Put one “Battery Day” in the books, folks. On Tuesday, Sept. 22, CEO Elon Musk finally held his long-awaited presentation running down everything Tesla (TSLA) plans to do over the next decade to cut the cost of batteries, and extend the range (and lower the price) of Tesla’s electric cars.

One of the key revelations: In an effort to accelerate the conversion of 300 million American cars from gasoline engines to electric, Tesla is pioneering a method of using “table salt (sodium chloride) to basically extract the lithium” … from 10,000 acres of Nevadan clay, ensuring plentiful supply of the metal for use in building more batteries. “Simply mix clay with salt, put it in water, the salt comes out with the lithium — done.”

“Nobody’s done this before,” avers Musk, but “it’s a very sustainable way of obtaining the lithium.”

And it certainly sounds like a bright idea. There’s just one problem: According to GLJ Research analyst James Bardowski, it probably won’t work.

In a firmly tongue-in-cheek report out Thursday titled “TSLA Claims to [Manufacture Lithium] ‘Simply’ w/ Salt … We See a Higher Chance of a $25K M3 Robo-Taxiing to Mars,” Bardowski calls Musk’s claim that Tesla can vertically integrate lithium production into its battery operations “eccentric,” and argues it’s liable to become just one in a long line of “broken promises” from the Tesla CEO.

Why is Bardowski throwing shade on Elon Musk this week? First off, as Tesla itself would probably admit (indeed, has admitted), this method of extracting lithium from clay “would be a first for the industry.”

That’s not to say there’s zero chance of success, of course, but Bardowski observes that “the details surrounding Tesla’s planned Li production were conspicuously light.” And viewed in light of past pie in the sky promises from Tesla (swappable batteries in 2012, for example, or fully-autonomous Teslas in 2014, or cars with 620 miles of driving range in 2015, or — most recently — 1 million robo-taxis driving folks around the U.S. “in 2019 or 2020”), Bardowski has his doubts that Tesla will deliver on this latest promise as well.

Even in the most optimistic scenario, the analyst notes that obtaining a permit to mine lithium in Nevada could take “years” for Tesla to secure, while obtaining the water needed to facilitate (what little we know of) the process — in the middle of the Nevada desert — could also prove problematic.

But what if Musk does end up delivering on this particular promise? Well, in that case, acknowledges Bardowski, Tesla’s move into lithium mining could pose serious competitive pressures on existing lithium producers such as Albemarle, Livent, Lithium Americas, and Sociedad Quimica y Minera de Chile.

As the analyst has previously warned, the global supply of lithium is on track to outpace demand into at least 2023. Combined with lower production targets for battery cathodes from Tesla itself, which will further depress demand for lithium without doing anything to slow supply coming online, Bardowski hypothesizes that Tesla becoming a lithium miner in its own right could accelerate the growth of lithium, and “quickly drag” down both lithium prices, and lithium profits for the incumbent producers.

That is to say, this could happen if Tesla’s promises bear fruit this time — it’s just that Bardowski thinks you’ll see robo-taxis on Mars before that happens.

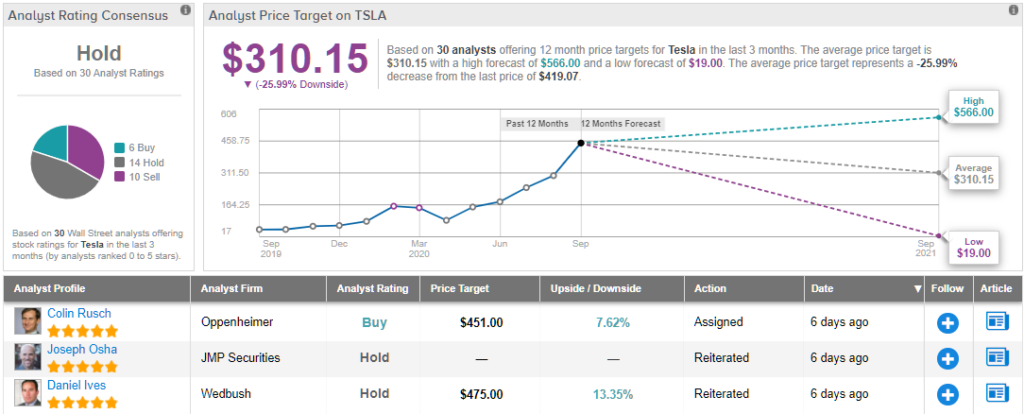

All in all, Street-wide caution circles the electric car giant, as TipRanks analytics model TSLA as a Hold. This boils down to 6 Buy ratings, 14 Holds and 10 Sells issued in the past 3 months. Meanwhile, the 12-month average price target, $310.15, implies a 26% downside from current levels.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.