Dexcom (NASDAQ: DXCM), a leading maker of continuous glucose monitoring (CGM) systems, announced mixed Q122 results last week and reaffirmed its full-year guidance.

Shares are down 24% year-to-date. However, Wall Street analysts continue to be bullish on Dexcom given its ability to capture further business in an underpenetrated CGM market and the rapid rise in diabetes across the globe.

Financial Snapshot

Dexcom’s Q122 revenue grew 25% year-over-year to $628.8 million, beating analysts’ estimates of $624.47 million. It’s worth noting that a substantial portion of the company’s revenue is recurring in nature. Disposable sensor and other revenue accounted for nearly 86% of Q122 revenue, while reusable hardware revenue contributed the remaining 14%.

Meanwhile, Q122 adjusted EPS declined 3% to $0.32 and lagged the Street’s estimate of $0.52. Marketing and growth investments as well as an unfavorable channel mix impacted the company’s profitability.

Dexcom continues to expect 2022 revenue of $2.82 billion-$2.94 billion, reflecting growth in the range of 15%-20%. It expects adjusted gross margins of about 65% and adjusted operating margins of nearly 16% in 2022.

Wall Street’s Take

Reacting to Dexcom’s Q1 results, Stifel analyst Mathew Blackman stated that most of the headwinds experienced by the company seem “transient in nature.”

Blackman noted that while Dexcom’s U.S. performance was a bit softer-than-expected, its growth accelerated sequentially, unlike rival Abbott (ABT). The analyst also pointed out that the lower-than-anticipated Q122 margins were due to certain one-time items that will fade or reverse over the course of the year, as emphasized by the company’s reaffirmed full-year gross margin and EBITDA (Earnings before Interest, Tax, Depreciation, and Amortization) guidance.

Blackman is also optimistic about the launch of G7 in additional Tier 1 countries following its roll-out in the UK. Dexcom’s G7 CGM received CE Mark approval in March, following which it initiated a limited launch of G7 in the UK in the subsequent weeks.

Blackman lowered his price target on Dexcom to $520 from $555 but maintained a Buy rating.

SVB Leerink Partners analyst Danielle Antalffy also lowered her price target on DexCom to $500 from $565 while maintaining a Buy rating following the Q122 results. The analyst feels that the adverse impact of channel mix, labor challenges, and currency headwinds might persist for the next few quarters.

That said, Antalffy continues to believe that Dexcom’s long-term revenue guidance of $4 billion-$4.5 billion by 2025 could be conservative.

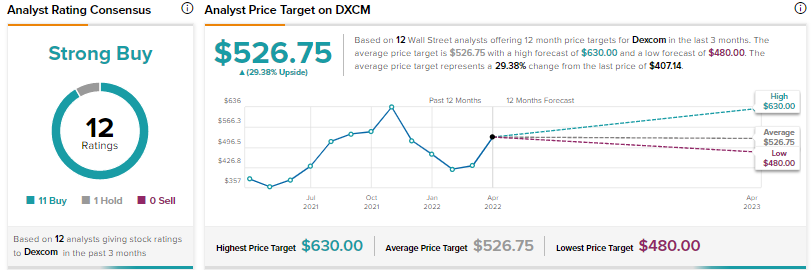

Overall, 11 analysts have a Buy rating on Dexcom, while one has a Hold rating. That adds up to a Strong Buy consensus rating. The average Dexcom price target of $526.75 implies 29.38% upside potential from current levels.

Conclusion

Despite the recent earnings miss and growing competition from Abbott, Wall Street continues to be bullish on Dexcom based on its dominant position in the CGM space and the rising adoption of CGM in the diabetes market.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure