Canadian Oil & Gas infrastructure giant Enbridge (TSE: ENB) (NYSE: ENB) has outperformed the market this year, as it is modestly in the green compared to the bear market that the S&P 500 (SPX) is experiencing. Investors may have flocked to the perceived safety of Enbridge’s 6.7% dividend yield, giving the stock a boost. However, we believe that there are better opportunities in the market and aren’t looking to buy shares of Enbridge.

Why Aren’t We Excited About Enbridge’s High Dividend Yield?

While Enbridge has a high dividend that has grown at a compound annual growth rate of 5.2% over the past three years, this isn’t enough to excite us. There are a few key reasons for this. First, with the major drawdowns in most stocks this year, higher-quality stocks with similar or higher dividend yields can be found, making ENB less attractive.

Second, its historical dividend growth rate isn’t exciting either, and with earnings per share expected to grow by under 7% in Fiscal 2022 and 2023 before slowing down to 3% growth in 2024, Enbridge’s dividend-growth prospects don’t look superb.

Enbridge’s Dividend Isn’t the Safest

Most importantly, however, Enbridge’s dividend isn’t the safest. While its dividend is covered by its cash flow from operations, which came in at C$9.76 billion on a trailing-12-months basis (compared to dividend payments of C$7.23 billion), its dividend is not covered by free cash flow (FCF), measured as operating cash flow minus capital expenditures.

Due to Enbridge’s capital-intensive business, it spends a hefty amount on maintaining or improving its operations. As a result, its trailing-12-months free cash flow figure comes in at a much lower C$3.33 billion.

In fact, its annual FCF hasn’t covered dividend payments a single time in the past decade. Because of this, ENB is essentially using debt to fund its dividend payments. Its long-term debt sits at a whopping C$70 billion.

Also, due to paying out more in dividends than it earns, ENB’s book value per share has been trending lower, going from C$30.53 per share in Fiscal 2018 to C$27.23 per share now.

With high dividend payments, it’ll be hard for the company to pay off its debt, which has been trending higher in recent years. Nonetheless, with a 2.6x interest coverage ratio, Enbridge can still manage its debt levels – for now.

However, it may have to suspend dividend growth or slow down its investments/CapEx in the future in order to maintain a healthy balance sheet, especially since interest rates are on the rise.

Is Enbridge Stock Overvalued?

Based on analyst targets, which suggest 6.9%, 6.7%, and 3.1% growth in earnings per share for the next three years, ENB has forward P/E multiples of 17.5x, 16.4x, and 15.9x for 2022, 2023, and 2024, respectively. While not overly expensive, these multiples are still not that attractive in a bear market where many stocks with similar growth rates are trading at cheaper valuations.

What is the Target Price for ENB Stock?

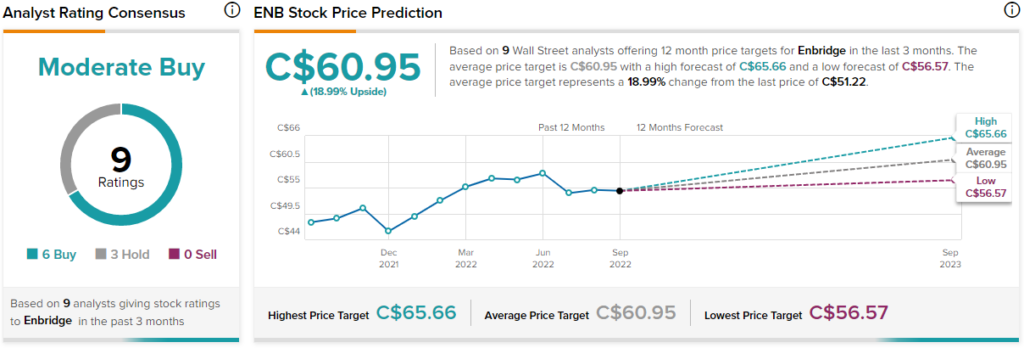

Analysts seem more optimistic, giving ENB stock a Moderate Buy consensus rating based on six Buys and three Holds. The average Enbridge stock price target of C$60.95 implies 19% upside potential.

Conclusion: There Likely are Better Opportunities Elsewhere

While Enbridge’s 6.7% dividend is nice, it doesn’t have much room to grow due to the company’s slow growth, relatively-low free cash flow, and high debt levels. Also, its valuation isn’t compelling, as discussed earlier. A positive note here is that Enbridge is making investments in renewable energy, which will help the company adapt. However, if debt levels keep rising, ENB may eventually have to stop investing so heavily, limiting its growth potential.

Regardless, the stock has outperformed this year, and analysts are still bullish on it. Therefore, it could be worth considering if a 6.7% dividend yield is something you are looking for.