Not all market giants have reported earnings yet. Once trading closes today, Disney (DIS) will take its turn to report its fiscal fourth quarter’s results.

Ahead of the print, Macquarie analyst Tim Nollen has been looking at the central themes that are likely to determine sentiment on all things House of Mouse-based.

While the analyst sees plenty to like, noting that Parks earnings have “rebounded sharply” from Covid lows and the DTC business is “generally positive,” he offers a note of warning for the times ahead. “A looming recession will likely hit ad spending at the networks,” Nollen explained, “as well as attendance and spending at parks.”

Nevertheless, with the Disney+ ad tier launching in the U.S. on December 8 and overseas next year, should all markets launch, Nollen sees an $800 million ad sales “opportunity” in 2023, and by Q4 expects DTC revenue to outpace that of the linear networks.

Boosted by an impressive slate (Black Panther 2 and Avatar 2), content releases and international expansion should see, according to Nollen, near-term subscriber growth accelerate. Should the company guide for lower FY23 OI losses in DTC, it could be a “key stock catalyst.”

With Disney’s parks “more efficient and profitable than ever,” the Parks business is booming despite capacity constraints overseas, yet Nollen points out that the Parks’ post-Covid recovery did little for the stock. So, what’s to be expected in a potential recession?

“Parks revenue fell 7% in 2009,” explained the analyst, before adding, “we are hopeful it can be less now with recent price increases, Genie+ flexibility, and new attractions along with easing capacity restraints in China.”

On balance, then, Nollen expects the “structural gains” in DTC to counter the issues faced by ads and parks, and thinks that given the stock’s 36% year-to-date decline, it offers an “attractive opportunity for investors.”

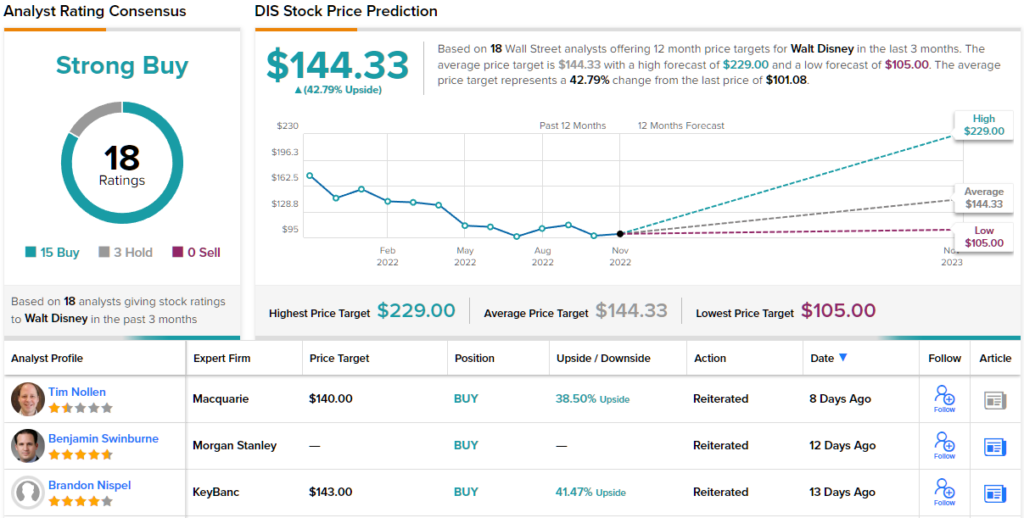

As such, Nollen rates DIS shares an Outperform (i.e., Buy) along with a $140 price target. The implication for investors? Upside of 40% from current levels. (To watch Nollen’s track record, click here)

And what about the rest of the Street? Most remain in Disney’s corner; based on 15 Buys vs. 3 Holds, the stock claims a Strong Buy consensus rating. The shares are expected to appreciate ~43% a year from now, considering the average price target stands at $144.33. (See Disney stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.