Without needing to get hyperbolic, last Friday amounted to the worst day ever for Snap (SNAP) stock. Shares took an unrepresented 27% beating after the company’s Q3 earnings disappointed on multiple levels.

While the company’s top-line figure failed to meet Wall Street’s expectations, the company’s outlook did little to reassure, as SNAP is faced with the duel challenge of the effects wrought from the changes to Apple’s iOS privacy settings – which gives users more control over how data is used – and the impact of the worldwide supply chain problems; companies are unlikely advertise product when they fear their products won’t make it to consumers in a timely manner.

Rosenblatt analyst Mark Zgutowicz had previously warned the iOS disruption would impact the ad ecosystem as a whole and have the direst consequences for platforms “over-indexed” to conversion-based DR (direct response) campaigns (such as Facebook). However, the 5-star analyst thought SNAP’s “branded campaign momentum would mitigate its DR exposure.”

While the changes will remain a “permanent obstacle to assisting advertisers and publishers alike,” Zgutowicz is “optimistic SNAP’s advanced and estimated conversion solutions will help create gateways around iOS’ obstacles over the next several months.”

And although the analyst thinks each iOS update will bring permanent ROAS (return on advertising spend) reductions, the impact won’t hit SNAP more than other “dominant walled gardens.” Actually, Zgutowicz thinks the opposite holds true, Snap’s “core positioning in AR and Gen Z is a unique asset enabling continued expansion of its still tiny share of the digital ad market.”

Nevertheless, the analyst’s new SNAP model factors in the company losing one-third of iOS-related revenue and also suggests an 8% revenue reduction through CY22E due to the current supply chain disruptions.

As such, Zgutowicz reduced his CY22 revenue forecast from $5.82 billion (a 44% YoY uptick) to $5.30 billion (up 33% YoY).

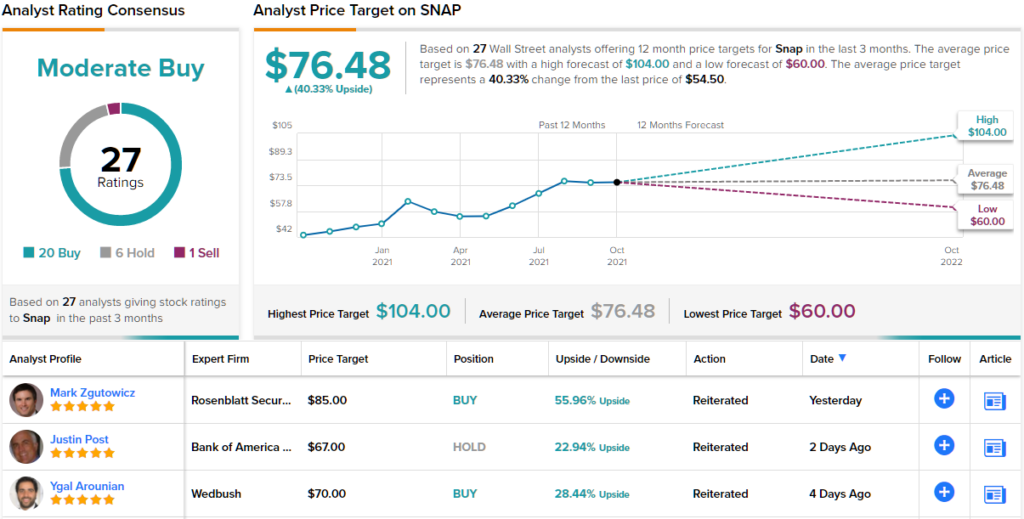

There’s also a change to Zgutowicz’ price target which drops from $100 to $85. That said, the new figure could still generate returns of 54% over the one-year timeframe. The analyst’s rating stays a Buy. (To watch Zgutowicz’ track record, click here)

Overall, despite the disappointing print, SNAP still retains most of the Street’s support; based on 20 Buys vs. 6 Holds and 1 Sell, the stock has a Moderate Buy consensus rating. Shares are expected to claw their way up again; going by the $76.48 average price target, the stock will be changing hands for ~40% premium a year from now. (See Snap stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.