The social media space has been dominated by behemoths like Facebook parent Meta Platforms over the years, but times could be changing. The growing uproar over censorship versus free speech has led some well-known names to search for ways to run their own social networks. In this piece, we used TipRanks’ Comparison Tool to evaluate two social media stocks – Digital World Acquisition Corp. (NASDAQ:DWAC) and Twitter (NYSE:TWTR) – that have mergers underway.

However, these two companies are on opposite sides of the merger battle. Donald Trump’s Digital World Acquisition Corp. was created for the sole purpose of acquiring his Truth Social platform, while Elon Musk has been pursuing an acquisition of Twitter on and off for months.

The State of Social Media

A critical problem facing social networking right now is the issue of censorship versus free speech. This topic can be quite subjective, so it’s no surprise that it has raised the ire of some people, including former president Donald Trump and Tesla (NASDAQ:TSLA) and SpaceX CEO Elon Musk.

The problem is that while some speech is clearly problematic, like messages between two individuals planning a bombing, other speech isn’t always clear. For example, some people may be offended by others’ beliefs or expect everyone to agree with everything they think or do, while others may express their personal convictions without meaning to offend anyone.

The issue arises when an entity like Meta Platforms defines what speech should be allowed and what shouldn’t be. Suddenly, political views and other personal belief systems come into play, which sometimes leads to censorship of speech that represents merely a difference of opinion rather than “misinformation” or even a threat against an individual or group.

As a result, Trump and Musk have both sought ways to operate a social media platform that allows for wider freedom of speech. Trump started his own social network called Truth Social, while Musk made a $44 billion offer to buy Twitter with the goal of reducing censorship on the platform.

Digital World Acquisition Corp.

First, it’s important to point out that DWAC is a special purpose acquisition company (SPAC). These blank-check companies are formed for the purpose of creating a pool of capital and then merging with an operational company. Since the fair value for SPACs pre-merger is usually around $10 a share, a bearish view looks appropriate for DWAC.

With DWAC declaring its target as Trump Media and Technology, the parent company of Truth Social, investors are betting on the success of that social network when they buy shares of the SPAC. As a result, some investors may have bought shares in the SPAC for more than $10 because they appreciate the company’s messaging as a social media company with very limited censorship. However, it might not have been wise to pay significantly more than $10 a share.

On Monday, DWAC postponed its shareholder vote on a 12-month extension to secure the merger after failing to capture enough shareholder support. The SPAC had already pushed back the deadline for shareholders to vote on the extension several times in the last month.

The merger is on hold because Digital World is facing both SEC and criminal investigations into possible securities violations in connection with conversations had before the announcement of the merger. As things stand now, DWAC is set to liquidate on Dec. 8 at $10 a share — triggering a loss for everyone who paid more than that.

Additionally, Trump himself is facing a criminal investigation into whether he kept sensitive government documents illegally. He has repeatedly said he might end up keeping his company private, which would also kill the merger and liquidate DWAC at $10 a share.

What is DWAC Worth?

There are no analyst estimates for DWAC, which makes valuation difficult. However, its existence as a SPAC does offer some clues and present a clear bearish argument, especially in light of the number of threats to its merger with Trump Media. Fair value looks close to $10 a share, and here’s why (aside from the many threats to the merger).

Most SPACs hold their initial public offerings at $10 a unit. Those $10 units actually contain one share and one warrant or a fraction of a warrant. Those warrants can be used to purchase another common share at an exercise price of $11.50 each.

Setting aside those warrants, if investors buy shares of a SPAC for more than $10 a share, they will lose money when they redeem those shares at $10 each. Additionally, if the SPAC does not find a company to merge with within two years, it liquidates and returns the IPO’s proceeds to the shareholders. At this point, the warrants will expire worthless.

When the SPAC merges with its target, its shareholders receive the equivalent of around $10 a share in the new company. Even including the warrant’s right to buy another share at $11.50 (which also results in dilution for shareholders), it looks like Digital World Acquisition Company could be overvalued.

Like DWAC, Twitter’s valuation is also tied closely to acquisition talk, although no SPAC is involved. Elon Musk offered $54.20 a share or $44 billion to buy the social network earlier this year but then backpedaled, arguing that the company grossly underestimates the number of spam or bot accounts on its platform. Due to all the uncertainty and the current stock price, a neutral view may be appropriate right now. However, new analysis will be required once this overhang is passed.

Twitter took Musk to court to force the deal through, and the court set a deadline of Oct. 28 to complete the purchase. If it’s not completed by then, the lawsuit will go to a trial. Forgoing all the drama that has ensued throughout the case, Musk renewed his $44 billion offer—with the caveat that it comes “without waiver of or prejudice to any of their rights, including their right to assert the defenses and counterclaims pending in the action.”

In the near term, Twitter’s valuation hangs on this proposed purchase by Musk, so all other attempts at valuing the company seem to offer limited value.

What is the Forecast for Twitter Stock?

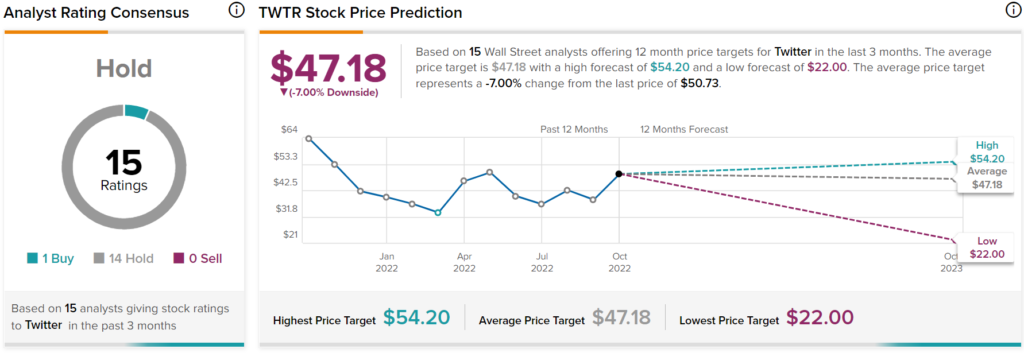

Twitter has a Hold consensus rating based on one Buy, 14 Holds, and zero Sells over the last three months. At $47.18, the average price target for Twitter implies downside potential of 7%.

Conclusion: Bearish on DWAC, Neutral on TWTR

At this point, too much is hanging in the balance for both DWAC and Twitter. The bottom line on DWAC is that the merger with Trump Media is in jeopardy, and it’s trading for more than $10 a share. With almost no chance of seeing the full price of their investment, the odds suggest shareholders who paid more than $10 a share for DWAC will lose significant amounts of money.

Meanwhile, Twitter’s valuation hangs on Musk’s offer for now, leading to a temporary neutral view. However, when that overhang is passed, it looks overvalued (without any further analysis).