DraftKings (DKNG), one of the largest online sports gambling platforms, has been making headlines. Last month, DraftKings stock dropped after the company announced a $20-billion offer to acquire U.K.-based Entain.

However, this week, DraftKings announced the company wouldn’t be tendering a formal offer after all.

DKNG stock has been bouncing around quite a bit lately. These types of growth-oriented acquisitions are likely to continue. Indeed, DraftKings has grown its market share and footprint over time in large part as a result of this maneuvering.

However, the fact that this deal fell through is generally being cheered on by the market.

The question many investors have right now is whether or not DraftKings is worth a gamble at these levels, currently 34.8% off its 52-week high of $74.38.

I’m cautiously bullish on this stock right now. Let’s dive into why the market may turn bullish on this stock in the months to come. (See Insiders’ Hot Stocks on TipRanks)

Impressive Earnings Growth

The online sports betting space is intriguing. With the gradual opening of new markets in the U.S. at the state level, companies like DraftKings are well-positioned to benefit from strong tailwinds.

The secular growth investors expect to see is translating into strong earnings numbers for DraftKings. The company’s $298 million in revenue this past quarter was good for nearly 300% year-over-year growth.

On the user growth front, investors saw DraftKings increase monthly unique users in a similar fashion. Accordingly, it appears there’s a tremendous amount of operating leverage with this company’s business model. With solid margins, investors are getting a rather large piece of a growing pie.

One of the reasons some investors remain very bullish on DraftKings is the eagerness of this company’s management team to continue raising the bar. This past quarter, DraftKings announced the company would increase its forward-looking guidance by approximately 15%.

This company has a solid cash balance of approximately $2.6 billion, as of June this year. Questions about capital needed to fund growth aren’t really pertinent at this time.

Accordingly, investors don’t need to worry about additional capital raises for the foreseeable future. This company has a manageable debt level, and a strong growth trajectory over the long term.

NFL Season Further Boosting DKNG

Besides the obvious catalysts that the online gambling space provides in terms of growth, there are other reasons why investors believe this is a stock with a tremendous growth trajectory.

Among the key factors investors are considering is DraftKings’ recent move to complete the migration to the company’s in-house betting engine, prior to the start of the NFL season. Thus far, the NFL season has proven to be one of the best on record in terms of betting volume. Of course, having online betting open up in so many states was likely to make this so.

However, DraftKings has done well to make its online platform formidable in this space. The company’s currently picking up a rather large market share in the online sports gambling space.

That’s not to say there’s no competition. However, DraftKings remains a top-tier online gambling platform with tremendous fundamentals, and a balance sheet that’s hard to beat right now.

Robust Expansion

DraftKings has undertaken an aggressive expansion plan which is assisted by the increasing legalization of online gambling across various U.S. states. In the second quarter, the company launched its services in Colorado and Illinois. It further launched iGaming services in West Virginia and Pennsylvania.

As per recent reports, the company also intends to spread its presence in Virginia, Michigan, and Tennessee. It has recently acquired Golden Nuggets Online Gaming in an all-stock transaction worth $1.6 billion. This deal will allow DKNG to leverage its iGaming platform, and vast player base of 5 million.

Wall Street’s Take

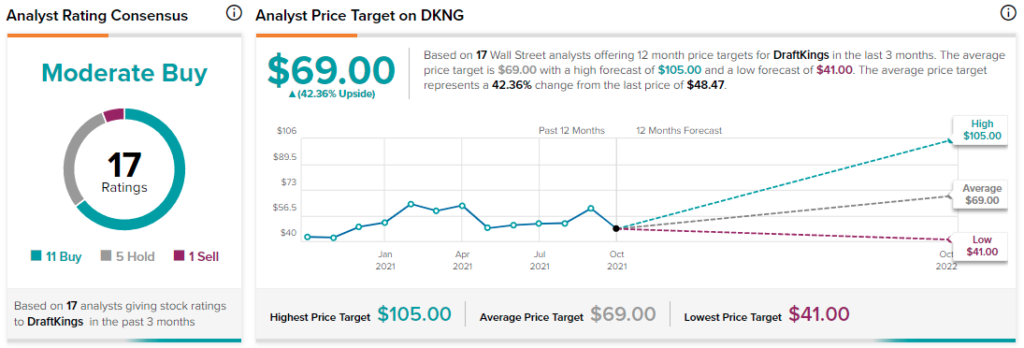

As per TipRanks’ analyst rating consensus, DraftKings stock is a Moderate Buy. Out of 17 analyst ratings, there are 11 Buy recommendations, five Hold recommendations, and one Sell recommendation.

The average DKNG price target is $69. The analyst price targets range from a high of $105 for each share, to a low of $41 per share.

Bottom Line

Several analysts are quite bullish on DKNG, given the strong growth that the company has shown recently. Moreover, it’s solid financials, low debt, and growth-oriented strategies are positives.

Sure, headwinds may materialize. However, investors bullish on the longer-term story with online gambling don’t really have a better option to choose right now. DraftKings appears to be a winner.

Disclosure: At the time of publication, Chris MacDonald did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.