Cathie Wood’s ARK Innovation Fund (NYSEARCA:ARKK) bills itself as investing in “disruptive innovation.” Unfortunately for ARKK ETF holders, it seems that ARKK missed out on at least the early stages of the rise of the most innovative and disruptive technological advance in recent times — artificial intelligence (AI) and generative AI, in particular.

Why Generative AI Should be in a Disruptive Innovation Fund

It’s hard to argue that the rise of AI, and specifically generative AI, isn’t the most disruptive technological breakthrough that we’ve witnessed in some time. For those unfamiliar with the term, Roundhill Investments defines generative AI as “artificial intelligence models capable of creating new, unique content (i.e., images, text, audio) by learning patterns and structures from existing data.”

Consumer-facing generative AI apps like OpenAI’s ChatGPT have gone viral and reached critical mass at an unprecedented rate. After launching in November 2022, ChatGPT hit 100 million users a mere two months later, becoming the fastest-growing application of all time.

And it’s not just ChatGPT — investors and the public alike have been amazed by OpenAI’s Dall-E software, which can create elaborate images from text-based prompts. Recently, Adobe unveiled its new Firefly generative AI engine, which enables users to edit images in Photoshop using just a text-based prompt.

While the average investor can’t invest in privately-held OpenAI, there are plenty of ways for investors to gain exposure to this type of innovation. For example, Microsoft owns a large stake in OpenAI. Alphabet has its own answer to ChatGPT called Bard.

The aforementioned Adobe is also publicly traded. Meanwhile, ChatGPT and other generative AI applications are powered by Nvidia’s semiconductors. Unfortunately, none of these names are found in the ARK Innovation ETF.

Conspicuous in Their Absence

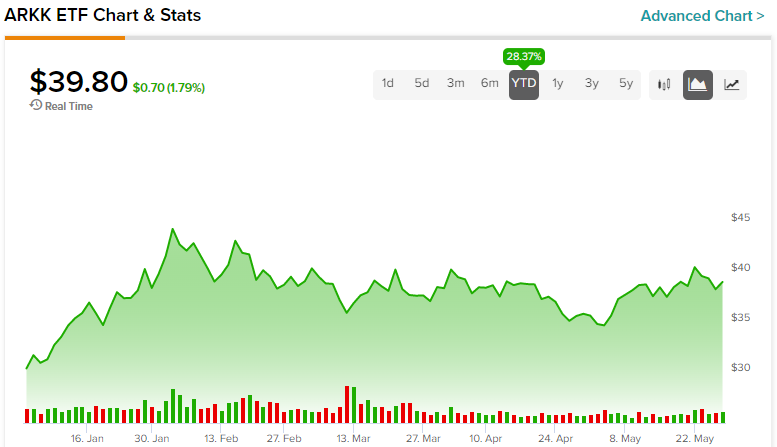

ARKK stock is up 27% year-to-date, so it’s hard to criticize its performance so far in 2023. However, the leaders in generative AI mentioned above are glaring in their omission from a fund that is focused on innovative and disruptive technology, and many of these names are up even more than ARKK.

Nvidia is up roughly 180% year-to-date, far more than ARKK. Last week, Nvidia reported blowout earnings and released show-stopping guidance for the current quarter, and the stock gained ~24% on the day, tacking on $184 billion to its market cap. To put things into perspective, Nvidia essentially added more than the entire market cap of Netflix or Nike to its valuation in a single day.

As mentioned above, Nvidia is not owned by ARKK. Making matters worse for ARKK holders is the fact that ARKK had the prescience to own Nvidia long before it became the hottest name in the market. ARKK exited its Nvidia position over the course of last November to this January, missing out on the bulk of its massive year-to-date run.

In fairness to ARK Invest, the firm does own Nvidia in smaller funds like the ARK Autonomous Technology & Robotics ETF (BATS:ARKQ) and the ARK Next Generation Internet ETF (NYSEARCA:ARKW), but there’s no way around the fact that they missed out on a massive gain in its flagship fund.

A Matter of Valuation?

In an interview with CNBC this past February, Cathie Wood said that the fund sold Nvidia as part of the process of “consolidating around their highest-conviction names” and that part of the reason that Nvidia didn’t make the cut was that its valuation is very high. Wood isn’t wrong about this valuation per se — after its monster earnings report, Nvidia now trades at a nosebleed 50 times forward earnings and 40 times consensus 2025 earnings.

It’s not a bad thing to take profits from some of your winners and consolidate them into your new best ideas, but unfortunately, the timing of this move didn’t work out in ARK’s favor. Furthermore, selling Nvidia based on its valuation makes some sense, although when looking at ARKK’s other top holdings, it doesn’t appear that valuation is a primary concern.

Below is an overview of ARKK’s top 10 holdings. Click on the image to learn more.

As you can see, Tesla is the fund’s top holding, with a large weighting of nearly 11%. Wood is a longtime and prominent Tesla bull, and this pick has been a big winner for ARKK, as Tesla has returned 86% year-to-date, driving a large part of ARKK’s overall gain. However, Tesla also trades at an expensive P/E multiple of 55 and a forward P/E of 39 times. While this is slightly cheaper than Nvidia, they are still clearly in the same ballpark, and both trade at valuations well above the broader market.

Meanwhile, other top-five holdings like Roku and Coinbase are not yet profitable.

ARKK does own another AI play, UiPath, in its top 10 holdings. UiPath specializes in workflow automation and trades at 46 times forward earnings and 41 times 2025 consensus earnings. So, again, it’s another example of a holding where the valuation is not all that different from Nvidia’s.

Top 10 holding Crispr, focused on gene editing technology, is not yet profitable but trades at 50 times sales (a premium to Nvidia’s price-to-sales multiple of 36).

As touched on above, Nvidia isn’t the only name involved in generative AI that is missing from ARKK’s portfolio. The fund doesn’t hold any semiconductor names, and to put it simply, analysts from Susquehanna recently called semiconductors the “picks and shovels” of the AI gold rush. None of the mega-cap tech names like Microsoft, Alphabet, or Meta Platforms, which are all pushing their own advances in AI technology, are present. Software names like Adobe or Hubspot, which are integrating AI into their platforms, aren’t present either.

Within enterprise software, however, in addition to UiPath, the fund has been buying Palantir, another stock that has benefited from surging investor interest in AI.

Further, the smaller ARK Autonomous Technology and Robotics ETF holds a 4.4% position in Nvidia. It takes a bit of a different approach to artificial intelligence and owns many industrial names that are incorporating robotics and AI technology into their products ranging from agriculture and construction machinery giants like Deere and Caterpillar to defense companies like Kratos and Lockheed Martin. As well, the ARK Next Generation Internet ETF has a 1.6% position in Nvidia, as well as small positions in Microsoft and Palantir.

Is ARKK Stock a Buy, According to Analysts?

According to the collective ratings of 398 analysts, ARKK comes in as a Hold. 49.75% of ratings are Buys, 40.45% are Holds, and 9.8% are Sells. The average ARKK stock price target of $49.81 implies 25.1% upside potential.

Looking Ahead

In summary, Cathie Wood and ARKK Invest certainly deserve credit for a strong rebound of nearly 30% so far in 2023. Still, you can’t help but feel that they missed out on perhaps the most “disruptive innovation” of all by selling Nvidia just before ChatGPT took generative AI mainstream.

Further, the fund doesn’t have much other exposure to the other pioneers in the space, whether it’s other semiconductor companies or tech mega caps that have emerged as the early leaders in the AI revolution. At this point in time, based on its current holdings, it has to be said that ARKK doesn’t look well-positioned to truly capture the upside of the next era of revolutionary technological innovation.