Shares of entertainment kingpin Disney (DIS) have been under an absurd amount of pressure these days, with concerns now ranging across the board.

With Disney+ growth showing signs of slowing, and a new COVID variant threatening to bring back restrictions at major parks, the house of mouse just cannot catch a break.

With current CEO Bob Chapek and former CEO Bob Iger reportedly “cutting ties” with one another, the frustration is almost palpable.

Despite ongoing headwinds and a rising risk that the U.S. economy could fall into a recession in 2023, I remain bullish on Disney stock.

It’s already in a bear market, having lost over 33% of its value from peak to trough. Now trading at $135 and change per share, the bar is set low, perhaps too low for a company the caliber of Disney.

Shanghai Disneyland Closes ‘Indefinitely’

Disney has lost its way amid the pandemic, and it’s a real shame that Shanghai Disneyland is once again closed due to the COVID pandemic in 2022.

The real question that should be on investors’ minds is whether such indefinite suspensions will be in the cards for other theme parks, specifically those in the U.S.

Although a stealth outbreak is the last thing the economy needs as the U.S. Federal Reserve begins to tighten further in its fight against inflation, I don’t think Disney’s other parks will suffer the same fate as that of Shanghai Disneyland.

That said, capacity reduction could take a stride out of Disney’s step, just as parks were about to increase capacity towards pre-pandemic levels.

For now, nobody knows what the near- or long-term future holds, with the coronavirus still continuing to take its toll.

Long-Term Fundamentals

Disney has so much upside if things were to go right for a change. Pent-up demand for experiences is likely still there, and arguably, Disney is in a far better position today to deal with another outbreak than it was two years ago.

Disney is capable of adapting to the new normal. For now, investors aren’t willing to give Chapek the benefit of the doubt as Disney+ has begun to lose its luster.

With the SVOD (streaming video on demand) space showing signs of maturity, Disney’s streaming service is no longer viewed as special.

In terms of content, though, Disney has enough to remain a leader. That alone should help it stay afloat come the next wave.

Wall Street’s Take

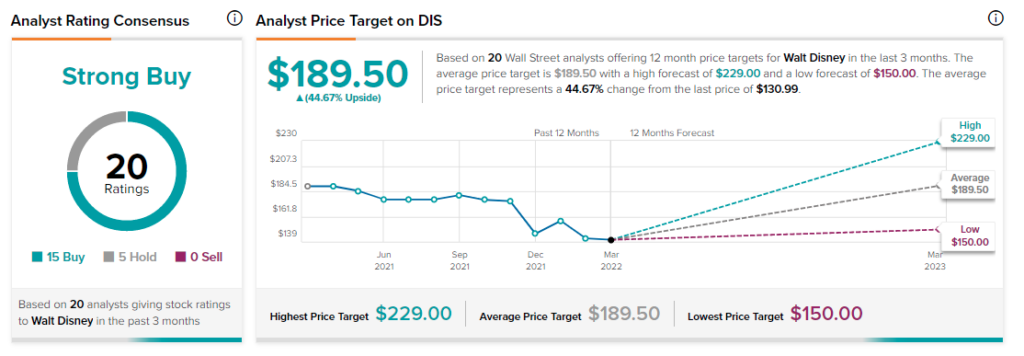

According to TipRanks’ rating consensus, DIS stock comes in as a Moderate Buy. Out of 20 analyst ratings, there are 15 Buy recommendations, and five Hold recommendations.

The average Disney price target is $189.50, implying 44.7% upside potential. Analyst price targets range from a low of $150 per share to a high of $229 per share.

Bottom Line on Disney Stock

With COVID surging again in time for spring, it appears that the reopening trade is off the table. The “roaring ’20s” talk we’ve heard about in late-2020 has now been replaced by fears of stagflation or a recession.

Could things take another 180-degree turn? They could, and that’s why I’m not so quick to give up on Disney stock as it fights through an increasingly challenging environment.

Disney’s parks business could have a heavy weight on its shoulders for quite some time. With new content on the way for the Disney+ platform in 2022 though, I think the American icon has staying power as it continues its evolution.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure