Top digital gaming (or iGaming) firms, such as DraftKings (DKNG) and Flutter Entertainment (FLUT) (which I am bullish on), could take a growing bite out of the traditional gambling market. They can happen as they embrace intriguing new technologies (think AI-powered bet personalization) to draw in new users and keep existing ones spinning that digital roulette wheel. As they say, the house always wins. And the more gamblers play, the more the digital gaming firms have to gain.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Additionally, I like the economics of iGaming far better than traditional casinos. iGaming doesn’t require the same level of security investments (except for cybersecurity), venue upkeep, floor staff, or dealing with cheaters that physical gaming establishments do.

In essence, it takes a great deal of the risks associated with running a traditional casino off the table. Not to mention, there’s less friction that comes between a gambler and the digital sportsbook or slot machine when all they have to do is open an app compared to driving on over to the local (or Vegas) casino, parking, buying chips, and finding a table.

Meet the Kings of iGaming

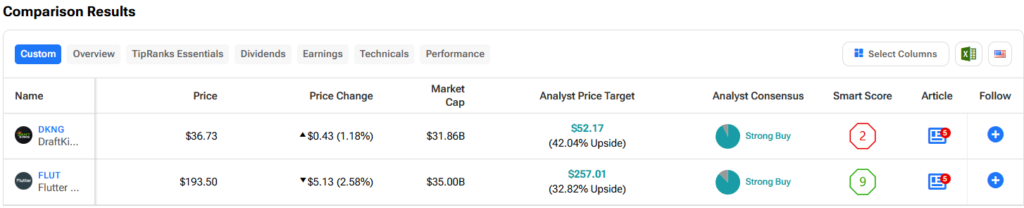

Undoubtedly, DraftKings (DKNG) and Flutter Entertainment (FLUT) are two of the kings of digital gaming these days. And in this piece, we’ll use TipRanks’ Comparison Tool to stack up the two gambling stocks and see which one Wall Street views as more worthy of rolling the dice.

Currently, both digital gaming stocks boast Strong Buys from the analyst community. Perhaps more notably, shares of both companies have average analyst price targets that imply more than 32% of expected upside over the year ahead. That’s some serious upside potential that could suggest significant undervaluation in shares relative to their growth profiles and overlooked catalysts ahead.

Personally, I’m inclined to stay bullish on both DKNG and FLUT as we move toward the end of the year. Though shares have been treading water more recently, their long-term narratives have never looked better.

DraftKings (DKNG)

DraftKings stock began pulling the brakes from its multi-bagger rally in late March. Since then, shares have sunk close to 25%. Despite the steady slip into a bear market, DKNG stock has remained up more than 160% in the past two years.

Even in the face of an ugly bear market, numerous analysts are still pounding the table on DraftKings ahead of its second-quarter earnings, which are due for reveal on August 1st. Indeed, it’s going to be tough to top the 53% year-over-year revenue growth posted in the first quarter.

That said, DraftKings has kept its foot on the growth gas while seeking to drive operating efficiencies where possible, so it will be interesting to see where top-line growth and margins stand.

Bank of America (BAC) analyst Shaun Kelley is cautious heading into its big number due to mounting customer-acquisition costs. Indeed, it takes money to bring customers in. But just how many will be sticking around after they’ve placed their first few bets?

Should the economy improve and more disposable income fall into the pockets of consumers, my bet would be the price of customer acquisition could prove worthwhile. With rates falling and macro headwinds potentially clearing up, perhaps the coming rough quarter could precede some remarkably good ones, especially as football season kicks off.

On the plus side, recent sportsbook launches in the states of Vermont and North Carolina are expected to propel EBITDA numbers in the second half. Such a timely catalyst and the stock’s recent rut make DKNG stock a very intriguing bet going into earnings, especially in the face of what I view as muted expectations from analysts like Kelley.

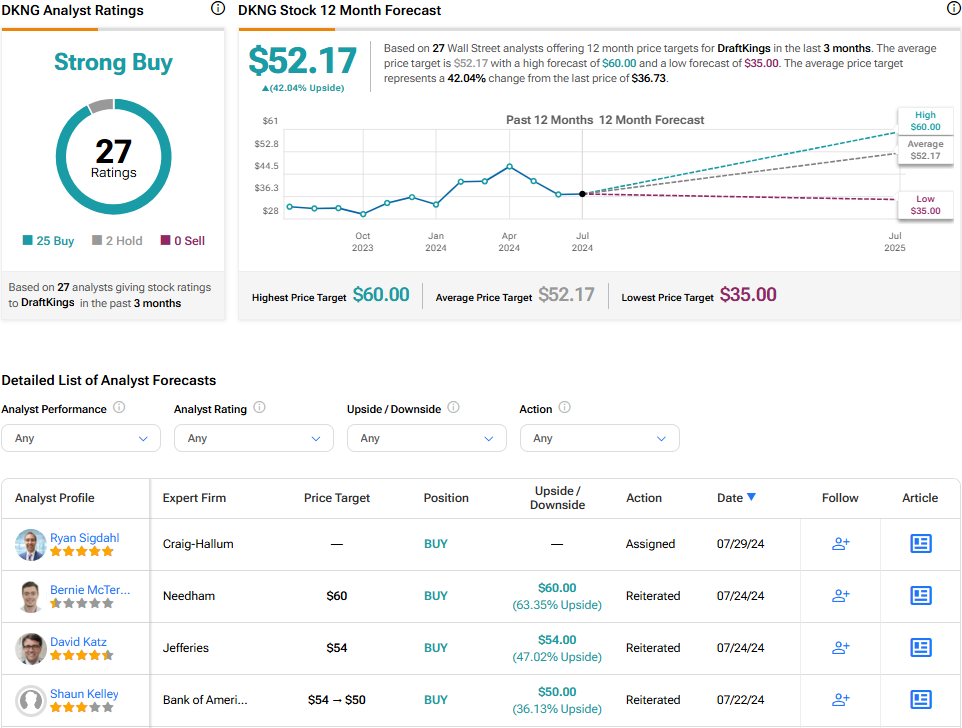

What Is the Price Target for DKNG Stock?

