The ecommerce industry has been on quite the ride over last few quarters. The COVID-19 pandemic accelerated the shift toward a digitized retail sector, and had no signs of slowing, until now. Many ecommerce firms, and in particular Ebay Inc. (EBAY) are up against tough comparisons from their past earnings performances. The online marketplace is expected to report its Q3 earnings results after market close on Wednesday, October 27.

In its previous report for Q2, the company printed strong results across the board, surprising on its earnings per share (EPS) by 2.17%. During that report, the company had announced an increase to its robust share repurchasing program, and also announced a sale of the majority of its Korean business.

Providing his hypothesis on the soon-to-be presented earnings, Daniel Salmon of BMO Capital Markets wrote that Ebay “continues to create value through spinoffs, new minority interests, and strong commitment to buybacks.” The five-star analyst was encouraged by the firm’s past performance, and raised his price target to $71 from $63.

However, he added that he expects a decline in gross merchandise value for the upcoming report, as well as for the months thereafter. Salmon also lowered his EBITDA estimates, due in part by the divestiture of Ebay’s Korean segment. Despite this, he did consider that the funds raised by selling divesting can be used to repurchase more stock going forward.

According to data aggregated by TipRanks, Ebay is forecasted to report 0.89 in earnings per share. The online retailer marketplace reported EPS of 0.85 last year for the same quarter.

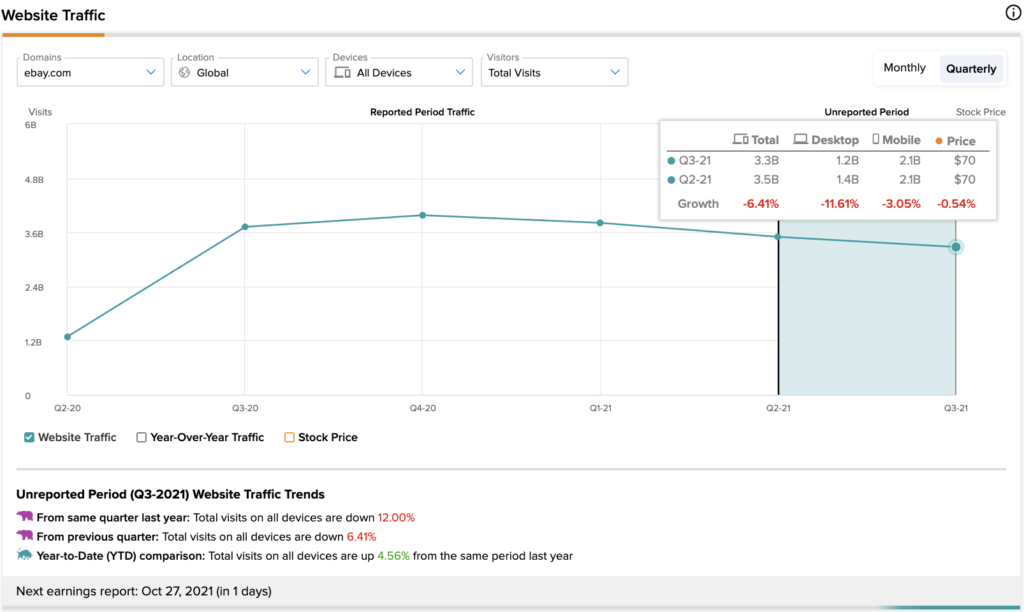

To gain more insight on Ebay’s engagement levels, TipRanks Website Traffic tool can be employed.

Traffic Stats

TipRanks’ Website Traffic Signal, whose data is provided by SEMrush Holdings (SEMR), shows another perspective for the curious investor to take into account. Quarter-over-quarter, total visits to ebay.com have declined –6.41%, while the stock valuation has fallen –0.54%. However, if comparing year-to-date of this year to the same time frame in 2020, one can observe a 4.56% gain in total visits across all devices.

While the decrease in quarter-over-quarter visits is discouraging for Ebay, the latter metric shows a significant increase in traffic even from the depths of the pandemic lockdowns, when online usage was at its peak. EBAY’s relevance has continued to strive on, even as economies largely reopened.

Global User Data

Furthermore, breaking down the data by region can provide a glimpse at international macro trends.

Visitors to ebay.com are overwhelmingly from the U.S., at about 78.2% of total users. Following the U.S. is the United Kingdom, which saw 3.5% of total global traffic.

How do the most traffic-heavy nation’s stats stack up against last year’s stats? Across all devices, year-to-date growth has gained 5.49%.

Wall Street Weighs In

Largely, the sentiment on Ebay is mixed. There is no overwhelming bullish or bearish sentiment on which short-term investors could confidently stand.

Salmon of BMO Capital went on to describe Ebay’s current situation. He wrote, “Investor debate is focused on the increasingly competitive eCommerce environment, which is also facing tough comps. We remain Market Perform as divestiture catalysts seem exhausted, yet valuation is undemanding.”

Regarding the remainder of financial analysts on TipRanks, Ebay has an analyst rating consensus of Moderate Buy, based on 6 Buy and 7 Hold ratings. The average Ebay price target is $76.77, reflecting a possible –4.74% downside from Friday’s closing price of $80.59 per share.

Disclosure: At the time of publication, Brock Ladenheim did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.