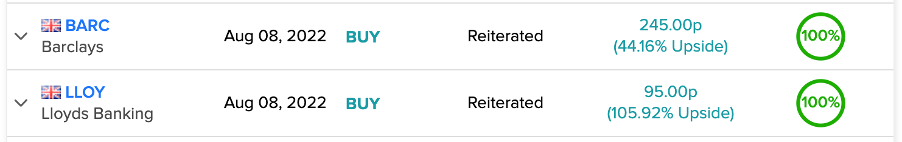

Analyst Andrew Coombs mainly covers financial and banking stocks and is highly bullish on the sector – today, we discuss two banking giants Barclays (GB:BARC) and Lloyds Banking (GB:LLOY) on which he has a 100% success rate.

Coombs is ranked 635 out of 7,987 analysts on TipRanks and has generated an average return of 16.3% per rating.

He has a success rate of 72%, with 55 out of 76 ratings being successful.

According to the TipRanks Star Ranking system, analysts are measured on three parameters, namely success rate, average return, and statistical significance. This tool makes it easy for the investor to choose the analyst and trust their advice in making investment choices.

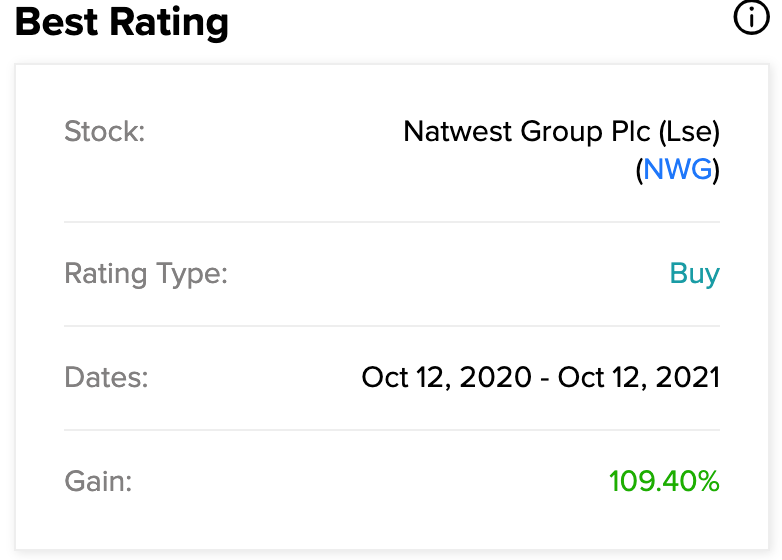

Coombs’ most profitable rating so far was the NatWest Group (GB:NWG) between October 2020 and October 2021, which generated a gain of 109.4%.

Let’s discuss the stocks in detail.

Lloyds Banking

Lloyds Bank is among the biggest financial companies in the UK, with a customer base of 26 million.

The group provides retail and commercial banking services under various brands such as Bank of Scotland, Halifax, Scottish Widows, and more.

The bank is already benefiting from higher interest rates set by the Bank of England to combat rising inflation. This was clearly visible in its 2022 half-year results, where it reported a 12% jump in its net income of £8.5 billion.

Based on such favourable economic conditions, the company raised its full-year guidance numbers. The bank now expects its net interest margin to be higher than 2.8%.

Andrew Coombs believes the bank has a very constructive outlook and said, “Lloyds has comfortably beat expectations and guided to a higher full-year net interest margin.”

Lloyds generates a lot of its revenue from mortgage lending, and the bank is feeling the pinch from the downturn in the housing sector.

Is Lloyds stock a good buy?

Last month, Coombs reiterated his Buy rating on the stock at a target price of 95p, with an upside of 105.9%

According to TipRanks’ analyst rating consensus, Lloyds Banking has a Moderate Buy rating based on eight Buy, two Hold, and one Sell recommendations.

The LLOY share price forecast is 66.8p, which is 41.4% higher than the current price level of 47.3p.

Barclays

Barclays is a global banking institution offering a diverse range of services across the UK, the U.S., India, China, and France among others.

Barclays also offers investment banking services along with its retail and commercial banking. This diversification of income makes Barclays well-placed in the current economic environment.

The company’s weaker performance in investment banking in the first half of its 2022 results was offset by higher interest rates in retail and commercial banking. Barclays’ total income increased by 16% to £13.2 billion. The income from its Corporate and Investment Bank segment (CIB) was up by 21%.

The net interest income grew by 22% to £4,763 million as compared to the previous year.

Andrew Coombs commented on the first-half results, “The magnitude of the fixed-income strength and equities weakness is somewhat surprising. As always with an investment banking-led revenue beat, the debate will be to what extent the market extrapolates this to 2023 and beyond.”

Is Barclays a buy or a sell?

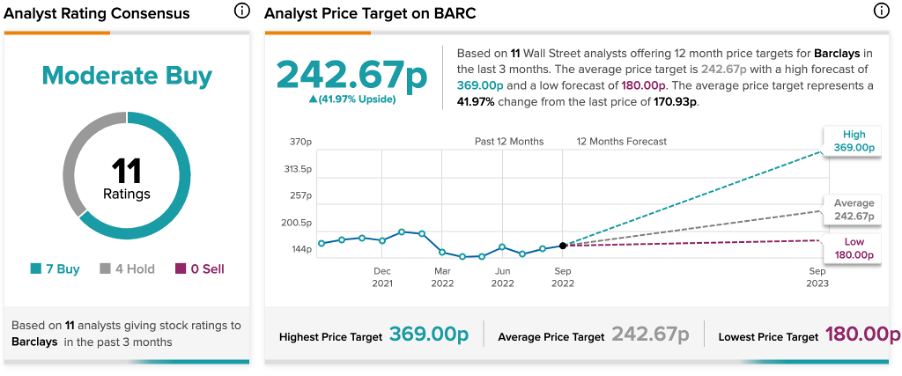

According to TipRanks, Barclays stock has a Moderate Buy rating, based on recommendations from 11 analysts.

The BARC target price is 242.6p, which shows an upside potential of 42%.

Conclusion

Investors can add these stocks to their portfolios as a safe bet during the inflationary period, based on Coombs’ in-depth research on these companies and his experience in the financial sector.

Coombs has a Buy rating on both the stocks.