Viewership of live sports is immensely popular, as viewers tune in to watch live action in the United States.

Indeed, according to a Statista report, viewership for live sports content in the U.S. is likely to rise from 154.4 million in 2019 to 160 million by 2024.

Using the TipRanks Stock Comparison tool, let’s compare two sports streaming companies, FuboTV and DISH Network, and see how Wall Street analysts feel about these stocks.

I am neutral about both stocks mentioned in this article.

FuboTV (FUBO)

FuboTV is a live television streaming platform for sports, entertainment, and news. The company primarily derives its revenues from the sale of its subscription services and the sale of ads in the United States.

In Q2, FUBO’s revenues soared 196% year-over-year to $130.9 million and surpassed the Street’s estimate of $118.9 million. The rise in revenues was driven by a 281% jump in its advertising revenues and an increase of 189% in subscription revenue.

Its adjusted loss narrowed down to $0.38 a share compared to a loss of $1.46 a share in the prior-year period. Furthermore, it compared favorably to the analysts’ estimate of a loss of $0.50 per share.

The company’s management stated on its earnings call that it is looking at developing its business strategy through the intersection of three business trends: a decline in pay-TV, the shift of “TV ad dollars to connected devices; and online sports wagering, a market opportunity which we believe complements our sports-first live TV streaming platform.”

Considering this strategy, FuboTV intends to launch its own Sportsbook for game wagering by the end of this year. Indeed, David Gandler, Co-Founder and CEO of FuboTV said on its earnings call, “The launch of our own Sportsbook is an important driver of the strategy as we aim to develop a flywheel, turning passive viewers into active participants, defining a new category of interactive sports entertainment television.”

Giving more details about the Sportsbook, Gandler added that the company is looking at the Sportsbook to “to be a holistic and hyper-personalized betting experience, reflecting what the user is watching on fuboTV at that very moment.”

Late last month, FUBO also announced that it will run a second round of beta tests on its predictive, free-to-play games and FanView live stats during the streaming of the South American Qatar World Cup 2022 Qualifying matches (CONMEBOL) in September. (See FuboTV stock chart on TipRanks)

In June, another beta test during CONMEBOL saw viewer engagement rise as watch time increased by 37%.

Following the news, Roth Capital analyst Darren Aftahi believes that “if FUBO can prove another lift in user engagement above June’s level, it could help build FUBO’s value proposition of being able to enhance its monetization and platform differentiation and create a flywheel for subscriptions and engagement, often a topic of skepticism amongst bears on the name.”

The analyst has a Buy rating and a price target of $45 (63.9% upside) on the stock.

Analyst Aftahi is also positive about the recent approval granted to FUBO to engage in online and mobile event betting in the states of Arizona and Iowa. Moreover, even before the launch of the company’s first official sportsbook, Fubo has already entered into a multi-year partnership with the New York Jets club and will be an Official Sports Betting partner of the club.

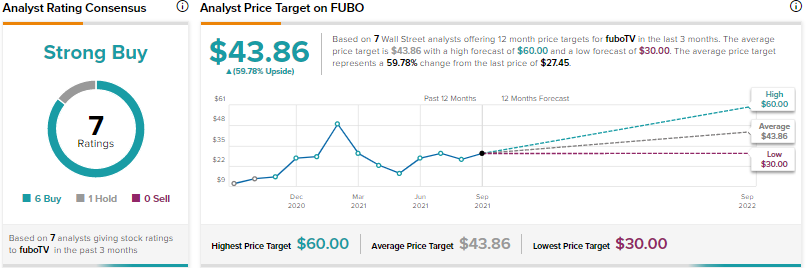

Turning to the rest of the Street, analysts are bullish about FuboTV, with a Strong Buy consensus rating, based on 6 Buys and 1 Hold.

The average FuboTV price target of $43.86 implies 59.8% upside potential from current levels.

DISH Network Corp. (DISH)

DISH Network has two primary business segments: Pay-TV and Wireless. The company’s pay-TV business consists of its pay-TV services and its linear television streaming service, Sling TV. Dish’s wireless business consists of pre-paid and postpaid retail wireless services and the deployment of 5G network.

Dish primarily competes with FuboTV through its Sling TV service.

In Q2, Dish’s revenues jumped 40.8% year-over-year to $4.49 billion versus consensus estimates of $4.43 billion. Diluted earnings came in at $1.06 per share, surpassing analysts’ estimates of $0.88 per share.

The company’s subscriber losses narrowed to 67,000 in Q2 versus a loss of 96,000 subscribers in the same quarter a year back. At the end of Q2, DISH had 10.99 million pay-TV subscribers. This included 8.55 million DISH TV subscribers and 2.44 million Sling TV subscribers. (See DISH Network stock chart on TipRanks)

Pay-TV services in the U.S. have been bleeding subscribers for quite some time now, as streaming services become increasingly popular. However, in Q2, according to J.P. Morgan analyst Philip Cusick, pay-TV services lost only 1.35 million subscribers, versus the analyst’s estimate of subscriber losses of 1.63 million.

The analyst estimates that subscribers to virtual multichannel video programming distributors (MVPD) like Dish’s Sling TV increased by 271,000, versus the analyst’s estimate of 303,000 subscribers. Indeed, Sling TV had net additions of 65,000 subscribers in Q2.

Virtual MVPDs are over-the-top streaming services that provide viewers with content from cable and broadcast networks as well as streaming providers.

Interestingly, Dish’s management acknowledged on its Q2 earnings call that sports viewership on broadcast networks is declining as sports streaming gains momentum. This could bode well for the company’s Sling TV service as it already offers various sports channels and recently launched the Barstool Sports Channel, which would offer sports and pop culture content.

Analyst Cusick has a Sell rating and a price target of $45 (1.7% upside) on the stock.

It remains to be seen how DISH navigates the pay-TV and virtual MVPD environment. However, analysts seem to be focusing more on the company’s wireless venture. DISH is intent on building out the first “cloud-native, OpenRAN [open radio access network]-based 5G network reaching over 70% of the population by 2023” in the United States.

Cusick referred to DISH’s agreement with AT&T, saying that he was hesitant on the stock. He worries that as other telecommunication companies including AT&T run towards 5G “there will be little room for Dish to maneuver and create a differentiated network that customers need to work with.”

In July this year, Dish entered into a long-term strategic Network Services Agreement (NSA) with AT&T (T), resulting in AT&T becoming the primary network services partner for DISH Mobile Virtual Network Operator (MVNO) customers.

An MVNO is a wireless service operator that does not own the network infrastructure over which it provides its services.

Turning to the rest of the Street, analysts are cautiously optimistic about Dish Network, with a Moderate Buy consensus rating, based on 4 Buys and 4 Holds.

The average Dish Network price target of $52.31 implies 18.2% upside potential from current levels.

Bottom Line

While analysts are cautiously optimistic about DISH, they are bullish about FuboTV. It is important here to note that while DISH seems to be concentrating more on its wireless business, it also seems to be looking at expanding the viewership for SlingTV by adding new channels such as Barstool Sports.

In contrast, FuboTV is looking at utilizing its existing viewership and aims to increase viewer engagement further through its foray into online sports betting.

Based on the upside potential over the next 12 months, FuboTV seems to be a better Buy.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance