Domino’s Pizza (DPZ) is a pizza company that operates a network of company-owned and franchise-owned stores in the U.S. and international markets. It operates through the following three segments: U.S. Stores, International Franchise, and Supply Chain.

The U.S. Stores segment consists primarily of franchise operations. The International Franchise segment comprises a network of franchised stores. The Supply Chain segment operates regional dough manufacturing and food supply chain centers.

The company was founded by James Monaghan and Thomas Stephen Monaghan in 1960 and is headquartered in Ann Arbor, MI.

Domino’s Pizza recently reported earnings, which saw disappointing results. Revenue came in at $1.01 billion, a slight miss of $20 million. When breaking down revenue into same-store-sales growth, its U.S. figures also disappointed, with a decline of 3.6%.

On the bright side, international same-store-sales growth was 1.2% when excluding the impacts of foreign currency fluctuations. Overall, revenue grew 2.7% year-over-year.

When it comes to earnings per share, the miss was even worse. The consensus for EPS was $3.08. However, Domino’s Pizza reported $2.50 per share – a big miss of $0.58. This is down from $3 per share in the first quarter of 2021.

Despite the disappointing quarter, we are bullish on the stock.

Headwinds Likely to Continue for Domino’s Pizza

Domino’s Pizza faced a number of headwinds in the quarter, which resulted in declining year-over-year profits despite overall revenue growth. Chief Executive Officer Ritch Allison blamed the Omicron surge, staffing shortages, and inflationary pressures for these results.

Indeed, restaurants in North America have been struggling to prevent workers from leaving for higher-paying jobs in what has been dubbed the “Great Resignation.”

Domino’s has attempted to incentivize customers to pick up their orders by offering $3 coupons. However, it seems unlikely that most consumers are willing to inconvenience themselves just to save a nominal amount of money.

In addition, the inflationary pressure on pizza ingredients is something that the company has minimal control over. The company is forced to either eat the costs or pass them on to customers. As things stand right now, it appears that DPZ has chosen the former rather than the latter.

This can be interpreted in one of two ways. Either the company is trying to remain competitive with its pricing, or it’s having difficulty passing on the costs to consumers.

Nevertheless, the CEO believes that these issues are likely to remain further into 2022, which means investors and analysts are likely going to have to readjust their expectations.

Growth Catalysts

Although Domino’s had a bad quarter, investors shouldn’t lose sight of the positives. To begin with, Domino’s was a huge pandemic winner that saw many customers order from it during lockdowns and while people were transitioning to the reopening phase.

As a result, the company could just be coming up against tough comps. It’s important to remember that Domino’s is still the largest pizza chain in the world, operating in an industry that is expected to continue growing at a CAGR of approximately 5.5% between 2021-25.

The company continues to open up new restaurants in the U.S. and internationally. In addition, with the Federal Reserve and other central banks raising interest rates, it’s only a matter of time before inflationary pressures begin to ease.

Furthermore, the company is still very profitable and generates plenty of free cash flow (about $490 million in the past 12 months). It repurchased $47.7 million worth of shares in the first quarter and has $656.4 million worth of authorized buybacks remaining.

At current prices, this represents approximately 5.5% of the shares outstanding. If prices were to continue falling, the company would be able to retire even more shares, which would ultimately benefit long-term investors even more.

Therefore, even though the company will continue to face headwinds, it doesn’t mean this is the end for Domino’s Pizza.

Website Traffic

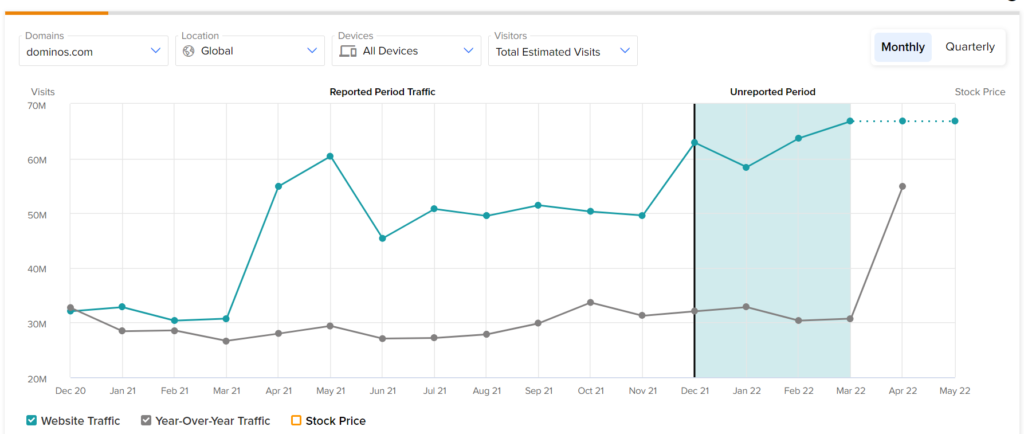

Domino’s has a strong online presence, which is one of the reasons why it was so successful during the pandemic. As a result, measuring Domino’s website traffic might be able to provide investors with important clues.

Taking a look at the website traffic starting from December 2020, we can see that total global visits have been trending up. Therefore, this is consistent with the company’s revenue growth year-over-year of 2.7%.

Unfortunately, it couldn’t provide us with clues to suggest that earnings were going to miss as much as they did. Nevertheless, it can still be a useful tool to measure demand, as it predicted NFLX’s recent earnings miss.

Dividend

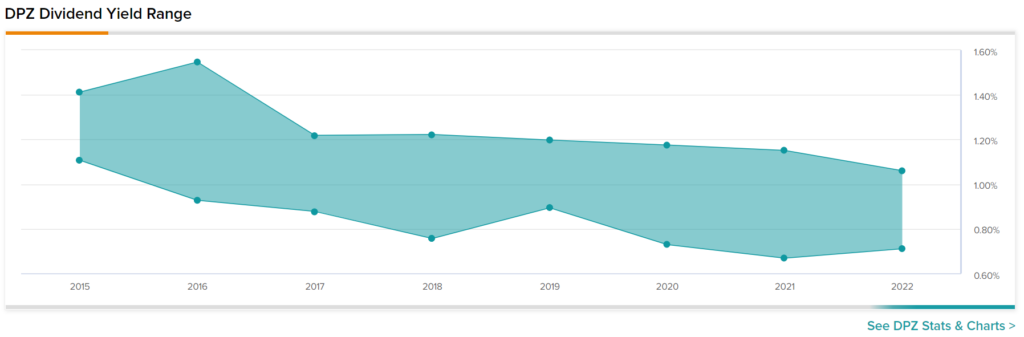

For investors that like dividends, DPZ currently has a 1.22% forward dividend yield, which is above the sector average of 0.44%. Taking a look at its historical dividend payments, we can see that its yield range has trended down in the past several years.

However, at a 1.22% forward yield following its recent decline, the company’s dividend is near the upper end of its range. This implies that the stock price is trading at a discount relative to the yields investors have seen in the past.

Wall Street’s Take

Turning to Wall Street, Domino’s has a Moderate Buy consensus rating based on nine Buys, 14 Holds, and one Sell rating assigned in the past three months. The average Domino’s Pizza price forecast of $419.13 implies 18.4% upside potential.

Final Thoughts

Although Domino’s is facing headwinds, it is still a great company that generates plenty of free cash flow. In addition, the company has gone through tough periods before, only to stage great comebacks later on. As a result, we are bullish on the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure