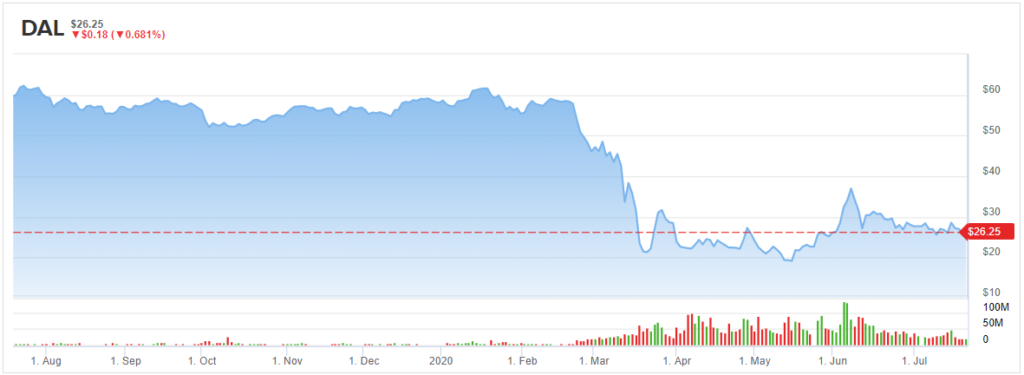

With the Q2 earnings report, Delta Air Lines (DAL) reported some huge under the surface improvements in the business. The market remains highly negative on the airline stock as quarantines slapped on passengers going to New York stall the traffic rebound.

The airline has been able to reduce the daily cash burn rate to levels that are no longer dire. With a huge liquidity position, investors can start playing the normalized earnings game in the next couple of years.

Eliminating Cash Burn

Not long ago, airlines like Delta panicked the market with discussions of daily cash burn levels of $100 million. The airline sector had seen an unprecedented collapse in traffic due to a virtual shutdown of the economy and the majority of tourist destinations.

It didn’t help that airlines provided prognoses based on zero-revenue environments. Now, Delta reported the June daily cash burn dropped down to $27 million, representing a 73% improvement. The domestic cash burn rate is down to only $17 million, with the ongoing shutdown of international routes accounting for $10 million in costs.

The airline has amazingly achieved this goal with revenues only approaching 20% of 2019 levels. The amount doesn’t even factor in the impact of excess payroll costs due to the grant from the Payroll Support Program, which required the airline to keep all employees on the payroll while only flying 10% of 2019 capacity for most of Q2.

Delta now forecasts breakeven cash burn rates by year end. The airline isn’t even optimistic about a surge in traffic.

Liquidity Machine

The airline ended Q2 with $15.7 billion of cash and cash equivalents on the balance sheet, with additional access to a $4.6 billion loan via the U.S. Treasury from the CARES Act. The airline now has too much liquidity for a forecast of average daily cash burn rates in the $15 million range for the rest of the year. The airline might only burn $2.5 billion the rest of the year.

While Delta didn’t even forecast a bullish end to the year, the airline should end the year with up to $12.5 billion in cash plus access to other loans. Previously, it wasn’t clear whether the company had enough cash to survive the COVID-19 crisis, now it might have too much cash.

The airline suggested that the $15 billion raised since March has a blended interest rate of only 5.5%. At such a rate, Delta is paying an incredible $825 million for access to cash the airline doesn’t need.

Naturally, excess cash isn’t necessarily a bad thing considering the risk surrounding weak travel in the sector. Ultimately though, Delta is spending over $200 million a quarter on additional interest costs, with a large portion of that debt unnecessary.

For the airline to return to 2019 levels, Delta needs to cut interest expenses dramatically. Delta earned $7.31 in 2019, so even similar traffic levels in 2021 would see the EPS cut to $6.00 based on these higher interest expenses.

Takeaway

The key investor takeaway is that Delta Air Lines is a cheap stock, with the company now boasting plenty of cash to survive the current weak traffic environment. As treatments improve or a vaccine becomes available, passengers will return to flying at 2019 levels. At $26.25, the stock is just too cheap with normalized EPS potential of $6-plus.

Out of 11 total analyst reviews published in the last three months, 8 analysts rated the stock a Buy, while 3 said Hold. Meanwhile, the $37.80 average price target suggests shares could rise 44% in the next twelve months. (See DAL stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclosure: No position.