Food delivery services have been going through many changes of late, and DoorDash (DASH) is no different. The company recently announced a major new stock buyback plan, the result of an earlier plan that would give employees better access to stock ownership.

The resulting buyback announcement sent shares up 2.2% in premarket trading on Friday, but the stock turned negative, and is currently down over 7% on the day.

It’s enough to make me bullish on DoorDash for several reasons. Better employee relations seldom hurt, even when they’re more contractors than employees, depending on where you work. However, DoorDash is also showing its concern for investors and making moves that accommodate everyone.

The last 12 months for DoorDash have featured both a rise and fall. The company rose sufficiently to challenge $250 per share back in November 2021. However, these gains proved unsustainable, and the company lost close to 75% of its value, dropping to its current levels.

DoorDash announced plans to launch a stock buyback program, supported by $400 million. It will be buying back its Class A common stock, a move to reduce share dilution caused by the company’s other recent plan to offer stock incentives to its delivery drivers.

Wall Street’s Take

Turning to Wall Street, DoorDash has a Moderate Buy consensus rating. That’s based on 10 Buys and six Holds assigned in the past three months. The average DoorDash price target of $127.94 implies 106.5% upside potential.

Analyst price targets range from a low of $80 per share to a high of $200 per share.

Investor Sentiment is on the Decline

While DoorDash’s plan for a buyback is sparking some investor confidence, it’s going to have a ways to go to get any real traction. The company has a Smart Score of 6 out of 10 on TipRanks. That puts it on the higher side of “neutral,” fully two points below the lowest level of “outperform.” A look at some of the key investor sentiment figures helps explain why.

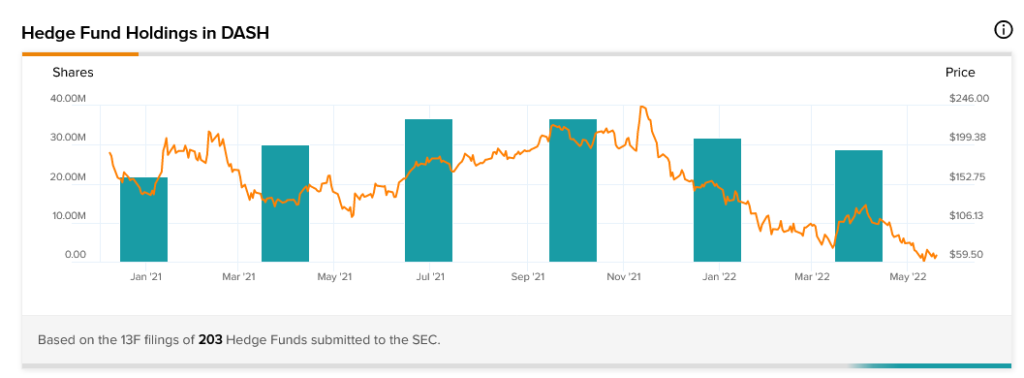

Hedge funds, based on the TipRanks 13-F Tracker, are steadily decreasing their involvement with DoorDash. For the third quarter running, hedge funds reduced their involvement.

Hedge funds went from just under 31.77 million shares in December 2021 to just under 28.7 million shares in March 2022. That’s all down from the high of just under 36.88 million shares in June 2021.

Insider trading, meanwhile, is heavily sell-weighted. In the last three months, insider selling transactions beat buying transactions by a narrow 16 to 15. However, going back to the full year, the ratio broadens dramatically. Sell transactions again beat buy transactions, this time 133 to 34.

As for retail investors who hold portfolios on TipRanks, that’s merely mixed. While TipRanks portfolios holding DoorDash stock are up just under 0.1% in the last seven days, they’re down 0.1% outright for the last 30 days. As for DoorDash’s dividend history, it simply doesn’t exist, nor does it show signs of starting.

A Simple Matter of Supply and Demand

DoorDash’s move here is a smart one. It needed a way to keep employees in the fold, so it gave them a more personal stake in the company by offering stock as part of compensation.

Back in April, the company even started offering “top-up” equity grants for those who joined after the IPO in 2020. That was mainly due to the differences in compensation levels for those who started at the IPO and those who followed.

Yet, in doing so, the company also made its stock a little less valuable. Handing out more stock increases the supply and thus lowers the value accordingly. So by DoorDash putting cash into buying back stock, it reduces the supply accordingly and should give the share price a bit of a goose upward as well.

DoorDash could use such a shot in the arm; tales abound about the various gaffes the company has seen in recent weeks. For instance, there’s the tale of the technical glitch that prompted another technical glitch and sent a customer a credit for $0. It came with DoorDash’s fondest wishes that the customer enjoys the discount of nothing off the next order.

Then there was the downright engrossing tale of the Texas toddler who, after getting his hands on Mommy’s phone, placed a DoorDash order for 31 cheeseburgers from Mcdonald’s (MCD).

However, DoorDash isn’t just a repository for comical glitches and missteps; it recently opened a “delivery-forward food hall,” a combination of a ghost kitchen and a virtual food hall.

It lets customers not only order food from various locations but also offers some quiet spaces for said customers to sit and eat the food that isn’t in a restaurant. It’s the third such location under the “DoorDash Kitchens” banner and the first outside of California, opening in Brooklyn.

The company could use some positive publicity that doesn’t just leave half the internet laughing. A stock buyback is a good, solid way to do that. It also serves as a shot in the arm for the stock. Given its current levels, the company could use that too.

Concluding Views

There are reasons to like DoorDash. Though its value as a pandemic darling that kept us in our favorite foods despite restaurant dining room closures en masse has declined, there’s still value to be had here. We still enjoy delivery, even if we like to go out, too.

DoorDash is working to keep that delivery flow going and modifying its compensation packages for employees and investors alike. That makes it a company to watch.

It also doesn’t hurt that DoorDash is trading well under even its lowest price targets right now. That suggests that it has some solid upside potential. Yes, investor sentiment is mostly negative right now, but there’s some very real potential DoorDash can turn it around.

The company can laugh at itself with its various gaffes, but it also understands the serious business that’s involved. That combination is enough to make me at least somewhat bullish.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure