Fortinet (FTNT) is a California-based cybersecurity company that’s absolutely skyrocketed over the past year. Indeed, any stock that’s up approximately 113% over the course of a year is a stock worth taking a deeper dive into.

What’s interesting about Fortinet is that this is what many would call a “legacy” business. Started in 2000, right around the previous tech bubble, Fortinet is a stock that’s provided absolutely astronomical returns for long-term investors bullish on the growth of cybersecurity needs over time.

This secular catalyst is one that’s impossible to ignore, and we’ll touch on that more in a minute. Additionally, considering Fortinet’s clientele base includes a range of large corporations and government entities all over the world, this is a company with some serious cash flow stability.

Fortinet went public in 2009 and debuted on Nasdaq, raising $156 million in its IPO. Over the course of the past 13 years, FTNT stock has provided long-term investors with returns of more than 3,500%.

There’s a lot to like about this long-term trajectory. However, the question remains – is this sort of performance repeatable in the future?

Currently, I’m bullish on Fortinet’s prospects moving forward. Let’s dive into what investors may want to know about this cybersecurity stock.

Fortinet Stock Bolstered by Strong Business Model

Looking at Fortinet stock, some investors can be enamored simply by the returns this company has provided over time. In doing so, many investors may lose sight of the core business that’s driven this growth over time.

Before diving into why FTNT stock is rising at such a rate, investors should know what the company does. Fortinet sells physical products like FortiGate firewalls, network security, security fabric and threat management appliances. It provides all these services by using its own software, called FortiOS network operating system.

Its technology makes it a forerunner in the network security sector. Most of its business comes from the U.S. (44%), however Fortinet is rapidly expanding in countries such as India, England and Canada.

Given the company’s impressive market share in a relatively fragmented industry, many investors view Fortinet as a broad-based play on cybersecurity growth. This has led to relatively steady growth over time, providing long-term investors with a continued strong thesis to own this stock.

Currently, Fortinet’s market capitalization of more than $51 billion is among the highest in the industry. However, the company’s price-earnings ratio has recently dipped under 100, suggesting Fortinet stock is growing into its valuation.

Does Fortinet Stock Have Long-Term Upside Potential?

The reality is that Fortinet stock still trades at a price-earnings ratio around 94. That’s high, for any established company. Of course, the company’s revenue growth around 30%, year-over-year, as well as earnings growth, provide a strong thesis as to why this valuation is so high.

However, there are many who believe that this valuation could cause the company problems in the near-term. Given the recent announcements from the Federal Reserve that interest rates are going to rise, and that the Fed’s balance sheet is likely to be reduced meaningfully, this hawkish environment doesn’t bode well for Fortinet in the near-term.

That’s the near-term. Longer-term investors may be less-dissuaded by this current environment. That said, since listing following the Great Recession, Fortinet stock hasn’t had to weather a meaningful tightening regime by the U.S. central bank. It’s entirely possible that we could be entering a prolonged period of hawkish monetary policy, something investors in all growth stocks appear to be preparing for.

Macro catalysts aside, it does appear that the overall outlook for the cybersecurity space is strong. A number of high-profile hacks this past year have shed light on just how little most large companies (and even governments) are spending on cybersecurity. For companies like Fortinet, an increase in spending alongside rising cyber crime, could be a major catalyst for the long-term. This is the catalyst many long-term investors are focusing on, regardless of the macro environment.

What are Analysts Saying about FTNT Stock?

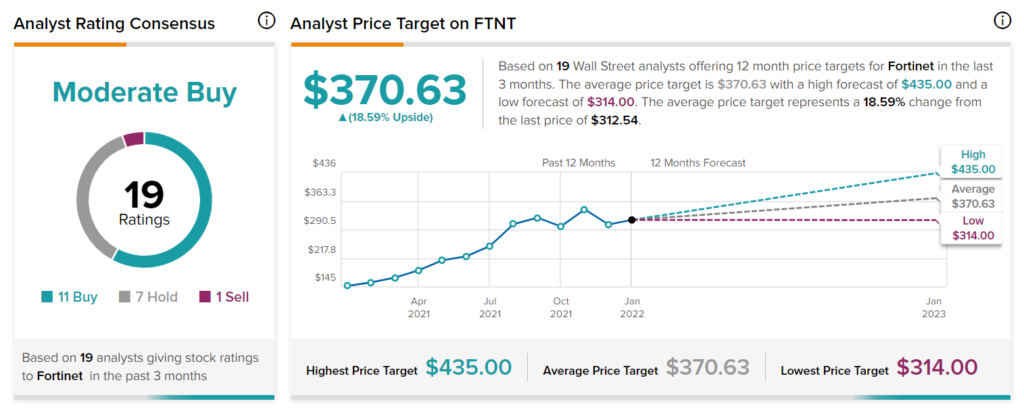

As per TipRanks’ analysts rating consensus, Fortinet is a Moderate Buy. Out of 19 analyst ratings, there are 11 Buy recommendations, seven Hold recommendations, and one Sell recommendation.

This stock has an average price target of $370.63, implying an upside of 18.6%. Analyst price targets range from a high of $435 per share to a low of $314 per share.

Bottom Line

As far as top cybersecurity stocks go, Fortinet has to be right up there with the best. This company’s strong long-term performance indicates not only market share stability, but also a strong outlook over the long-term. Large customers want established solutions, and in this regard, Fortinet comes out ahead.

Of course, 2022 could provide a bumpy ride for all growth stocks. While Fortinet’s valuation has improved over the past year, questions are whether this company will be able to grow its top and bottom line at a similar rate, moving forward.

That said, the long-term outlook for Fortinet remains strong. There’s a reason most investors remain bullish on this stock. Indeed, Fortinet could be the one cybersecurity holding every investor looking for growth in 2022 should consider right now.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure