We had the November jobs numbers come out last Friday, and the result underwhelmed the markets. Economists had predicted some 500,000 new jobs, but the number came in at just 245,000. Unemployment fell slightly, to 6.7%, but that good news was attributed to a decrease in the labor force participation rate. Overall, it was a not a good jobs report to greet the incoming Biden Administration.

At the same time, markets were up. The S&P 500 is trading at near record high levels. It seems that investors put more faith in the positive news about COVID vaccines – which are expected to become available before the spring – than they did in the jobs report.

Deutsche Bank analysts have been following the markets closely, and are tapping two stocks they believe are poised to go higher. We ran the two through TipRanks database to see what other Wall Street’s analysts have to say about them.

S&P Global (SPGI)

First up is a familiar name. S&P Global is the holding company responsible for, among other interests, the famed S&P and Dow Jones stock indexes. The company is involved in independent financial research, a range of international market intelligence services, and the global commodity markets. In short, S&P is more than just a major stock index – it’s a major full-service financial research, information, and investment firm in its own right.

S&P Global’s financial performance and share appreciation have remained solid through the COVID crisis. The company saw revenues peak at $1.94 billion in Q2, but the third quarter top line of $1.85 billion was also considered strong – it beat the forecast by 5.4%, and grew 9.4% year-over-year. Earnings for the third quarter showed a similar pattern – a sequential decline from Q2, but a strong beat of the quarterly forecast. The $2.85 reported EPS was 8% above the $2.64 estimates, and up 15.8% yoy.

The strong financials through a difficult year are reflected in the share performance — SPGI is up 23% year-to-date. Ironically, the S&P company’s stock has greatly outpaced the S&P index’s year-to-date gains; the S&P 500 is up 14% over the same period.

In another sign of strength, S&P Global last month announced its purchase of IHS Markit. IHS is a well-known data analytics firm, focusing on economic measures – especially the various purchasing manager surveys published monthly around the world. The acquisition is an all-stock deal, valued at $44 billion.

Deutsche Bank analyst Ashish Sabadra writes that S&P Global has a firm foundation for further growth.

“We believe trust in the brand, along with pricing power, should enable mid- to high-single-digit revenue growth over the medium to long term, with potential upside from international geographies. In addition, the high-margin Indices business with an asset-linked royalty model provides an enviable opportunity for skimming the growth in market liquidity over time without major costs,” Sabadra noted.

Sabadra initiated coverage on SPGI with a Buy rating, while his $415 price target implies a one-year upside potential of 24%. (To watch Sabadra’s track record, click here)

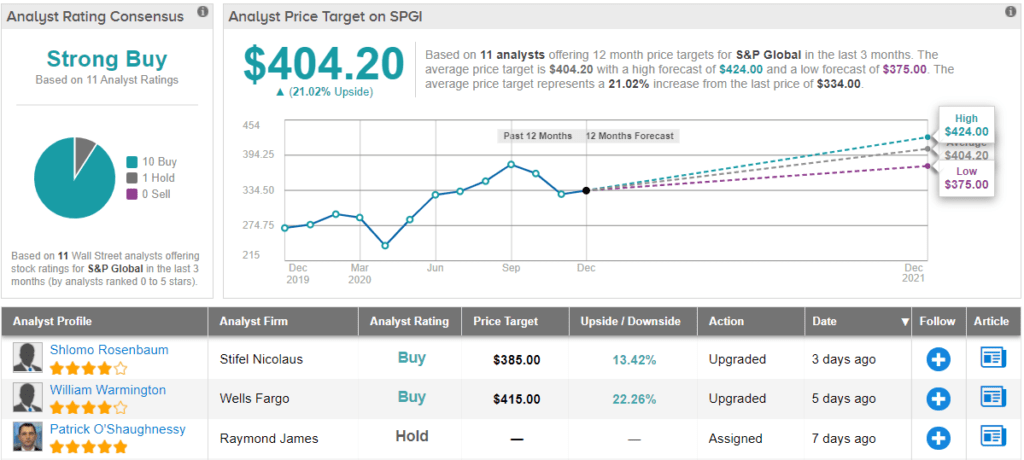

Overall, the Strong Buy analyst consensus rating on SPGI is based on 11 reviews, breaking down to 10 Buys and 1 Hold. The stock’s $404.20 average price target suggests it has room for 21% growth from its current trading price of $334. (See SPGI stock analysis on TipRanks)

Kohl’s Corporation (KSS)

Kohl’s Corporation is a staple of shopping mall retail – and as such, it has felt a heavy pressure from the shutdown policies of the corona crisis. Kohl’s saw store closures and falling sales and profits during the first quarter, along with major decreases in foot traffic in its stores. These are all problems that have plagued brick-and-mortar retailers throughout 2020.

The retailer has proven agile in trying to adapt, however. Amazon has shown that customers still want to make purchases, and will turn online to do it. Kohl’s, seeing this, has developed an arrangement with the e-commerce giant; the department store now accepts Amazon returns at almost all of its physical locations. This leverages Amazon’s strength into foot traffic at Kohl’s as stores reopen.

In addition, Kohl’s is working to reach customers outside of malls, as shown by its agreement with Sephora to allow the cosmetic seller to open shops inside Kohl’s stores. The arrangement promises gains for both companies, as Kohl’s can attract new customers and Sephora can replace its now-defunct arrangement with JCPenny.

These moves by Kohl’s have shown at least partial success, and the retailer’s finances have improved from the deep trough experienced in Q1. Revenues rose from $2.43 billion in first quarter to $3.98 billion in the third, while EPS, which troughed at a $3.20 loss in Q1, has returned to profitability with a 1-cent gain in Q3. That penny gain was far ahead of the 46-cent loss forecast for the quarter.

The recent positive trends for Kohl’s prompted Deutsche Bank’s Paul Trussell to upgrade his stance on the stock from Neutral to Buy, and to set a $49 price target. This figure implies a 20% upside for the next months. (To watch Trussell’s track record, click here)

Backing his stance, Trussell writes, “[The] transformational announcement of a partnership with Sephora combines with other unique traffic drivers including Amazon returns, expansion of athletic and outdoor, and a differentiated off-mall omnichannel experience to give us confidence in consistent positive comp growth for years to come. Our math suggests that the addition of Sephora could add ~$1B in incremental sales once fully rolled out…”

Not everyone out on Wall Street is quite as excited regarding this tech player’s upside potential as White, considering TipRanks analytics showcase SNAP as a Hold.

Not everyone out on Wall Street is quite as excited regarding this retail player as Trussell, considering TipRanks analytics showcase KSS as a Hold. This is based on 11 reviews, including 4 Buys, 5 Holds, and 2 Sells. KSS shares are selling for $40.83, and recent share appreciation has pushed the stock price above the $34.90 average price target. (See KSS stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.