It’s difficult to put a positive spin on the current state of the stock market. While 2022’s action has seen moments of relief, for the most part, the trend has been resolutely downbeat, as reflected in the main indexes’ performances. All are down by at least double-digits; the tech-heavy NASDAQ’s 27% drop has been the most acute, while the S&P 500 has often flirted dangerously close to bear market territory.

That said, while it’s hard to watch any owned stock sink to the bottom, the upside to the downside is that investors get to pick up shares of good companies on the cheap. Of course, the hard part is to spot the good companies — those that will flourish again once the market-wide sell-off abates. This is where a guiding hand from Wall Street’s pros comes in handy.

The stock experts at banking giant Wells Fargo have identified two names whose share price is down over 50% this year; however, they believe both offer good value right now and are set to push higher over the coming months – and by higher, we’re talking about triple-digit gains. We ran the pair through the TipRanks database to get a feel for the rest of the Street’s view on these stocks. Here’s the lowdown.

Beam Therapeutics (BEAM)

Let’s start off in the high-risk, high-reward biotech sector. With the goal of providing life-long remedies to people suffering from debilitating diseases, Beam Therapeutics is a pioneer in the use of base editing, a potentially new class of precision genetic therapeutics. Base editing is a novel technology that has the ability to create “gene knockouts” or rectify faults or mutations in intact cells’ DNA.

For biotech companies working on the development of new drugs, the cash runway is of vital importance. Standing in Beam’s stead is a recently signed four-year research collaboration with pharma giant Pfizer; the company will receive $300 million upfront and could also receive future milestone payments of up to $1.05 billion. The cash is intended to speed up development and help get the drugs to market.

That could still be a while away; Beam has various in-house programs in the very early stages of development, although some are now moving closer to the clinical testing stage.

BEAM-101 intended to treat sickle cell disease (SCD) and the first patient is expected to enroll in the phase 1/2 BEACON-101 trial in 2H22. BEAM-102 is also indicated to treat SCD with the company expected to file an IND (investigational new drug application) in the year’s second half. The IND for BEAM-201 is also on track to be filed in 2H22; this drug is intended as a therapy for relapsed/refractory T-cell acute lymphoblastic leukemia and T-cell lymphoblastic leukemia.

It might still be early days but with the stock down significantly – shares have declined by 58% year-to-date – and the technology offering plenty of promise, Wells Fargo analyst Yanan Zhu thinks investors should take note.

“We continue to see BEAM’s base editing technology as the most compelling next-generation gene editing platform, and see current valuation as a highly attractive entry point. We believe the inherent advantages of base editing, including the capability for precise edits and avoiding double strand DNA breaks, should translate into superior clinical data for BEAM-101, thereby providing validation of the base editing platform,” Zhu opined.

To this end, Zhu rates BEAM an Overweight (i.e. Buy) while the $145 price target makes room for one-year gains of a huge 338%. (To watch Zhu’s track record, click here)

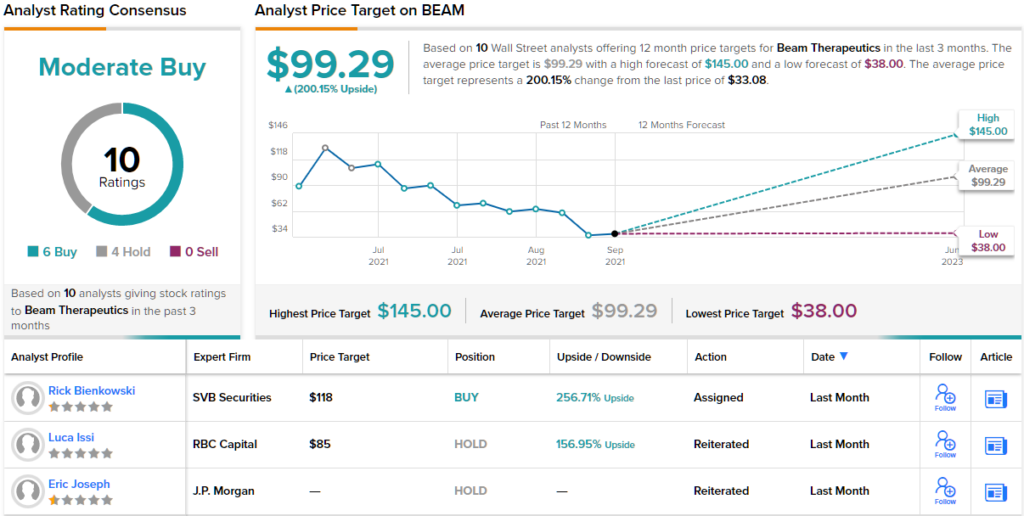

So, that’s Wells Fargo’s view, how does the rest of the Street see the next 12 months panning out for Beam? Based on 6 Buys and 4 Holds, the analyst consensus rates the stock a Moderate Buy. The stock trading price is $33.08 and its $99.29 average price target is decidedly bullish, implying a 12-month upside of 200%. (See BEAM stock forecast on TipRanks)

iHeartMedia (IHRT)

Let’s switch stations now and tune into something entirely different. iHeartMedia is one of the U.S.’s most prominent audio companies with its reach spread out across multiple platforms; the company boasts of having a quarter of a billion monthly listeners, who are able to choose from over 860 live broadcast stations, or tune into the iHeartRadio digital service, which is available on 250+ platforms and on more than 2,000 connected devices. The company is also the U.S.’s number one podcast publisher, with almost 30,000,000 listeners in the latest data reported – for May 2022.

IHRT’s latest financial statement – for 1Q22 – was something of a mixed bag. Revenue increased by ~19% year-over-year to reach $843.46 million, just outpacing the $839.42 million consensus estimate. However, the company didn’t fare quite as well on the bottom-line with EPS of -$0.33 coming in worse off than the -$0.27 analysts predicted. Further disquieting investors, iHeartMedia saw out the quarter with ~$5.5 billion in net debt.

The current risk-off environment is inhospitable to companies unable to turn a profit while carrying a heavy debt load does not help either. Moreover, investors are concerned that a recession could further impact ad spend, and that in turn will impact the media company’s growth. All have contributed to the stock’s woeful performance in 2022; shares have shaved 53% off their value since the turn of the year.

However, Wells Fargo’s Steven Cahall is not overly concerned with ad money drying up and sees the stock as ripe for the picking right now.

“Given IHRT’s diversification, with no ad category making up more than 5% of revenue, we believe the company is better positioned to outperform its smaller radio peers on category specific weakness. With the stock down, we think the market is pricing in a weakening ad market and punishing IHRT for its leverage. We see an attractive entry point at current levels given our view of the ad market and IHRT’s strong operating leverage,” Cahall explained.

These comments form the basis of Cahall’s bullish thesis. The analyst gives IHRT stock an Overweight (i.e. Buy) rating, while his $34 price target suggests shares have room for growth of ~248% in the year ahead. (To watch Cahall’s track record, click here)

What about the rest of the Street? Most are on board; there are 4 Buy reviews, and with an additional 1 Hold and Sell, each, the stock makes do with a Moderate Buy consensus rating. Overall, there’s plenty of upside projected here; going by the $24.67 average target, the shares are expected to appreciate by 152% over the coming months. (See IHRT stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.