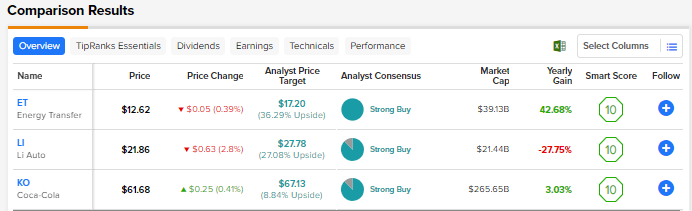

The ongoing macro uncertainty offers investors a good opportunity to pick large-cap stocks trading at attractive levels. Large-cap stocks have a market capitalization of more than $10 billion. While most large-cap stocks are well-established, mature players in their respective sectors, they can also be stocks of companies with robust growth potential. Using TipRanks’ Stock Comparison Tool, we will place Energy Transfer (NYSE:ET), Li Auto (NASDAQ:LI), and Coca-Cola (NYSE:KO) against each other to pick the most compelling large-cap stock.

Energy Transfer (ET)

Energy Transfer is a well-diversified midstream energy company with a strong footprint in 41 U.S. states. The company claims that about 30% of the nation’s natural gas and crude oil is moved through its pipelines.

A strong demand backdrop in the energy market helped Energy Transfer deliver impressive performance in the first nine months of 2022. Its Q3 2022 results benefited from increased volumes across all its core segments and the recent acquisition of Enable Midstream. Energy Transfer’s adjusted distributable cash flow grew 21% to $1.58 billion in Q3 2022.

Robust cash flows support the company’s high dividends. In October 2022, the company declared a dividend per share of $0.265 for Q3 2022, reflecting a 15% hike from Q2 2022. It had excess cash flow of about $760 million after distributions as of Q3-end. Overall, Energy Transfer has a strong financial position that allows it to invest in high-return growth projects and enhance shareholder returns.

Is Energy Transfer a Good Stock to Buy?

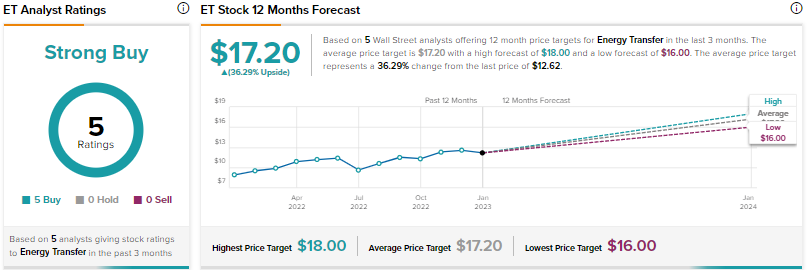

Last month, Citigroup analyst Spiro Dounis initiated coverage of Energy Transfer with a Buy rating and a price target of $16. The analyst commenced coverage of 23 midstream stocks with a “constructive cash flow outlook,” although he cautioned that investors need to be selective due to a challenging macro backdrop.

Dounis feels that the midstream sector has “arguably never been better prepared for macro headwinds,” given the considerable reduction in leverage and capital spending.

Overall, Energy Transfer scores Wall Street’s Strong Buy consensus rating based on five unanimous Buys. The average ET stock price target of $17.20 implies 36.3% upside potential even after last year’s strong run. The company has an attractive dividend yield of 6.9% (based on the dividends paid in the trailing twelve months.)

Li Auto (LI)

Chinese EV maker Li Auto and its peers faced severe COVID-led disruptions in 2022. Nonetheless, Li Auto ended 2022 with solid deliveries in the month of December. Specifically, Li Auto’s December deliveries increased 51% year-over-year and 41% month-over-month to 21,233 units.

Overall, deliveries jumped 47% to 133,246 vehicles in 2022. The company fared better than peers Nio (NYSE:NIO) and XPeng (NYSE:XPEV), which posted growth of 34% and 23%, respectively, in their deliveries last year. Li Auto’s revenue in 2023 is expected to be boosted by the launch of its Li L7 5-seater SUV on February 8. Meanwhile, the company expects its profitability to improve through cost management and greater economies of scale as production increases.

What is the Target Price for Li Auto Stock?

Following the December deliveries update, Morgan Stanley analyst Tim Hsiao reiterated a Buy rating for Li Auto stock with a price target of $23. Hsiao feels that “investors could give the company credit for its solid execution in meeting the founder’s upbeat target of Rmb10bn of monthly revenue by year end.”

The Strong Buy consensus rating for Li Auto is backed by seven Buys and one Hold rating. At $27.78, the average Li Auto stock price target of $27.78 suggests 27.1% upside potential. Shares have declined more than 28% over the past year.

Coca-Cola (KO)

Coca-Cola’s recession-resilient business helped it in raising its 2022 outlook following upbeat Q3 results. It guided for organic revenue growth in the range of 14% to 15% and adjusted EPS growth of 6% to 7% for the full-year 2022. Coca-Cola continues to enhance its offerings with new beverages, keeping in view the need for healthier options.

Is KO Stock a Buy, Sell, or Hold?

For Atlantic Equities analyst Edward Lewis, Coca-Cola and PepsiCo (NASDAQ:PEP) remain favored beverage names for 2023 due to “category momentum, ongoing investment and strong execution supporting elevated growth.” The analyst expects revenue momentum for these two companies to continue in FY23, driven by their extensive distribution networks, robust market shares, and continued focus on innovation.

All in all, the Street’s Strong Buy consensus rating for Coca-Cola is based on seven Buys and one Hold. The average Coca-Cola stock price target of $67.13 implies 8.8% upside potential. KO stock has risen nearly 4.3% over the past 52 weeks. Coca-Cola is a dividend king and has raised its dividends for 60 consecutive years. Its dividend yield stands at 2.9%.

Conclusion

Wall Street is bullish about all the three large-cap stocks discussed above. However, analysts estimate higher upside potential in Energy Transfer stock compared to Li Auto and Coca-Cola. Moreover, Energy Transfer’s solid dividend yield makes it the most compelling pick among the three large-cap stocks discussed here.