Lyft (LYFT), the popular ride-hailing company, is facing financial challenges due to a combination of risk factors, all of which could keep it from generating profits and managing its finances effectively.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

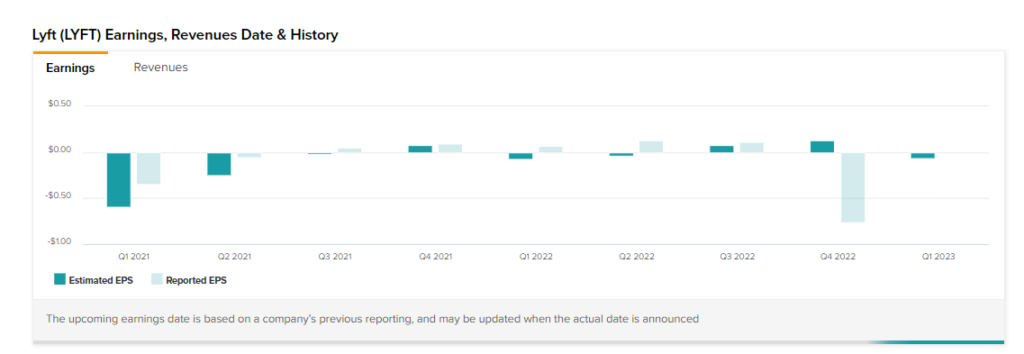

On February 9, 2023, Lyft announced its fourth-quarter earnings, when the company’s financial challenges became evident. Lyft estimated its EPS to be $0.13, but the reported EPS was -$0.76. The stock fell from $16.22 to $10.31, marking a 36.3% decline. This decline is indicative of the significant challenges Lyft is currently facing in managing its finances and generating profits.

What Happened to LYFT?

According to the company’s CFO, Elaine Paul, Lyft’s profit and loss statement is under pressure due to varying insurance renewal timings. This uneven distribution of insurance costs means that the expenses associated with insurance renewals are concentrated during certain periods and not evenly spread out throughout the year, which creates financial challenges for the company.

Moreover, Lyft’s adjusted EBITDA has been significantly lower than in previous quarters due to changes in how the company calculates its non-GAAP financial measures. These changes were made in response to SEC guidance issued in December 2021, which required all public companies to revise their non-GAAP financial measures to include insurance reserve adjustments for prior periods. As a result, Lyft’s adjusted EBITDA was negatively impacted, highlighting the challenges the company is facing in managing its finances.

While seasonality and lower prices are also contributing factors to Lyft’s projected decline in earnings, the impact of different insurance renewal timings and changes in adjusted EBITDA calculations are significant challenges that the company will need to address in the short- to medium-term. As the ride-hailing industry continues to evolve and competition intensifies, effective financial management and planning will be crucial for companies like Lyft to remain competitive and successful.

LYFT’s Risks – TipRanks Saw Them Coming

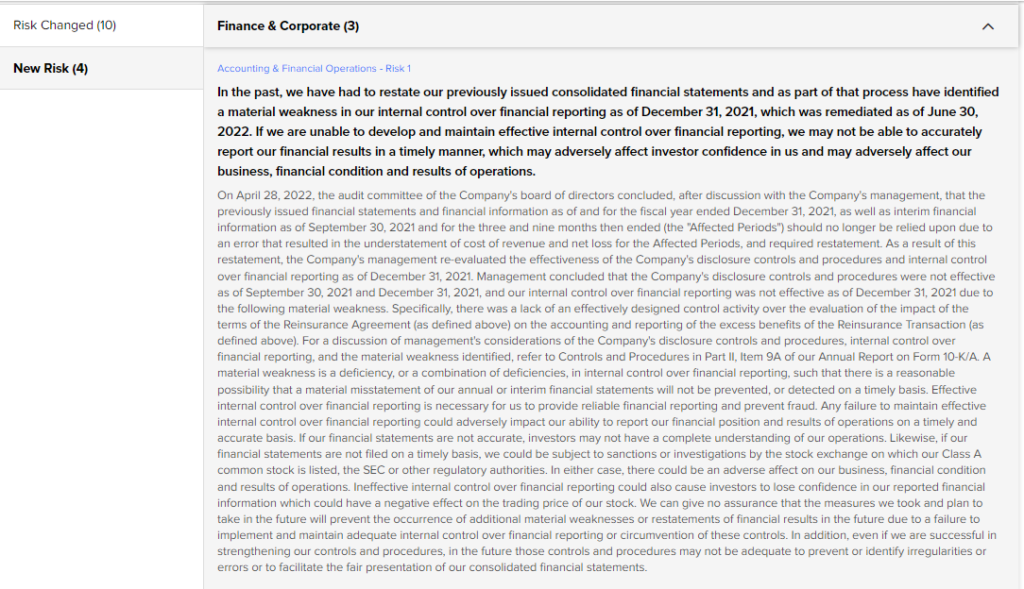

TipRanks users who regularly use the risk analysis tool were aware of the issues faced by Lyft, in terms of its internal controls over financial reporting.

On November 8th, 2022, the tool showed a new risk factor about Lyft’s material weakness in its internal controls, which was identified during the restatement process of its previously issued consolidated financial statements. While this weakness was remediated on June 30, 2022, the risk factor noted that failure to develop and maintain effective internal control over financial reporting could adversely affect the company’s financial results and investor confidence.

This indicates that the issue with the company’s internal controls is not a recent development and highlights the importance of monitoring such risks through analysis tools like TipRanks’ Risk Factor tool.

Conclusion

The recent announcement by Lyft regarding its projected decline in earnings highlights the ongoing challenges faced by ride-hailing companies, especially in a highly competitive and constantly evolving industry. However, for investors who TipRanks’ Risk Analysis tool, this news did not come as a surprise.

By providing users with access to timely and accurate information about a company’s financial health and risk factors, TipRanks helps investors stay ahead of the curve and make more informed decisions. As the ride-hailing industry continues to evolve, TipRanks’ Risk Analysis is just one example of the types of tools that can give investors a competitive edge in today’s fast-paced and ever-changing market.