From Thursday through Sunday, the new “The Batman” feature film exploded onto screens, delivering the third highest attended movie weekend of the past two years for AMC Theatres (AMC), with more than four million tickets sold globally. It didn’t hurt that, with $128.5 million it box office revenue booked over four days, “The Batman” easily delivered “the most successful opening weekend of all the first installments in the Batman series of films” (according to Quartz.com).

And yet, by the evening of the Tuesday after this boffo Batman weekend, AMC’s share price had fallen a stunning 17% from the share price it enjoyed on the day before the caped crusader’s arrival. So did investors simply not get the memo? Are they making a mistake in not realizing that “The Batman” has saved the day, and AMC stock is now a “buy?”

Not necessarily — at least not according to Barrington’s James Goss. The analyst explained that — with Batman or without him — AMC stock remains a pretty “speculative” investment, and is no sure thing.

In Q4, notes Goss, AMC’s revenues approached $1.2 billion, and earnings before interest, taxes, depreciation, and amortization were $159.2 million. CEO Adam Aron is being “diligent” about keeping costs in check, “operating at relatively constrained hours… offering fewer showings [to] limit the impact of labor and supply challenges, while maximizing the utilization of the footprint,” and “negotiate[ing] with landlords, vendors and creditors [to free] up liquidity,” the analyst opined.

Aron has refinanced AMC’s debt to lower interest payments and give the company some measure of “additional flexibility.” And he’s succeeded in “limit[ing] cash burn,” and even managed to generate some positive operating cash flow in Q4. Combined will well-timed sales of stock to raise cash, Aron has amassed $1.5 billion in cash on the company’s balance sheet (alongside, admittedly, nearly $10.8 billion in debt).

All these steps, admits Goss, have resulted in “improved… ability to sustain operations despite the challenging financial markets.” Nevertheless, the company’s financial situation remains tenuous, and the best rating Goss can bring himself to give the stock is Market Perform (i.e. Hold) — without making any promises on the stock’s price target.

What might AMC do to turn that “market perform” rating into a “market outperform?” The analyst notes that the CEO has “outlined a number of initiatives designed to create a more diverse business model beyond its core theatrical exhibition operations.” The company might, for example, issue co-branded credit cards to create new revenue streams and bolster customer loyalty to AMC. Or it might create its own cryptocurrency. (AMC has already introduced a series of Non Fungible Tokens for sale). AMC might even sell “AMC branded popcorn” in grocery stores “in packaged or microwavable forms.” (Don’t laugh. Goss says that could actually be “a substantial business.”)

As the analyst muses hopefully, “there is always a possibility that one or more [of these ideas] may gain traction.” In the meantime, however, investors should probably expect AMC to keep losing money while it seeks such traction. In Goss’s estimation, the earliest AMC might conceivably turn profitable again is… 2025.

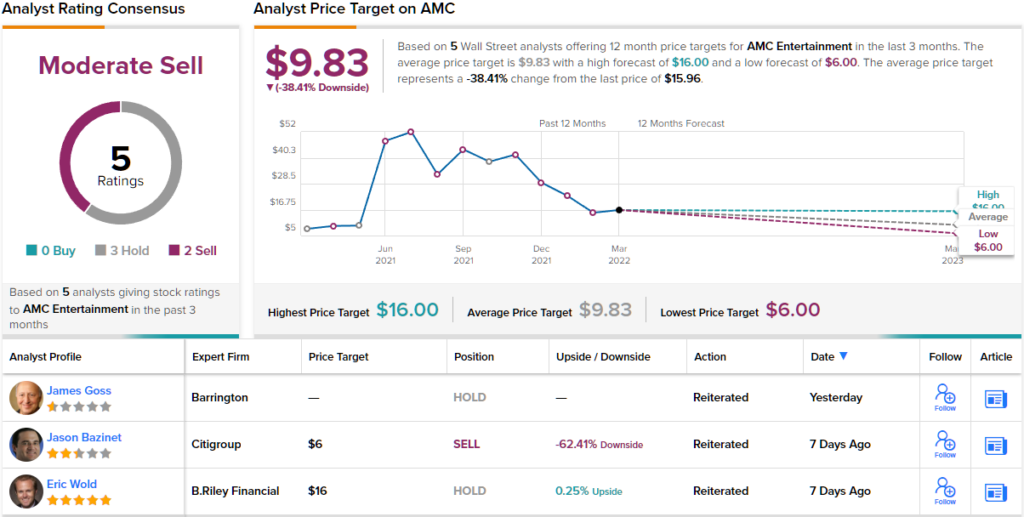

Looking at the consensus breakdown, the bears have it. Based on 3 Holds and 2 Sells received in the last three months, the word on the Street is that AMC is a Moderate Sell. At $9.83, the average price target suggests shares will be changing hands at ~38% discount a year from now. (See AMC stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.