Putting behind 2 miserable years of market action, Alibaba (NYSE:BABA) shares are already up 35% since 2023 kicked off. In fact, zoom out a bit further and the shares have gained 90% since October’s lows.

The big question now for Baird’s Colin Sebastian is “could this rally have legs?”

Ahead of Alibaba’s FQ3 earnings next month, there are some positive developments that might help sustain the uptick. Going by data from the National Bureau of Statistics (NBS), in 2022, online sales of physical goods in China saw a 6% year-over-year rise. Sebastian reckons December volumes increased by ~15% y/y, amounting to an acceleration on the respective ~13% and ~4% growth notched in October and November.

Sebastian also thinks that in December online sales most probably dropped by around 15% month-over-month. This would be “consistent” with pre-Covid trends of respective 13% and 15% drops from 2018 and 2019. It would also mark an improvement on the trends seen in 2020 and 2021, which showed respective 20% and 24% declines.

“Looking ahead,” commented the 5-star analyst, “we expect that the recent easing of pandemic-related restrictions as well as uncertainty around global macro conditions will encourage the central government to support domestic consumption, and thus, online and in-store retail sales could benefit. Additionally, government scrutiny over technology companies appears to be easing a bit, as focus turns to stabilizing the real estate sector.”

Additionally, since the “work from home” trade never really picked up steam in China, the analyst does not see a “rotation out of e-commerce stocks in China” in the post-pandemic environment. Factor in the potential for domestic consumer spending to improve and the easing of geopolitical issues, and with BABA’s valuation still “well below historical average earnings multiples,” there could be “further upside potential.”

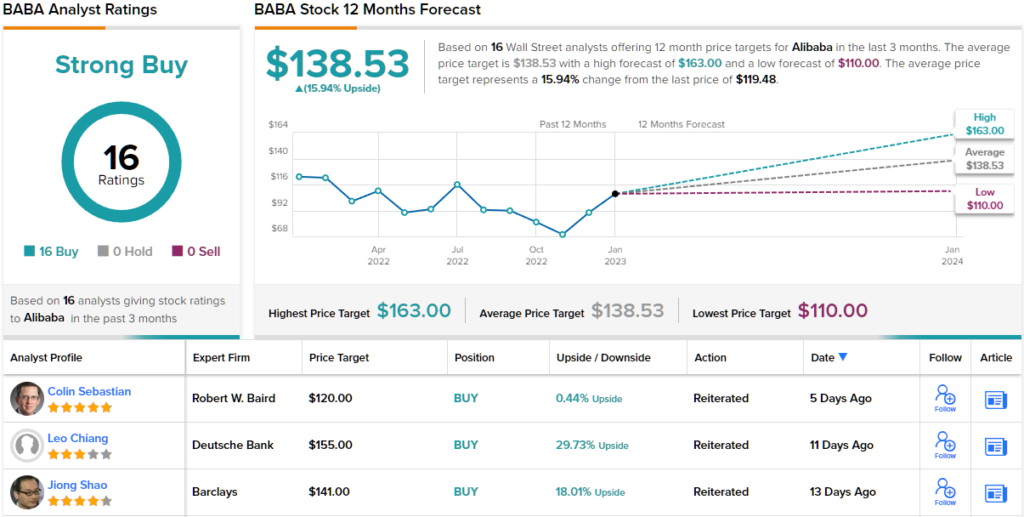

That all sounds promising, although it looks like Sebastian needs to revise his price target for BABA; at $120, shares are expected to stay range-bound. (To watch Sebastian’s track record, click here)

Overall, all agree BABA stock is one to own; all 16 analyst reviews are positive, making the consensus rating a Strong Buy. Going by the $138.53 average target, the shares will be changing hands for a 15% premium a year from now. (See Alibaba stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.