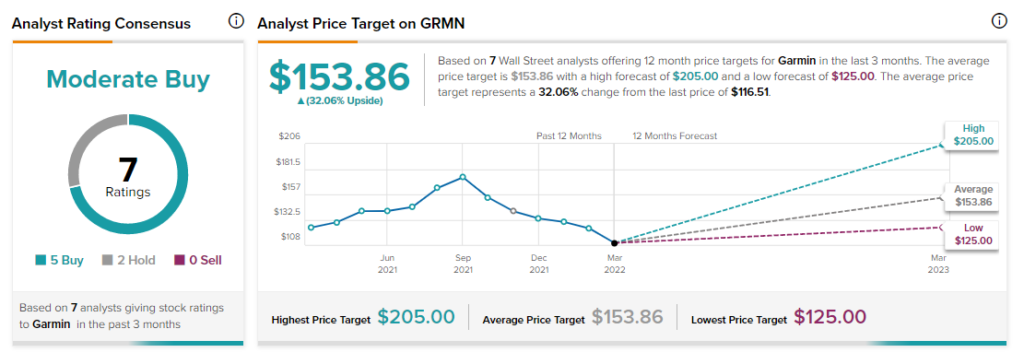

Turning to Wall Street, Garmin has a Moderate buy consensus rating, based on five Buys, two Holds, and zero Sells assigned in the last three months.

The average Garmin price target is $153.86, representing 34\2.1% upside from current price levels, with a high forecast of $205, and a low forecast of $125.

Final Thoughts

After all things are considered, Garmin maintains an effective business model, centered around high-quality products.

The company’s financials look strong and, especially in the case that broader market turmoil causes the stock price to drop further, GRMN would offer a good investment choice.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure