Shares of online marketplace Etsy (ETSY) are down nearly 40% so far this year.

I think shareholders should not be concerned about the decadent quality of performance. The stock price decline, affecting the entire consumer cyclical sector and not just Etsy, is mainly due to a stock market rotation away from specific sectors towards energy, consumer staples, and financial services sectors.

Investors want to take advantage of rising oil and gas prices, hedge against the risk of another economic recession, or be prepared for the expected rate hike by the Federal Reserve and other central banks.

Backed by the industry’s promising outlook, I think the stock has the tools to reverse the trend. Thus, I am bullish on this stock.

Online sellers and buyers can also trade through Etsy’s marketplaces of Etsy.com and Reverb.com. Here they can negotiate a variety of items belonging to different product categories.

Registered sellers can sell handmade products or vintage items. The latter must be 20 years or older. These products include jewelry, bags, clothing, home furnishings, toys, craft supplies, and various tools. The company operates globally.

Q3-2021 Results

Thanks to the addition of 7 million new buyers (though still below expectations) coupled with strong growth in habitual buyers, total revenues rose by 18% year-over-year to $532.4 million in the third quarter of 2021, topping the analysts’ average projection by $13.3 million.

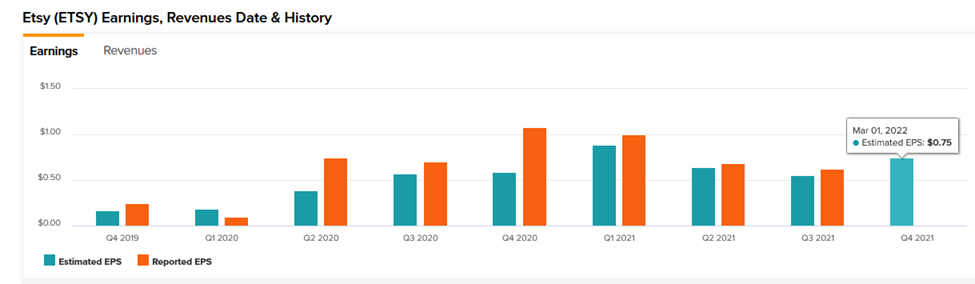

On a GAAP basis, Etsy’s earnings were $0.62 per diluted share, beating the median consensus estimate by $0.07.

On a consolidated basis, gross merchandise sales (GMS) grew 18% year-over-year to $3.1 billion, while GMS on the Etsy marketplace grew 12% year-over-year to $2.7 billion.

Looking Ahead

Looking ahead to the last quarter of 2021, Etsy is expected to report GMS in the range of $3.9 billion to $4.1 billion, up 12% year-over-year.

Revenues are expected to hover in the $660 million to $690 million range versus a median consensus estimate of $694 million.

Analysts are forecasting earnings of $0.75 per diluted share for the last quarter of 2021, according to TipRanks’ earnings calendar.

A Solid Business

Internet retail activities will continue to grow as more buyers and sellers trade online. In terms of annual sales, internet retail is on track to be worth nearly $7.4 trillion in three years, up 50% from approximately $5 trillion in 2021.

Etsy is helpful to buyers who can try to meet the need by choosing from over 85 million different items. However, the platform also makes it easier for sellers looking to monetize specific categories of handmade or vintage products.

Additionally, Etsy’s competitive advantage lies in its operating costs, which are certainly lower than many other online retailers. Many costs such as those for premises, warehousing, staff, and energy are avoided as sellers are connected directly to the ranks of potential buyers through Etsy’s platforms.

Internet and software applications enable efficient exploitation of the potential of a wide range of products with relatively little investment. Etsy’s revenue comes from a commission applied to the posting of the ad and a certain premium calculated on the final price of the sale.

Of course, there are competitors, but the nature of the products that sellers and buyers trade makes Etsy’s business quite original.

Solid Balance Sheet

Financial health is solid, as evidenced by an Altman Z-Score of 6.6 and an interest coverage ratio of 29.3. The company’s operations are secure. Lenders receive timely repayments and interest. The current ratio of 2.3 shows that Etsy has no trouble managing ongoing expenses.

Wall Street’s Take

In the past three months, 12 Wall Street analysts have issued a 12-month price target for ETSY. The company has a Strong Buy consensus rating, based on nine Buys, three Holds, and zero Sell ratings.

The average ETSY price target is $233.09, implying 71.4% upside potential.

Conclusion

The stock has fallen recently, but that’s because of a market cycle that currently favors certain sectors, especially oil stocks. These effects are short-lived. Operating in a fast-growing sector and with a respectful team, Etsy has what it takes to resume growth.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure