Fertilizer prices were already high in 2021. Unfortunately, Russia’s invasion of Ukraine earlier this year has only added fuel to the fire, and fertilizer prices have been soaring since tanks rolled across the border.

The war in eastern Europe is creating a possible fertilizer shortage, which can have global disruptions for farmers’ livelihoods, output, and the overall cost of food.

Since the invasion of Ukraine, shipping companies have boycotted Russia, the world’s largest fertilizer producer, refusing to dock and collect goods from the country. As a result, Russian exports have plummeted, resulting in a major fertilizer supply shortage around the world.

Meanwhile, coupled with the high price of natural gas, a key component in fertilizer production, it is becoming unsustainable for European manufacturers to keep up with demand.

As we all know, fertilizer is a critical component in agriculture, so rising fertilizer prices will eat into farmers’ profit margins. Farmers may also be forced to reduce their crops in preparation for the spring harvest, potentially resulting in lengthy and huge food shortages. As a result of this, food costs would rise all around the world.

In light of the foregoing circumstances, investors might want to add fertilizer stocks to their portfolios. We’ve put together two fertilizer stocks that have posted great earnings results and have received a Smart Score of “Perfect 10.”

The Mosaic Company (MOS)

Mosaic is the leading manufacturer of potash and phosphate fertilizer in the United States. MOS shares, in particular, have risen by more than 60% year-to-date.

The demand for phosphate and potash in North America remained robust in 2021, and the trend is expected to continue this year. Mosaic is well-positioned to benefit from increased fertilizer demand around the world.

Last month, the company reported impressive fourth-quarter results, with revenues of $3.84 billion, up 56.3% year-over-year. Meanwhile, adjusted earnings came in at $1.95 per share, up from $0.57 per share the previous year.

Furthermore, the company is repurchasing shares aggressively to return funds to shareholders. Mosaic approved a new $1 billion share repurchase authorization in the fourth quarter, which will take effect immediately after the current program is completed. Also, Mosaic is a dividend-paying corporation with a current yield of almost 0.47%.

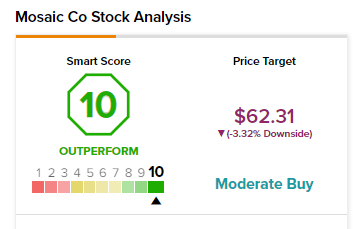

Mosaic has received a Moderate Buy consensus recommendation from Wall Street analysts, based on seven Buys and seven Holds. The stock is currently trading at $64.45, with an average MOS price target of $62.31, implying almost 3% downside potential from the current levels.

Other TipRanks’ metrics like Investor Sentiment and Smart Score remain encouraging.

Notably, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Mosaic, with 37.1% of investors increasing their exposure to MOS stock over the past 30 days. Meanwhile, MOS is performing well with a Smart Score of ‘Perfect 10.’

CF Industries Holdings, Inc. (CF)

CF Industries is the next company on the list. The corporation is a global leader in the production and distribution of nitrogen fertilizer and other nitrogen products.

The company is well-positioned to profit from increased nitrogen fertilizer demand in key countries.

In terms of financial performance, CF Industries had a successful fourth quarter. It saw a significant boost in earnings, jumping to $705 million from $87 million in the year-ago quarter. In addition, revenue increased by 130.5% year-over-year to $2.5 billion in the fourth quarter.

The corporation also returns capital to shareholders through share buybacks and dividends. The current dividend yield for the company is 1.09%.

Buoyed by this upbeat scenario, CF Industries’ shares have risen more than 42% year-to-date.

CF Industries has a Moderate Buy consensus rating on TipRanks, based on five Buys and nine Holds. As for price targets, the average CF stock price prediction of $96.23 implies almost a 4% downside potential from the current levels.

Meanwhile, CF Industries scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Bottom Line

The need for fertilizers is being fueled by high global demand, the tight supply crunch due to eastern European geopolitical factors, and a rebound in crop commodity prices. Both Mosaic and CF Industries are well-positioned to profit from this ongoing trend, and as a result, their stock prices may further rise in the coming days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure