The courtship in the sky finally concluded last week after Spirit Airlines (SAVE) finally accepted JetBlue’s (JBLU) offer to be acquired at $33.50 per share. The $3.8 billion deal also includes a $2.50 prepayment per share upon investor approval and a ticking $0.1 per month fee. A ticking fee is essentially a pay-for-delay structure that provides the buyer an incentive to ensure that a deal reaches fruition on time.

According to the Wall Street Journal, Spirit Airlines’ CEO, Ted Christie, commented, “Many things were said, but business is business.”

The development comes after a drawn-out competition between JetBlue and Frontier Group (ULCC) over Spirit and after the takeover candidate could not rally enough investor support for its now terminated $2.9 billion deal with Frontier.

The buildup to the acquisition was more than acrimonious, as over the months, Spirit defended its deal with Frontier and saw JetBlue as trying to fend off competition. JetBlue, for its part, said Spirit’s Board was not having the best of stockholder interests in mind.

The Significance of the Deal

The JetBlue-Spirit combination will help the former with its strategic growth with the ability to cater to more customers on a higher number of routes with low fares. The U.S. skies are currently dominated by American Airlines (AAL), United Airlines (UAL), Delta Airlines (DAL), and Southwest Airlines (LUV).

With Spirit, JetBlue now becomes the fifth biggest name in the industry and will be in a better competitive position. The deal helps JetBlue offer over 1,700 daily flights to over 125 destinations with greater relevance in airline hubs, including Las Vegas, Dallas, Houston, Chicago, and Detroit. Moreover, the combined entity will have 458 planes on a pro forma basis and an order book of more than 300 Airbus aircraft.

The CEO of JetBlue, Robin Hayes, commented, “By enabling JetBlue to grow faster, we can go head-to-head with the legacies in more places to lower fares and improve service for everyone. Even combined with Spirit, JetBlue will still be significantly smaller than the Big Four, but we will be much better positioned to bring the proven JetBlue effect to many more routes and locations.”

Additionally, JetBlue anticipates net annual synergies to be between $600 million and $700 million and an annual top line of about $11.9 billion based on 2019 levels. Significantly, it also expects the deal to be substantially accretive to its bottom line in the first full year upon closing.

The Path Ahead

The deal involves a $0.1 per share per month ticking fee beginning in January 2023 until the closing or termination of the agreement. At the same time, the transaction remains subject to closing conditions, approval from Spirit’s shareholders as well as regulatory approvals. The transaction is expected to close no later than H1 2024.

In the event that the transaction faces antitrust hurdles and is not completed, JetBlue will pay Spirit $70 million in reverse break-up fee and $400 million to its investors less of any amounts paid prior to termination.

Analysts’ Take on JBLU

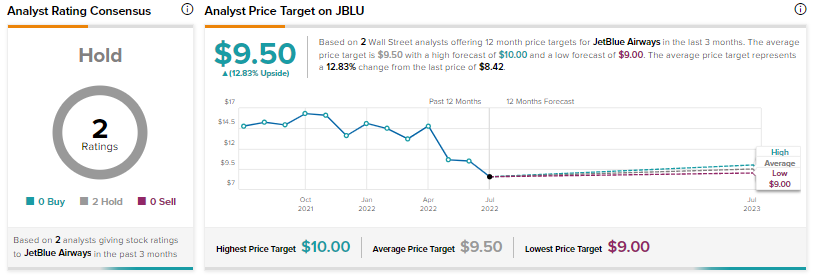

While JetBlue shares are down nearly 43% so far this year, the Street has a Hold consensus rating on the stock alongside a $9.50 average price target. This implies a 12.83% potential upside.

Hedge Funds Remain Positive about JBLU

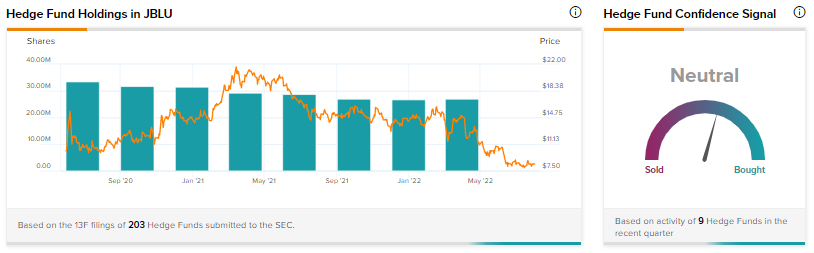

Despite the price decline, hedge funds seem to have spotted a major opportunity in the stock and have lapped up 219,300 shares in the last quarter. Notably, Jean Marie Eveillard’s First Eagle Investment has raised its JetBlue holdings by 115% recently.

Closing Note

With this mega move, JetBlue will now look to go head-to-head with the four bigger names that control over four-fifths of the market, but the combination will only have about a 9% market share.

This means JetBlue will have its task cut out for itself and how the victor with the Spirit trophy fares in the coming periods will be keenly watched.

Read the full Disclosure