DKNG stock is a Strong Buy, according to analysts, with 25 Buys and two Holds assigned in the past three months. The average DKNG stock price target of $52.17 implies 42% upside potential.

Flutter Entertainment (FLUT)

Flutter Entertainment has been fluttering sideways so far this year, with shares actually down 3% year-to-date. Undoubtedly, the iGaming firm behind FanDuel has a dominant position in the U.S. gaming market. But it still desires to expand further as new states get the green light for a big launch. At this juncture, Flutter looks poised to flutter higher as it defends its turf in the U.S. iGaming scene through its aggressive push.

In the latest quarter, the firm saw revenue rise 32% year-over-year, thanks to its own move into North Carolina. As the firm looks to use its size (and market leadership) to its advantage while introducing new innovations (think Parlay Hub for easily exploring and tracking parlay bets), Flutter may just be able to follow up a solid quarter with an even better one.

Flutter CEO Peter Jackson (not to be confused with the famous film director) stated his firm is “focused on continuing to expand our player base, market share, and embedding future profits within our business through disciplined investment and operational efficiency.” That sounds like a pretty solid strategy, but what differentiates it from DraftKings?

Hedgeye, which praised FLUT stock as a new long idea earlier this month, highlighted that there’s a “strengthening investment case for owning both” DKNG and FLUT. However, Hedgeye views Flutter as de-risked going into the second quarter, which is due on August 13th. I’m inclined to agree.

Additionally, FLUT stock looks a heck of a lot cheaper than DKNG at 2.8 times price-to-sales (P/S) and 32.3 times forward price-to-earnings (P/E) versus 4.2 and 103.1 times for DKNG, respectively.

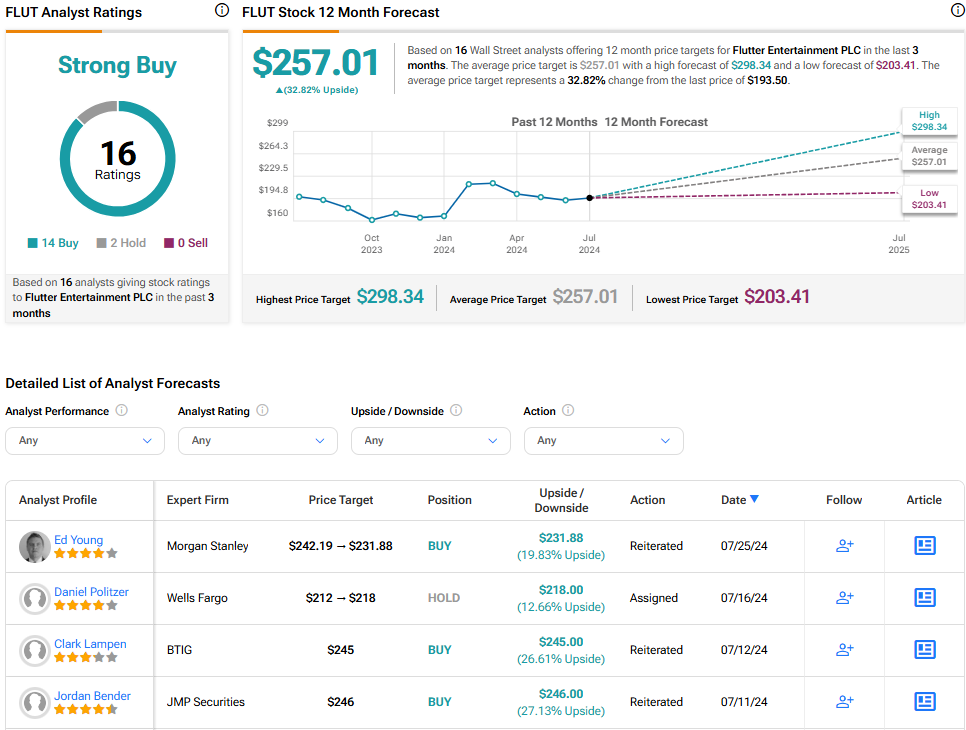

What Is the Price Target for FLUT Stock?

FLUT stock is a Strong Buy, according to analysts, with 14 Buys and two Holds assigned in the past three months. The average FLUT stock price target of $257.01 implies 32.8% upside potential.

Conclusion

The iGaming duopoly of DKNG and FLUT looks like fantastic bets for the second half. With Wall Street analysts’ confidence, recently launched business in states such as North Carolina, and management’s focus on growing prudently, the two names look timely and perhaps undervalued relative to the catalysts and growth ahead.

Between the two, Wall Street sees DKNG stock as having more room (over 42%) to run.