In sharp contrast to the semiconductor sector, chip giant Intel (INTC) has struggled in 2020. While the PHLX Semiconductor Sector Index (SOX) – the industry’s overall barometer – has added 20% of gains year-to-date, INTC shares have declined by 16%.

The sharp drop is mostly on account of investors disappointment in delays to the release of the company’s next-generation 7nm chips, which have been moved back to 2022. Intel was already struggling to keep up with other high-flying semiconductor players such as Nvidia and AMD, but the latest delay has sent the stock into a tailspin as investors have wondered whether Intel can recapture its former glories.

Well, the company certainly seems to think it can do just that. In a confident move which should restore some positive sentiment, Intel announced an ASR (Accelerated Share Repurchase) to buy back $10 billion’s worth of stock, funded from the company’s own pockets. ASRs are normally an indication that a company is undervalued, and Intel management obviously feel the latest sell off has presented an opportunity which needs to be taken.

Deutsche Bank analyst Ross Seymore applauds INTC’s aggressive stance and believes the ASR will set a floor in the company’s share price as well as signal confidence in its ability “to deliver a strong array of new products over the next 1-2 years.” However, the 5-star analyst believes it will take more than share repurchases for confidence to be fully restored.

“Despite these positives,” Seymore said, “We continue to believe INTC’s share price will remain relatively range-bound until the company clarifies its plan to rectify its manufacturing and product roadmap following the recently announced delays to the 7nm ramp. Until the company rebuilds investor (and customer) confidence in the timing, location (internal vs. external) and financial implications of its manufacturing strategy, we continue to see the shares as being range-bound.”

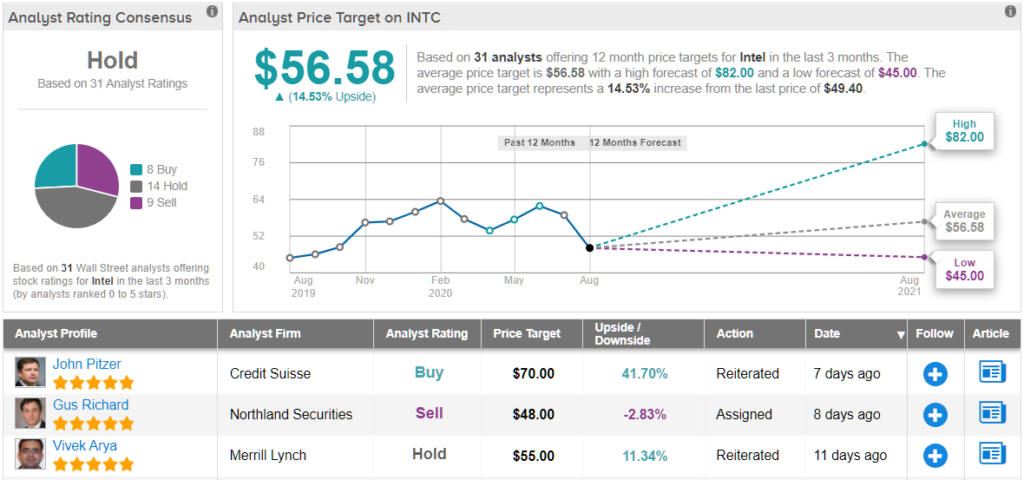

Accordingly, Seymore maintains a Hold rating on INTC shares, alongside a $60 price target, which actually implies a 21% upside from current levels. (To watch Seymore’s track record, click here)

The rest of the Street concurs. Based on 8 Buys, 14 Holds and 9 Sells, the chip giant has a Hold consensus rating. Yet, investors could be lining their pockets with a 15% gain, should the $56.58 average price target be met in the year ahead. (See Intel stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

This article was originally posted on TipRanks.