fuboTV’s (FUBO) growth metrics have been mightily impressive, but the sport-first streamer is still piling up the losses. The company is banking on sports betting to help it eventually turn a profit and the early signs here are promising. At least that is the opinion of Roth Capital analyst Darren Aftahi.

Recent times have seen the company announce a slew of partnerships and new market access deals for its mobile sports betting platform. The most recent is the long-term partnership formed with Houston’s professional soccer teams, Houston Dynamo and Houston Dash, although sports betting is not yet legal in Texas.

While Aftahi notes the deal mostly involves marketing and promotional sponsorship of the teams, it could assist with building “brand awareness” both for fuboTV and the sportsbook across the country, while the marketing campaigns and user engagement features could “serve as a steppingstone to sports gaming if/when legalized” in Texas.

It also brings the market access agreements up to nine and follows a flurry of recent activity in the field. By leveraging its partnership with Caesars Entertainment and expanding on its current New Jersey deal, the company has gained access to Mississippi, Louisiana, and Missouri. Furthermore, the company gained market access in Ohio by making use of its marketing partnership with the Cleveland Cavaliers.

Leveraging its existing relationships eases the barriers to entry in these states while the team-related marketing campaigns “expands” brand awareness.

It all bodes well for the future and brings the company closer to having a “robust” gaming platform, according to Aftahi.

“While the sportsbook is still in the very early stages,” the 5-star analyst summed up, “We see this as the beginning of a proof-of-concept model that can later potentially foster better economics.”

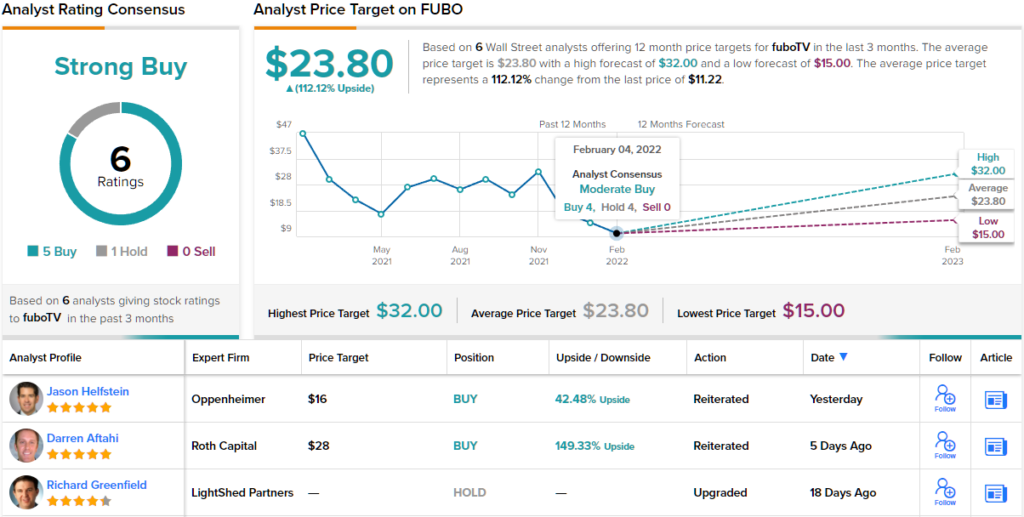

To this end, Aftahi maintained a Buy rating on FUBO, along with a $28 price target. Should the figure be met, investors are looking at one-year gains of a hefty 150%. (To watch Aftahi’s track record, click here)

What does the rest of the Street have in mind for FUBO? The stock currently has a Moderate Buy consensus rating, based on 4 Buys vs. 2 Holds. However, the outlook is far more conclusive where the share price is concerned. Going by the $23.80 average target, shares are expected to climb 112% higher over the one-year timeframe. (See fuboTV stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.