As the 30-year mortgage rate crossed the 6% mark last week, for the first time since 2008, concerns over the rising cost of purchasing homes could keep buyers away from the housing market in the U.S. for some time. In this scenario, let’s look at three homebuilding companies in the U.S. – D.R. Horton, Inc. (NYSE:DHI), Lennar Corporation (NYSE:LEN), and NVR, Inc. (NYSE:NVR) – and understand what lies ahead for their stocks.

However, before we proceed any further, it is important to know that the sales of new single-family houses fell to 511,000 units in July 2022 from 726,000 in July 2021 and 732,000 in September 2021.

While shares of D.R. Horton have declined 19.3%, Lennar stock lost 22.9% in the past year. Meanwhile, shares of NVR have declined 17.8% in the trailing twelve months.

A consolidated chart of the stocks mentioned above, designed using TipRanks’ Stock Comparison tool, is provided below.

D.R. Horton, Inc. (NYSE:DHI)

The $24.7-billion homebuilding company operates in 105 markets and 33 states of the United States. By volume, DHI is one of the largest manufacturers of high-quality houses. The company’s brands include Freedom Homes, D.R. Horton, and Emerald Homes.

D.R. Horton’s Chairman of the Board, Donald R. Horton, said, “In June, we began to see a moderation in housing demand as mortgage interest rates increased substantially and inflationary pressures remained elevated.”

“Although these pressures may persist for some time, we believe we are well-positioned to meet changing market conditions with our affordable product offerings and lot supply and our strong trade and supplier relationships,” he added.

For the fourth quarter, the company anticipates revenue to be within the $10-$10.8 billion range. Homes closed are expected in the range of 23,500 to 25,500.

Is D.R. Horton Stock a Buy?

Despite suffering from demand moderation, due to high mortgage rates in the near term, D.R. Horton appears well-positioned to grow in the long run. On TipRanks, the company commands a Strong Buy consensus rating based on 10 Buys and two Holds. DHI’s average price target of $86.91 mirrors upside potential of 22.2% from the current level.

Meanwhile, hedge funds have a bullish stance on DHI stock, evident from the purchase of 6.2 million DHI shares in the last quarter.

However, retail investors have decreased their holdings in DHI by 0.5% in the last 30 days, and corporate insiders have sold DHI shares worth $696.8 thousand in the last three months. Both these stakeholders seem to be wary of the impact of rising mortgage rates on home sales demand.

Lennar Corporation (NYSE:LEN)

The home building company offers quality homes under its Lennar brand. It also provides mortgage financing and various other financial services to its customers.

In June, the company’s Executive Chairman, Stuart Miller, said, “The Fed’s stated determination to curtail inflation through interest rate increases and quantitative tightening have begun to have the desired effect of slowing sales in some markets and stalling price increases across the country.”

For the third quarter of 2022, the company forecasts new orders to be within the 16,000-18,000 range versus 17,792 homes in the second quarter. Operating earnings from the company’s Financial Services segment are forecast to be $70-$75 million, down from $103.9 million in the previous quarter.

Is Lennar a Good Stock to Buy?

For now, a wait-and-watch approach to this $21.5-billion could be a good idea for investors. Analysts tracked by TipRanks have a Hold consensus rating on the stock, which is based on four Buys, four Holds, and three Sells. LEN’s average price prediction of $85.44 reflects an upside of 12.73% from the current level.

While insiders have sold LEN shares worth $1.2 million in the last three months, the number of portfolios with investments in LEN stock has decreased 1.5% in the past 30 days.

Surprisingly, hedge funds bought 1.7 million LEN shares in the last quarter.

NVR, Inc. (NYSE:NVR)

The $13.4-billion company offers homes under the Heartland Homes, NVHomes, and Ryan Homes brands. It also provides mortgage services.

The company’s new orders (homes) were down 16% year-over-year in the second quarter of 2022, while the average sales price of new orders grew 7%.

Is NVR Stock a Buy?

The company’s homebuilding and mortgage banking services are exposed to high mortgage rates. Considering this, we find a wait-and-watch approach ideal for investors interested in NVR stock.

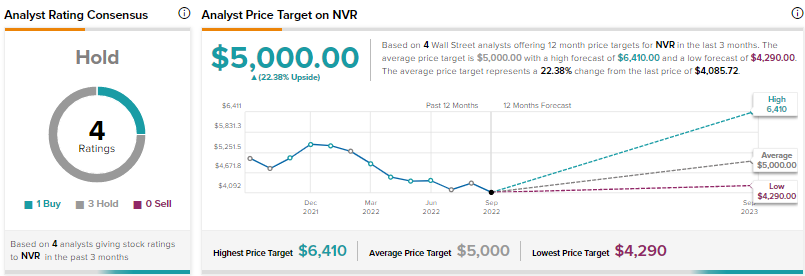

On TipRanks, the company has a Hold consensus rating based on one Buy and three Holds. NVR’s average price target is $5,000, reflecting upside potential of 22.38% from the current level.

Corporate insiders have sold $11.6 million worth of NVR shares in the last three months.

On the contrary, hedge funds purchased 14.2 thousand NVR shares in the last quarter, and retail investors increased their exposure to the stock by 9.4% in the last 30 days.

Concluding Remarks

For the week ended September 15, the country’s 30-year mortgage rate was 6.02%, up from the year-ago tally of 2.86%. The mortgage rate was 5.13% for the week ended August 18, 2022. It is worth noting that the recent increase in the mortgage rate is the byproduct of the Federal Reserve’s hawkish stance on curtailing inflation in the country.

The Fed increased the interest rate by 25 basis points (bps) in March, 50 bps in May, 75 bps in June, and 75 bps in July. The current interest rate range is 2.25%-2.50%. More rate hikes are likely in the months ahead, as the federal agency aims at lowering the rate to 2%.

Under such circumstances, high mortgage rates will likely impact residential home building companies, like DHI, LEN, and NVR, in the quarters ahead.

Read full Disclosure