Etsy, Inc. (ETSY) is an online global marketplace that brings together approximately 100 million buyers and 7.5 million sellers who have a passion for unique and creative goods. Etsy’s shares closed up 4% at $117.47 on April 13. Amid the ongoing tech sell-off, ETSY stock has lost 44% year-to-date and more than 46% over the past year.

Over the last four years, Etsy’s gross merchandise sales (GMS) have grown at a compound annual growth rate (CAGR) of 36.11%, with most of it contributed by the pandemic-driven online shopping drive. In Q4FY21 alone, Etsy’s GMS grew 16.5% year-over-year to $4.2 billion.

On the revenue front too, the last four years have witnessed a robust CAGR of 40.13%, and in Q4FY21, Etsy’s revenues grew 16.2% year-over-year to $717 million.

After capturing the hearts of millions of buyers and sellers online, what’s next on Etsy’s cards? Well, its executives have a very ambitious dream of becoming the next Amazon.com (AMZN)! But every aspiring dream comes at a price, and Etsy is facing one of its most difficult times in years. Some of the sellers are against the big dream and are even willing to undergo personal loss by shutting shops to display their discontent.

Can Etsy be the next Amazon?

In February, Etsy sent a memo to its sellers stating that it would hike the merchant fees paid by them for using the portal from 5% to 6.5% starting April 11. This is the first fee hike since 2018.

Standing by his strategy of competing with Amazon, Etsy CEO, Josh Silverman, said, “You’ve got to do something different.” The company noted that the increased fees will not affect the company’s bottom line. Instead, it will be used to spend on marketing, customer support, and artificial intelligence techniques to remove listings that do not meet Etsy’s policies.

Etsy is trying to increase its presence and become the next Amazon kind of e-commerce portal to scoop up a larger piece of the trillion dollar global e-commerce market. As per Statista, in 2021, global retail e-commerce sales stood at $4.9 trillion and are projected to grow by 50% over the next four years to $7.4 trillion by 2025.

However, the news of a 30% fee hike sent a spiraling wave of discontent among sellers who saw the hike eating away a chunk of their earnings.

Thousands of Etsy sellers signed an online petition for a one-week strike starting Monday, and few have even shut shops. Etsy shop owner Kristi Cassidy, who started the petition, believes that sellers must have the right to voice their opinions when such decisions are made. Sellers are also disgruntled about a few other things and are demanding that all of those issues be sorted out.

For one, the genuine sellers are asking Etsy to weed out the reseller shops that are selling mass-produced goods that they do not produce themselves. Secondly, Etsy sellers want to scrap the “Star Seller” program that rewards sellers based on immediate query responses and penalizes those that are slow.

The small-business owners at Etsy are unable to manage the pressure of quick responsiveness, especially on weekends when they are away. Replying to this, Mr. Silverman noted that it is in the best interest of sellers to give “great quality service to buyers.” Sellers earned $12.2 billion on the Etsy marketplace last year as opposed to just $5 billion in 2019, simply reflecting the huge opportunity sellers have to increase their income should they be proactive with customer support.

And lastly, sellers demand that Etsy let them opt out of offsite ads for their products that make more than $10,000 in annual sales. The company even asks sellers to offer free shipping to customers, which eats away at their margins further.

Sellers per se also have a reasonable stance when they say that higher advertising does not necessarily increase sales for them. This is because most of the items sold are handcrafted and require time to produce, which limits their volume of sales. Kristi Cassidy even states that because of this factor, she does not sell on bigger portals like Amazon.

Analyst Take on Sellers Strike

In light of the Etsy sellers’ strike, Guggenheim analyst Seth Sigman monitored the current number of unique items sold on the platform. The observation showed that this number is just -1% from the pre-strike figure at ~97 million and is notably +5% higher year-over-year.

Noting the same, Sigman said, “While the pushback seems louder vs. the last increase in 2018, we expect that this too will blow over, with an opportunity for the additional fee revenue to be reinvested starting in Q2 and supporting acceleration in the business. Ultimately, we see few if any alternatives to this marketplace today.”

Additionally, the analyst is yet to see the impact of the current chaos on the prices of the items sold on Etsy. Moreover, according to Sigman, “initial web traffic/app data suggests little slowdown.”

Sigman has a Buy rating on ETSY stock with a price target of $230, which implies a whopping 95.8% upside potential to current levels.

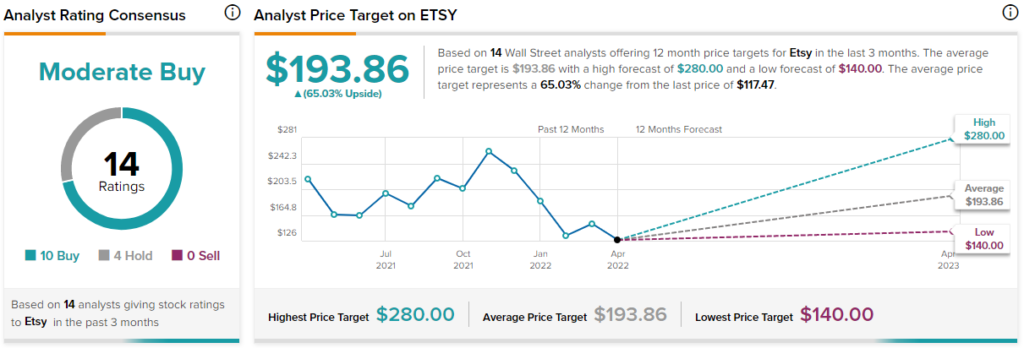

The other analysts on the Street have given ETSY a Moderate Buy consensus rating based on ten Buys and four Holds. The average Etsy price forecast of $193.86 implies 65% upside potential to current levels.

Ending Thoughts

In wake of the recent chaos at Etsy, the near-term performance looks blurry. However, it is noteworthy that there are very few niche marketplaces like Etsy for sellers to demonstrate their products, and the bigger players like Amazon have even higher fees for merchants and require the scale to operate, which the small businesses cannot afford.

In the long run, Etsy and its sellers will find common ground and all the steps taken for improving the business will prove beneficial for all. Moreover, with the stock price hovering significantly away from its all-time highs, it may be a good time to enter.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure