Defense stocks have been rocketing since before the invasion of Ukraine by Russia. I like Elbit Systems (ESLT), which successfully engages with big contractors like General Dynamics (GD), about which I have written for TipRanks. I am bullish on the underdog ESLT.

Elbit Systems has been an Israeli legacy defense contractor since 1966. Product sectors are military, commercial aviation, medical instrumentation, and homeland security hardware and software. The company specializes in military arms and munitions, equipment and systems for manned and unmanned aviation, electro-optics, naval operations, land vehicles, command-and-control communications, intelligence, and cyber systems.

What is causing all the consternation? Russia’s years-long campaign over Crimea and stationing troops and naval forces in Syria and Iraq. Turkey’s cross-border incursions and bellicose threats. America’s Middle East vendettas. There is bad blood between the U.S. and China. Iran sponsors attacks on neighbors and invests in nuclear weapons. Global cyberwarfare demands better software and Elbit’s systems to defuse the fray.

The investment community always spots the trends. SPDR S&P Aerospace & Defense ETF (XAR) shares sold for $85 for a share in January ’18. The shares have since propelled about 78%. ESLT battled up into the $170 range. Shares are up about 62% over the past year.

On February 28, ’22, ESLT stock jumped 15.5% to $206. There is no reason to assume the enmities causing rising demand for military hardware and software are waning.

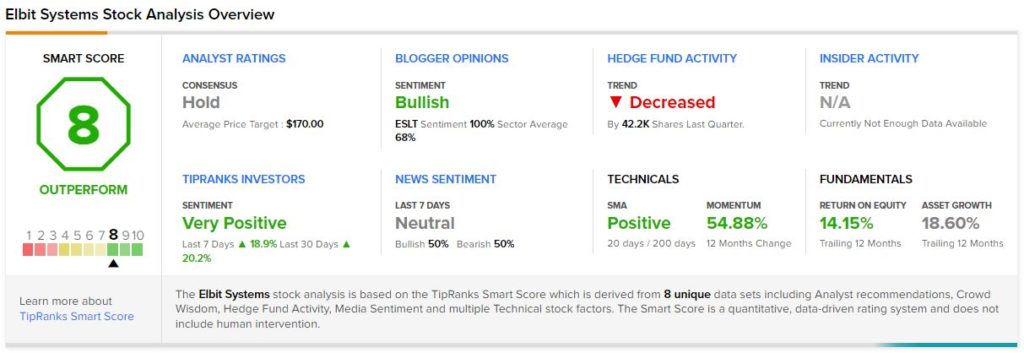

Only one analyst covers ESLT currently and labels it as a Hold. The analyst’s price target of $170 implies 16.3% downside potential. However, I believe that ESLT has the potential for popping another 10% as tensions mount. Its price-to-book ratio is 3.8x compared to 2.7x for the aerospace and defense industry.

Positives

Ownership is broadly divided: institutions (23%), the public (~33%), and public companies (+44%). Management is a seasoned team. The CEO has been in office for nearly nine years, and two VPs have been there for 21 and 14 years, respectively.

ESLT receives scant attention in the news, despite strong technicals, good momentum, and a good return on equity (14.15%).

In the past 12 months, ESLT generated net income of ~$334 million from annual revenue of $5.16 billion. In the last report, for the period ended September 30, 2021, Elbit beat quarterly estimates for both non-GAAP and GAAP EPS. Revenue was up 20.2% year-over-year, $96.6 million more than expected. The consensus EPS forecast for the next quarter is $1.92, implying 25.5% year-over-year growth.

The debt ($1.1 billion)-to-equity ($2.5 billion) ratio rose in the past five years to 44.4%. Operating cash flow covers its debt.

Elbit is one of a small but essential battalion of Israeli defense companies. Israel depends for its survival on it and ensures its prosperity. The State needs Elbit but lets it operate independently.

Several years ago, a former government minister told me that Israel will expand its military-industrial complex since the U.S. failed to deliver weapons in a timely manner during the nearly-lost 1973 Yom Kippur War.

Elbit’s healthy foreign sales generate goodwill for the State and garner foreign currency. Elbit opened a sales office in the United Arab Emirates after the Abraham Accords.

In Q3, 31% of revenue came from sales in Asia-Pacific, 30% to North America, 17% to Europe, and a mere 18% to Israel. Elbit is expanding by acquisitions, spending $380 million buying Sparton in 2021. Sparton produces systems for undersea warfare.

Downsides

A paltry dividend yield of 0.9% is a downside. Second, the stock price can be rocky. However, the levered beta is less than one, meaning ESLT’s volatility is less than market volatility.

Takeaway

The share price is high, but Elbit Systems’ revenue and profits should increase. 40% of the current backlog is scheduled for delivery. Production and delivery of goods are picking up with COVID-19 cases decreasing. Also, its short interest is negligible.

Keep in mind the aphorism that my professor Hans Morgenthau postulated; nations will have an obsession with maintaining a balance of terror and always need companies like Elbit Systems.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure