The week got off to a rocky start as the markets digested the collapse of Silicon Valley Bank last week, and the Federal regulators’ shutdown of Signature Bank over the weekend.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Sparking fears of contagion, on Monday, stocks in the banking sector saw shares drop dramatically, as investors scrambled to figure out the new patterns of risk and reward. The effect was most pronounced among the mid-sized and regional banking firms. In that niche, sudden drops in share value prompted trading halts for multiple stocks.

For the retail investor, the situation is still cloudy – but one strong indicator of where things are going may be coming from the banks’ insiders, the company officers with fiduciary responsibility for the solvency of their institutions. These insiders don’t trade their own banks’ stocks lightly, and when they do, it sends a sign that investors should pay attention.

We can use the Insiders’ Hot Stocks tool at TipRanks to follow some of these trades – and doing so shows us that the insiders are calling a bottom on two regional bank stocks. According to the TipRanks data, while both showed massive losses in early trading on Monday, both retained their ‘Buy’ ratings and feature triple-digit upside for the year ahead, according to the Wall Street analysts.

Customers Bancorp (CUBI)

We’ll start with Customer’s Bancorp, a regional bank based in West Reading, Pennsylvania. By market cap, $550 million, the company fits squarely in the small-cap category; by total assets held, approximately $20.8 billion, it’s a modest banking institution. Customers Bancorp is the parent company of Customers Bank, a full-service bank offering a range of personal, commercial, and small business banking products.

In the last few trading sessions, CUBI shares have dropped 39%, with a large part of that hit coming on Monday morning, when the shares plummeted 70%. The stock did stabilize, and later in the day regained part of that loss.

Customers Bancorp’s exposure to this week’s troubles came after the bank saw a mixed quarter to finish off 2022. In 4Q22, CUBI reported a total interest income of $269.6 million, up a solid 17% year-over-year. On the negative side, however, the company’s net income available to shareholders was $25.6 million, for a 74% y/y drop. On a per share basis, the diluted EPS of 77 cents not only missed the $1.59 forecast but was also down sharply from the $2.87 per diluted share reported in 4Q21.

With the shares on the backfoot, on the insider front, we find that the company Chairman and CEO Jay Sidhu has stepped in to take advantage. He purchased 45,450 shares of CUBI just yesterday, despite the potential crisis ignited by the SVB failure. Sidhu paid over $499K for the shares, and currently holds a total of 1.68 million shares.

This stock has caught the attention of Wedbush analyst David Chiaverini. Following the Q4 print, he saw reason for optimism in CUBI, and wrote, “On the positive side, average deposits saw a sequential increase of 14%, driven by a strong increase in noninterest-bearing despots, as well as core fee income increasing $8 million, well above our forecast of a decrease of $1 million. Credit quality weakened modestly as NCOs increased $9 million to $27 million or 70 bp of total loans in 4Q from $18 million or 47 bp of total loans in 3Q… we believe the current discount is too extreme relative to fundamentals.”

In line with this outlook on the shares, and based on its “high growth potential as it transforms into a fintech-oriented, digital-forward bank,” Chiaverini rates CUBI as Outperform (i.e. Buy), with a $37 price target to suggest a robust 112% upside over the next 12 months. (To watch Chiaverini’s track record, click here)

Customers Bancorp has picked up 3 recent analyst reviews, and these are unanimously positive for a Strong Buy consensus rating. The stock is currently selling for $17.42 and the $48.33 average price target implies a strong 177% one-year upside from that level. (See CUBI stock forecast on TipRanks)

Metropolitan Bank Holding (MCB)

The next stock we’ll look at is Metropolitan Bank Holding, whose main subsidiary is Metropolitan Commercial Bank. MCB focuses its services on businesses, entrepreneurs, and personal customers, in the mid-market banking segment. The bank, which is based in New York City, maintains six full-service banking centers in the City and on Long Island, and backs them up with no-fee access to more than 1 million ATM machines globally plus online banking and mobile banking apps.

This is another small-cap community bank, but a look at the company’s recent 4Q22 report shows that Metropolitan Bank stands on a firm foundation. The bank had $6.3 billion in total assets as of December 31, 2022; while this was down y/y, the bank did register an increase in total loans. Metropolitan Bank saw its loan business increase in Q4 by almost 5%, or $223 million, to reach $4.8 billion. The bank also had $5.3 billion in total deposits, and during Q4 it was able to finish divesting itself from the cryptocurrency business.

At the bottom line, Metropolitan Bank had a diluted EPS of $2.43 in 4Q22, for a gain of 43% y/y.

With all of that, recent trading has been hard on MCB – the stock fell by 44% in Monday’s session.

The insiders have not been shy about buying up shares of MCB at a discount. No fewer than 5 have done so – but the largest insider trade, by President and CEO Mark DeFazio, deserves special notice. DeFazio spent just under a half-million dollars to pick up 20,517 shares. In total, DeFazio now holds 131120 shares.

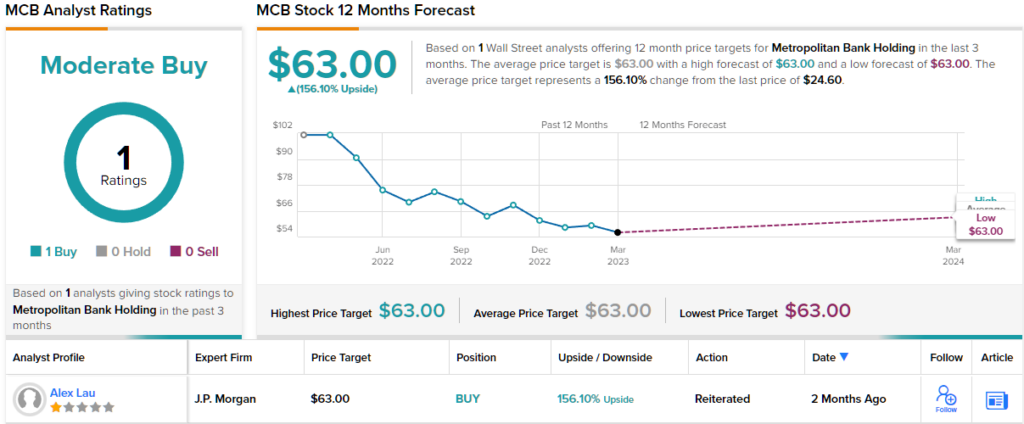

JPM analyst Alex Lau is pleased with what he sees in MCB, and lays out a path forward for the bank in the coming year: “In the fourth quarter, the fintech BaaS business grew deposits (+6% q/q or +51% y/y ), showing positive momentum despite a challenging deposit environment. Looking into 2023, the key focus for MCB is on its ability to drive low-cost deposits to fund its loan growth engine while managing the net interest margin…”

Giving some quantification to his outlook, Lau rates this stock as Overweight (i.e. Buy), and gives it a $63 price target for an impressive 156% upside out to the one-year time horizon. (To watch Lau’s track record, click here)

Lau’s is currently the only analyst review on file for Metropolitan Bank Holding, which is trading for $24.60. (See MCB stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.