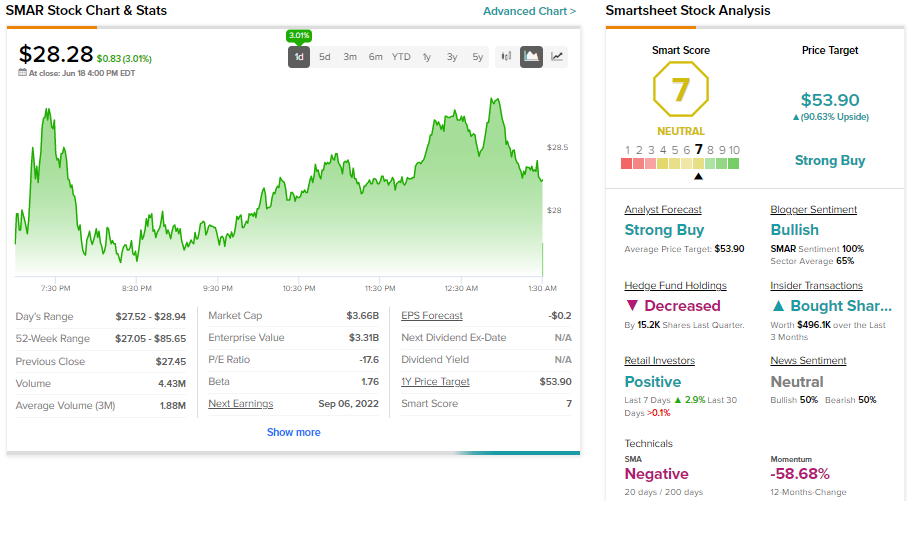

Like most tech stocks, Smartsheet (NYSE: SMAR) is on a downtrend in 2022 and has lost substantial value. The shares of this workflow management platform have dropped about 67% from the 52-week high due to the broader market selloff amid recession fears.

Now What?

While Smartsheet stock has slumped, its top line continues to improve year-over-year and sequentially. Furthermore, its large customer base, with more than $100K annual contract value, is also expanding.

What’s more? Smartsheet’s dollar-based net retention rate stays high while billings remain strong.

In response to Smartsheet’s recent quarterly performance, William Blair analyst Jake Roberge, who took coverage from Arjun Bhatia, stated, “Strength in new customer additions was the highlight of the quarter, in our view. The first quarter was a new quarterly record for customer bookings and represented the highest net logo growth that Smartsheet has seen since its IPO.”

The analyst is bullish on SMAR stock. The analyst highlighted the traction in SMAR’s large customers, high retention rate, large addressable market, and attractive valuation for his bullish outlook.

Roberge added, “With the stock trading at just 5 times calendar 2023 revenue for a business putting up sustainable 40%-plus growth in a sizable market, we believe the stock is attractive at these levels and would recommend it for long-term investors.”

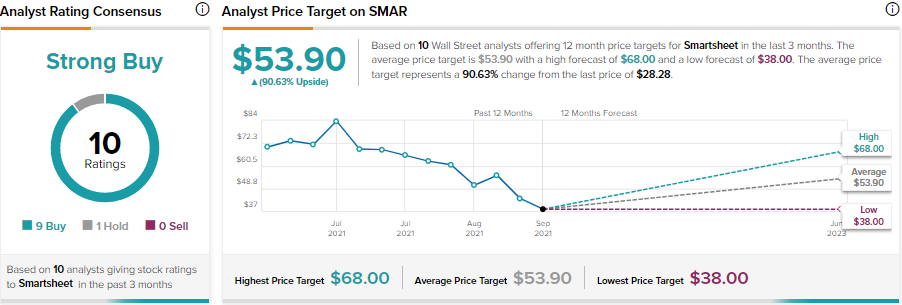

Along with Roberge, most Wall Street analysts are optimistic about SMAR stock. It has received nine Buy and one Hold recommendations for a Strong Buy consensus rating. Further, the average Smartsheet price target of $53.90 indicates 90.6% upside potential from current levels.

Bottom Line

While SMAR’s fundamentals remain strong, it has a Neutral Smart Score of 7 out of 10 on TipRanks. Notably, SMAR’s revenue and customer base continue to expand, but the growth rate is decelerating sequentially. Further, the weak macro environment could pose challenges.

Nevertheless, SMAR’s management expects that the momentum in its business will sustain. Its growing customer base, increase in average contract value, and strength in the global work management market bode well for future growth.

It’s worth mentioning that the macro headwinds haven’t had any impact on its financials yet. However, management took a cautious stance and incorporated macro-related headwinds in its full-year revenue and billings guidance. This makes its guidance conservative as it has not seen any challenges yet and indicates that it could outperform its outlook in FY23.

Read full Disclosure