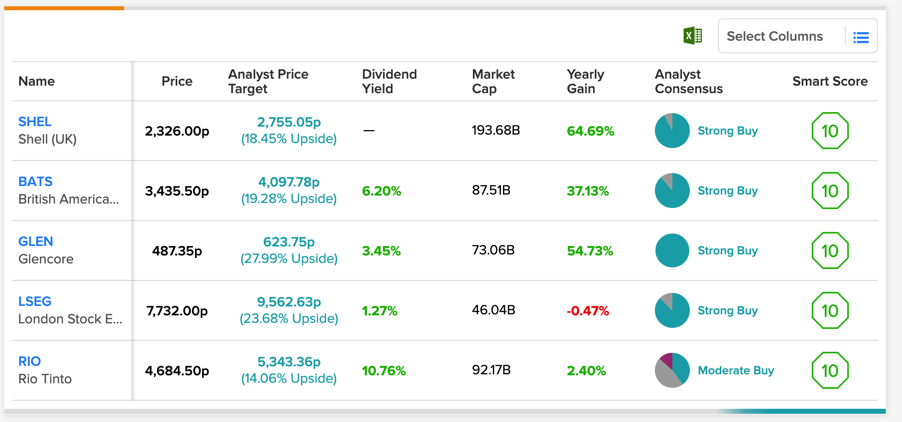

There’s no denying we live in turbulent economic times – but some stocks are blooming amid warnings of recession: here are five such stocks that have good analyst coverage along with Buy ratings on TipRanks.

Oil and gas company Shell (GB:SHEL), tobacco manufacturer British American Tobacco (GB:BATS), commodity trader Glencore (GB:GLEN), financial company London Stock Exchange Group (GB:LSEG), and metal and mining company Rio Tinto (GB:RIO) are five frequently-rated stocks which offer the promise of good returns.

We used TipRanks’ Shares Screener tool to compare the stocks; let’s see what makes them favourites of top analysts.

Shell (UK) Stock

Shell is an oil and gas exploration company with operations in around 70 countries.

The stock was recently trending when the company announced Wael Sawan as its new CEO, following Ben van Beurden’s decision to step down after 40 years with the company. As the company is focused on a net-zero energy future by 2050, it is in the right hands, as Sawan was heading the renewable business at Shell and brings a vast experience on the table.

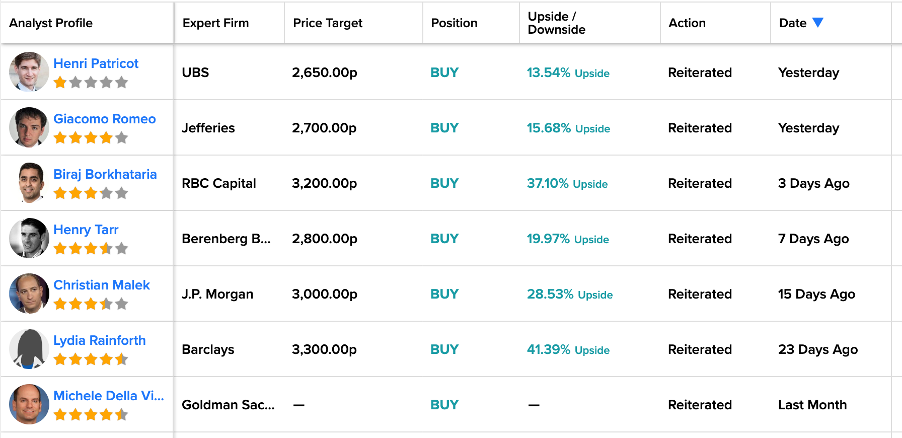

According to TipRanks, Shell stock has a Strong Buy rating. The company enjoys the wide coverage of 13 analysts, out of whom 12 have made Buy recommendations.

The SHEL share price forecast is 2,755p, which is 19% higher than the current price level.

British American Tobacco Stock

BAT is a multinational cigarette manufacturer with many market-leading brands.

The company has successfully incorporated the new category segment in its business, which was started in 2019.

As the tobacco industry shifts towards nicotine and smoke-free products, BAT is well-placed to ride along with its new category brands such as Vuse, Glo, Velo, etc.

