Etsy’s (ETSY) “House of Brands” comprises four e-commerce marketplaces. These include the namesake etsy.com, its more significant asset, which lists mainly handmade and vintage products. The other three are Reverb, depop, and elo7.

Reverb is a musical instruments marketplace, helping musicians to trade any part of the gear. Depop operates as a second-hand clothing marketplace, while elo7 specializes in the Latin American market.

Etsy’s success story over the past few years has been quite remarkable, with the company capitalizing on the rapidly expanding e-commerce space. Driven by the pandemic shifting an increasing number of consumers online, the company has seen its financials proliferate lately.

More importantly, Etsy has managed to stay unfailingly profitable throughout its expansion phase. This is a great characteristic amongst its industry peers, many of which have been forced to widen their losses in order to meaningfully grow.

Etsy’s stock trades substantially lower from its past highs following the violent correction stocks in the I.T., communications, and consumer discretionaries have experienced year-to-date.

However, Etsy continues to be a top destination for e-shoppers, and with shares now rather cheaply valued relative to their historical multiples, Etsy stock likely offers an appealing investment proposition. I am bullish on the stock.

Putting Results Into Perspective

Etsy’s Q4 2021 results came in rather strong, inspiring investors, who had previously questioned whether Etsy remains a genuine growth stock.

In Q4, revenues rose 16.2% year-over-year to a record $717.1 million. This compared with a growth of 128.7% in the prior-year period. Hence, you can already see why concerns over whether Etsy is worthy of being called a “growth stock” had emerged over the past year.

While the latest quarter’s revenue growth rate is definitely not amazing, investors need to put Etsy’s results into perspective and glimpse at the bigger picture. The fact that Etsy is even posting further growth following its overblown expansion in the midst of the pandemic is not to be taken softly.

From 2015 to 2019, the company’s revenues would rise anywhere from 18% to 46%. Then, spanning from Q2 2020 and Q1 2021, Etsy recorded four consecutive quarters of triple-digit revenue growth, with the highest being 141.5% in Q1 2021.

The massive sales boost was driven primarily by demand for handmade/custom masks and COVID-19-related essentials skyrocketing. As far as I am concerned, the company could have well posted declining revenues from last year’s bloated sales and still have delivered rather impressive numbers, relatively speaking.

Assume, for instance, that Q4 2021 revenues had landed at $600 million (i.e., a negative revenue growth versus Q4 2020). That number would still imply a growth of 122% compared to Q4 2019. Thus, I support that any deceleration concerns are actually overblown.

Wall Street’s Take

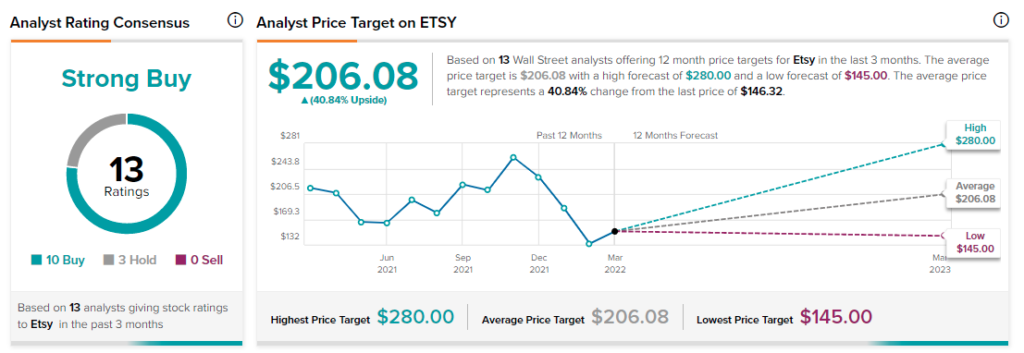

Turning to Wall Street, Etsy has a Strong Buy consensus rating, based on 10 Buys and three Holds assigned in the past three months. At $206.08, the average ETSY price target implies 40.8% upside potential.

Conclusion

One could argue that the stock’s prolonged rally last year priced in the company’s aggressive expansion. However, with shares now notably lower from their previous highs and the company’s results on a strong trajectory, it may be prime time for investors to reconsider their view of Etsy.

The stock is now trading with a forward P/E of around 25 attached. Combined with earnings-per-share growth expectations of approximately 25% through 2026, I believe Etsy is now rather attractively priced.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure