Despite challenges in the global supply chain, First Solar (FSLR) continues to manufacture products, expand production and enter new markets. In 2023, two new First Solar production plants will start operating, which will double the total capacity.

I expect revenues to double in the coming years, as the demand for the products is very high, and FSLR has pre-orders for several years to come. In addition, through a partnership with PVO International, the company expands into the photovoltaic market in Europe. I am bullish on the company.

Company Profile

First Solar, Inc. manufactures solar panels and provides service, support, and recycling. The company sells modules in the U.S., Western Europe, India, Latin America, Brazil, the Middle East, Japan, Australia, and Southeast Asia. Furthermore, the company manufactures and supplies equipment for factories with a similar production profile. The company was founded in 1990, and its headquarters are in Tempe, Arizona.

Industry Opportunities

According to IHS Markit, installed PV capacity worldwide is expected to double in size over the next five years.

First Solar currently has three manufacturing facilities, one domestic and two international in Southeast Asia. Many of the world’s largest grid-connected photovoltaic power plants are built by First Solar and are in operation across the globe.

PVO International has become the official distributor of First Solar in Europe. Through this partnership, low-carbon modules will be available to the growing PV markets in Europe and will help achieve ambitious zero-emission targets.

First Solar has an industry-leading module recycling program that recycles more than 90% of the semiconductors and glass used in its modules: glass is reused in new glass products, and semiconductors are reused in new First Solar modules.

Financial Performance

The revenue in the third quarter of 2021 decreased by 37% year-over-year to $584 million, driven by lower revenue in the system segment. The increase in revenue of the modular segment partially offset the losses in the system segment. Also, at the end of the quarter, 820 megawatts of modules remained in transit and were not recognized as revenue during the third quarter.

In 2018 the company began producing Series 6 panels, which were so successful that the company decided to focus on them. After that, the revenue began to grow, and strong demand for Series 6 continues today.

A significant growth driver is the construction of next-generation factories in Ohio and India, which will begin operations in 2023. First Solar’s six manufacturing plants in Ohio, Malaysia, and Vietnam have a combined capacity of 8 GW. The expansion of production in the United States and India will double the nameplate capacity to 16 GW in 2024. Given that demand for Series 6 is high and that FSLR already has 16.5 gigawatts of pre-orders through 2024, we expect First Solar will be able to make shipments and double its revenue.

In 2018, the gross margin was 9.94%, and the operating margin was -5.02%, today these figures are 24.5% and 17.95%, respectively. The net profit margin in the third quarter of 2021 was 17.26%. Margins grow as revenue grows. Thanks to processing services, the company partially offset the losses associated with high transport costs in the face of supply chain problems.

The high demand for products and strong financial position of FSLR allow the company to increase production. Although the gross margin declined due to supply chain problems, First Solar maintained its net profit margin at a comparable level. We expect margins growth to continue if supply chain problems are addressed in the coming years, as the company should become more efficient as it grows.

Valuation

In my opinion, Wall Street underestimates the potential impact of the launch of new manufacturing plants, which will double the company’s productivity (from 8 to 16 GW). Therefore, I valued the company based on two potential scenarios: 1) the Wall Street consensus on revenue 2) a gradual doubling of revenue from 2024.

I expect CapEx volume to decline following the launch of capital-intensive factories. Margins and other relative indicators are predicted based on historical dynamics and the current trend. The terminal growth rate is 5.5%. My assumptions are presented below:

- Wall Street Revenue Consensus

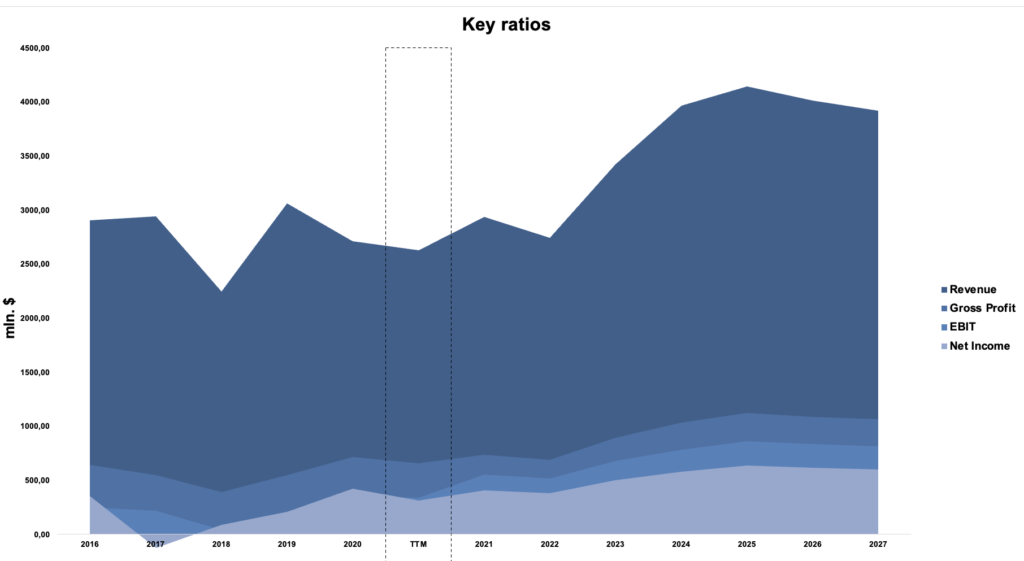

Based on my assumptions, the expected dynamics of key financial indicators are presented below:

With a Stable growth Cost of Equity equal to 10%, the Weighted Average Cost of Capital [WACC] is 9.7%.

With terminal EV/EBITDA equal to 12.63x, the company’s fair value is $8.9 billion or $84,22 per share. Thus, the company is trading around a fair price.

2. My scenario

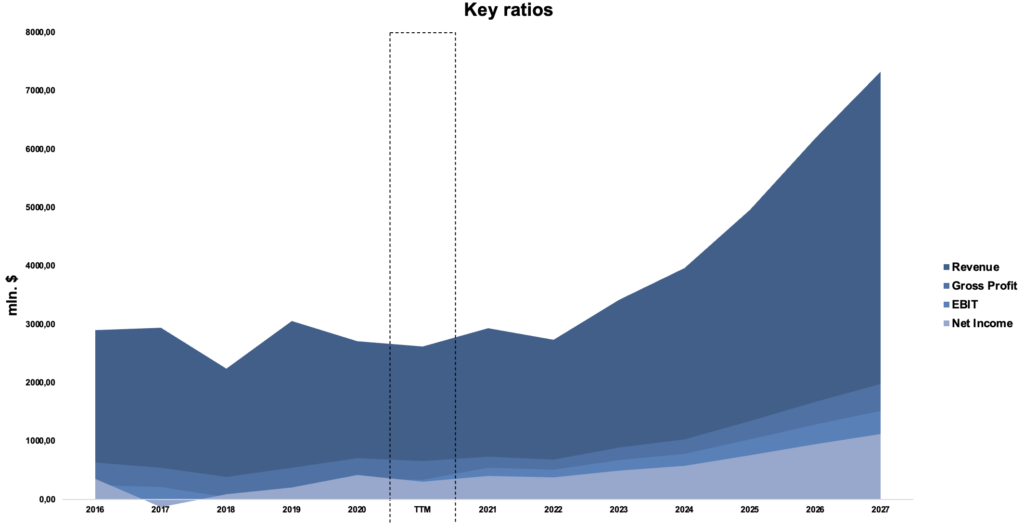

Based on my assumptions, the expected dynamics of key financial indicators are presented below:

With a WACC of 9.7%, the company’s fair value is $11.15 billion or $104,89 per share. Thus, the company is trading at a significant discount to FVM. Even if my scenario is too optimistic, the margin of safety is relatively high, since according to the first scenario, FSLR is also trading without a premium.

In terms of EV / Sales and EV / EBITDA multiples, the company does not look expensive compared to its main peers.

Wall Street’s Take

From Wall Street analysts, First Solar earns a Hold analyst consensus based on five Buy, nine Hold, and two Sell ratings. At $111.15, the average FSLR price target implies 31.3% upside potential.

Conclusion

First Solar is an excellent opportunity for a long-term investor, as the company is one of the leaders in the growing solar energy market. New plant launches in the U.S. and India could lead to explosive revenue growth as FSLR’s production capacity doubles.

The demand for the company’s products is high – First Solar already has pre-orders for 16.5 gigawatts until 2024. According to my valuation, the margin of safety for purchase is high.

Disclosure: At the time of publication, Vladislav Kolomeets did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >