The retail sector has been under pressure recently due to rising inflation, labor shortages, and supply chain constraints. As many retail companies announce their quarterly earnings this week, investors will be looking at these earnings to gauge the impact of inflation.

In a bid to tame this soaring inflation, The National Retail Federation (NRF), which represents the retail industry, has urged the U.S. Government to reduce tariffs.

However, it seems that U.S. consumers are taking this retail inflation in stride. According to the NRF, citing data from the U.S. Census Bureau, retail sales in April were up 0.9% from March, adjusted seasonally, and increased 6.4% year-over-year, unadjusted.

How have retail stocks fared in the most recent quarter in this scenario? Let’s take a look at two such retailers, Ralph Lauren, a luxury retailer, and Urban Outfitters, a lifestyle retailer, both of which announced their earnings on May 24.

Ralph Lauren (NYSE: RL)

Ralph Lauren is a global luxury retailer that is involved in designing, marketing, and distributing premium lifestyle products. The company’s portfolio of brands includes Ralph Lauren, Ralph Lauren Collection, Ralph Lauren Purple Label, Polo Ralph Lauren, and Double RL, among others.

Ralph Lauren distributes products in five categories including fragrances and hospitality, apparel, footwear, accessories, and home.

The retailer giant reported revenues of $1.52 billion in fiscal Q4, up 18.3% year-over-year, beating consensus estimates of $1.4 billion. RL reported earnings of $0.34 per diluted share on a reported basis and $0.49 per share on an adjusted basis. The adjusted EPS surpassed analysts’ estimates by $0.13 cents.

Ralph Lauren’s fourth-quarter revenue growth was driven by a rise in revenues across all geographic regions in double digits and exceeded even its FY19 and FY20 pre-pandemic results for the same period. Even after disruptions due to the pandemic, the retailer registered a year-over-year revenue growth of 49% in North America, 54% in Europe, and 27% in Asia.

What’s more, the Average Unit Retail (AUR) metric, which indicates the average selling price for an item during a specific period also went up 13% year-over-year across RL’s direct-to-consumer network in Q4 and increased 15% for FY22.

Ralph Lauren COO and CFO, Jane Nielsen, commented on the strong AUR growth on its earnings call. She stated, “This strong AUR growth along with favorable channel and geographic mix, more than offset higher than expected ocean freight costs with steep increases in oil prices following the invasion of Ukraine.”

China is an important market for RL and despite COVID-related restrictions, sales rose 27% year-over-year in Q4 in the country. But the management continued to be optimistic about this market and pointed out that even with these disruptions, “our brands are resonating with consumers and the underlying health of our business remain strong.”

However, RL does expect COVID to continue to impact its business in China in Q1 of FY23 with a “limited contribution from foreign tourist sales.”

When it comes to rising costs, the company’s management indicated on its earnings call that it anticipates raw material, labor, and freight costs to remain elevated going into FY23, particularly in the first half of the year.

Nielsen outlined the company’s plans to mitigate this increase in costs and stated, “We plan to leverage our multi-pronged elevation strategy to continue driving AUR significantly above our long-term targets in order to mitigate mid-to-high single-digit product cost inflation in fiscal ’23.”

The retailer has projected its revenues to grow in “high single-digits” or at around 8% year-over-year in FY23 on a constant currency basis. The operating margin is anticipated to range between 14% and 14.5% on a constant currency basis.

While Guggenheim analyst Robert Drbul remained impressed with RL’s Q4 results, considering the challenging operating environment, he did believe that “RL is taking appropriate steps to drive meaningful growth across all channels and geographies.”

However, given the headwinds for the company mentioned above, the analyst lowered his FY23 EPS estimate from $8.75 to $8.50.

Drbul considers the shares “fairly valued” at current levels and as such, is sidelined on the stock with a Hold rating.

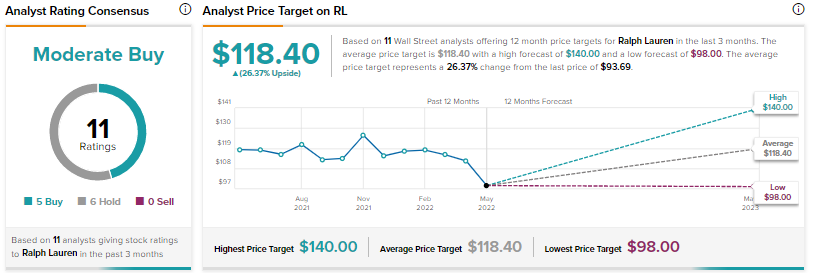

However, other Wall Street analysts are cautiously optimistic with a Moderate Buy consensus rating based on five Buys and six Holds. The average RL price target is $118.40, which implies 26.4% upside potential to current levels.

Urban Outfitters (NASDAQ: URBN)

Urban Outfitters is a lifestyle retailer whose portfolio of brands includes Anthropologie, BHLDN, Free People, FP Movement, Terrain, Urban Outfitters, Nuuly, and Menus & Venues brands.

URBN announced its Q1 results on May 24. Similar to RL, this retailer also seemed to have brushed aside the impact of inflation as its revenues increased 13.4% year-over-year to a record $1.05 billion, but still fell short of consensus estimates of $1.19 billion.

Earnings came in at $0.33 per diluted share in Q1 meeting analysts’ estimates. The Q1 results seem to have cheered investors as shares soared 15.5% on Wednesday to close at $20.77.

However, URBN’s costs were impacted by inflation. Richard A. Hayne, CEO, Urban Outfitters commented on the results, “We are pleased to announce record Q1 sales driven by an 11% Retail segment ‘comp’ [retail segment comparable sales]. Unfortunately, the impact of inflation on our costs of doing business more than offset the benefit of record revenues.”

URBN does not expect this revenue growth to continue in the second quarter and anticipates retail segment comparable sales to grow in the “low single-digit range” while the wholesale segment could see sales increase in the “mid-single digits”. Overall, this is expected to increase Q2 revenues in the “low single-digit range.”

The rising costs also adversely impacted URBN’s gross and operating profit margins, which declined in Q1. This downward trend is expected to persist going into Q2.

Urban Outfitters CFO, Melanie Marein-Efron, pointed out a number of factors that are likely to affect its gross margin going into Q2. This includes a combination of higher inventory levels that could result in “higher markdowns versus last year’s low levels.”

In addition, supply chain logjams leading to rising freight costs could drag down initial product margins resulting in “an approximate 500 basis point decline in gross profit margins for the second quarter.”

Considering these headwinds, Deutsche Bank analyst Gabriella Carbone expects URBN’s EPS to range between $0.65 and $0.70 in Q2. The analyst added, “While improving trends should begin in 3Q, we believe investors are likely to remain cautious given the volatile macro backdrop and the potential for promotional activity to pick up to a greater degree than expected.”

While the analyst was positive about the sales growth at URBN’s Anthropologie and Free People brands, Carbone remained concerned about the higher inventory and sales, general and administrative (SG&A) costs which could lead to “ongoing EBIT margin misses.”

As a result, Carbone remained sidelined on the stock with a Hold rating and lowered the price target to $24 from $35 earlier. Carbone’s price target implies an upside potential of 15.5% at current levels.

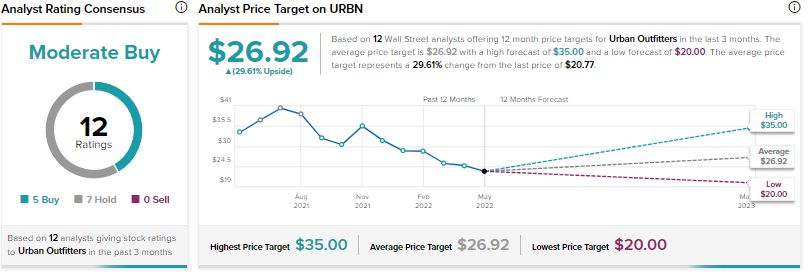

However, the rest of the analysts on the Street are cautiously optimistic with a Moderate Buy consensus rating based on five Buys and seven Holds. The average URBN price target is $26.92, which implies 29.6% upside potential to current levels.

Bottom Line

In the most recent quarter, both RL and URBN appear to have weathered the storm of inflation quite well. However, it seems that macro challenges are likely to persist for the rest of the year. Based on the cautiously optimistic stance of Wall Street analysts for both stocks, it seems that they are waiting to see how RL and URBN perform in 2022.

Read full Disclosure.