Yesterday, Wix.com (WIX) reported double-digit growth in its top line for the first quarter, marking a near 30% compounded growth in revenue for the past two years.

Despite this growth, shares of the company closed nearly 6% lower as it missed bottom-line expectations and lowered its guidance. In the present broader market turmoil, growth stocks are getting hammered as investors gravitate toward safety.

While yesterday we highlighted how TipRanks data could have helped gauge the growth in the top line of the company well in advance, today we look at the pithy insights Tipranks data offers regarding profitability concerns for Wix.

Risk Factors

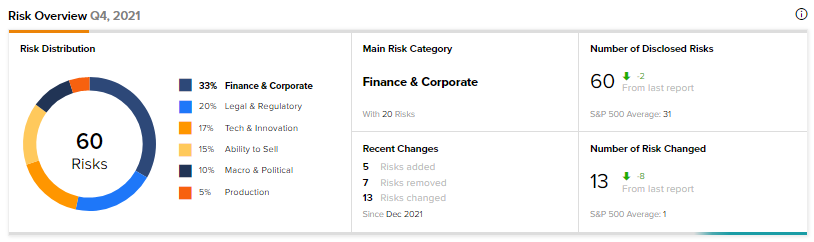

The TipRanks risk factors tool brings to the fore some of the key risks that Wix changed in its fourth-quarter regulatory filing under the Finance & Corporate risk category.

Wix has noted that it has a history of operating losses and expects to incur losses in the future as well. Furthermore, it may not achieve profitability in the future. Due to higher selling and marketing expenses, the company expects higher operating expenses. As its user base grows and economies of scale kick in, Wix plans to leverage these expenses to reach profitability.

Nonetheless, it conceded that “If we are unable to grow our premium subscriptions at the required rate or maintain or increase revenues per premium subscription…we may be unable to achieve profitability at the time expected by investors, or at all.”

Of the total 60 potential risks for the stock, Finance & Corporate (33%) and Legal & Regulatory (20%) are the top two contributing categories.

Hedge Funds

Furthermore, TipRanks data also highlights that hedge funds are making the most of this price decline and have lapped up 869,700 shares in the company in the last quarter. Hedge fund confidence signal remains very positive in Wix at present.

Analysts Stick With Wix

Despite the price drop yesterday, analysts are sticking with the stock with an average price target of $125.53, which implies an 88.26% potential upside, at the time of writing.

JMP Securities’ Andrew Boone has reiterated a Buy rating on Wix alongside a price target of $130 (a decrease from the earlier $140).

The analyst commented, “With near term catalysts around pricing increases and growing partner revenue given the upcoming LegalZoom partnership and integration, we would take advantage of shares trading at just 2.6x 2023E revenue as revenue acceleration and margin expansion can support a higher valuation.”

Closing Note

While concerns around subdued guidance and profitability may persist for now, in the long scheme of things, Wix remains a growth story, and a price drop of 70% over the past 12 months should put the stock on investors’ radar.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Why Did Hippo Fly 31% on Friday?

Large Layoffs at Alibaba-Russia Joint Venture

Bristol Myers to Hive off New York Manufacturing Unit