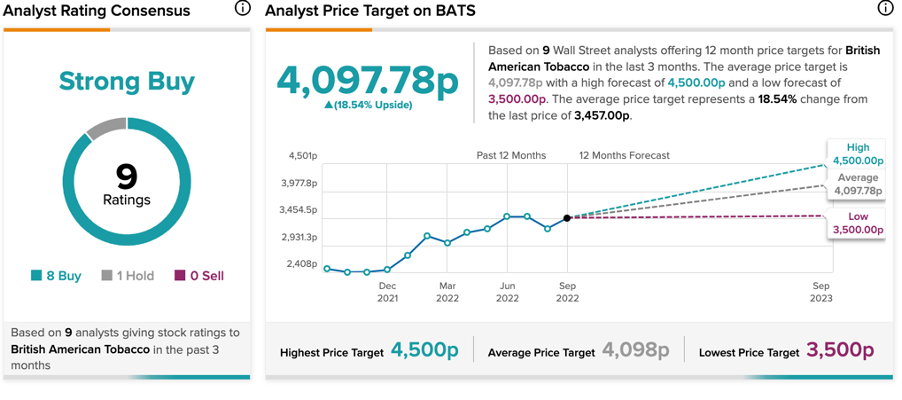

BAT is a stable dividend payer and currently has an attractive dividend yield of 6.2%.

The BATS target price is 4,097.7p, which shows a growth of 18.5% on the current price level.

Glencore Stock

Glencore produces a wide range of metals and minerals such as copper, nickel, zinc, and various other natural resources.

The company is riding high on its strong performance in its half-yearly results for 2022. Earnings jumped by 119% and revenues by 43%, driven by record coal prices. As the company’s profits are highly dependent on commodity prices, share prices remain volatile. Still, the stock had been trading up by 60% in the last year.

Speaking of the future, the company’s coal business is all set to witness a further increase in demand due to gas export disruptions from Russia. The company is expecting huge profits in the full-year results of 2022.

The company has a Strong Buy rating based on 12 Buy recommendations from high-rated analysts on TipRanks.

The GLEN target price is 623.7p, which has a 27.5% upside on the current price level.

London Stock Exchange Group Stock

The London Stock Exchange Group has a balanced portfolio of recurring revenue-generating divisions, with a majority of income coming from Data and Analytics.

In its half-year results for 2022 the company posted strong growth across all its segments with total profits up by 21.9% to £1.06 billion. The data and analytics segment contributed 65% to the total income and is well-placed for stable income in the future.

The company remains on track to achieve its full-year targets, along with cost synergies of £100 million in 2022.

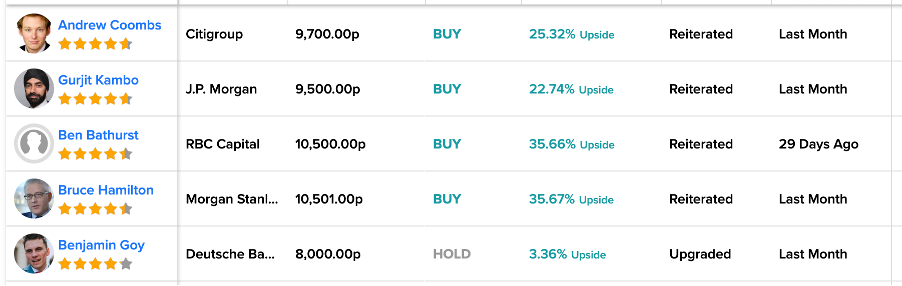

The stock enjoys a buy rating from a lot of five-star-rated analysts on TipRanks.

The LSEG target price is 9,562.6p, which has an upside potential of 23%, with a high forecast of 10,500p.

Rio Tinto Stock

Global mining company Rio Tinto is one of the best dividend-paying companies in the market. It has a dividend yield of 10.76% as compared to its industry average of 1.99%.

The share price has been shaky of late as the company’s earnings were lower than expectations in its half-year results announced in July 2022. This was a result of the decline in iron-ore prices, which is one of its main products.

Talking about the outlook, RIO is focusing on metals like nickel and lithium, which are both critical in the battery market. This provides a huge scope of opportunity for the company, with another stable cash flow segment under its umbrella.

According to TipRanks, Rio Tinto stock has a Moderate Buy rating, based on 15 analysts’ recommendations.

The RIO share price forecast is 5,343.4p showing a change of 13% on the current trading price.

Conclusion

These companies are big, leading names in their respective sectors. Most of them are also stable dividend payers, which makes them even more attractive!