Deere & Company (DE) is a renowned manufacturer of agricultural equipment and construction machinery, diesel engines, and heavy equipment. I am bullish on the stock.

Baird’s Bullish Call Amid Tractor Release

Many think Deere stock has reached its peak after gaing steadily over the past five years, but Baird analyst Mig Dobre believes the sales potential of the firm’s autonomous tractor has yet to be priced in by the market.

According to Dobre, “The tractor revolutionizes how critical jobs (tilling, planting, harvesting) will be done, rendering prior modes of farming obsolete and setting up a multi-year fleet upgrade cycle.”

The household manufacturing name unveiled its fully autonomous tractor last week and says it’s ready to scale and sell in bulk later this year. There’s great excitement across the commercial farming space, as farmers are excited about increasing their production with this piece of equipment through cost-savings and increased operating efficiency.

The release of Deere’s latest precision farming product is another indication of how it’s successfully pivoted into the autonomous space, and the company’s stock could benefit in 2022 due to early market leadership.

The Market’s Role

Deere stock is set to benefit, from a business perspective, after farmers profited immensely in 2021, thanks to soaring commodity prices. Many crop producers will likely re-invest in maintenance and upgrades this year with excess cash on hand, ultimately benefiting Deere, considering its market-leading position.

The broader stock market consensus is favorable to Deere at the moment. Deere is considered a value stock, and value seems to be the name of the game right now as GDP continues to recover along with non-tech company earnings.

Valuation

The Deere naysayers can be ignored for now, as its stock is significantly undervalued. Deere’s PE is trading at a 10.73% discount, with its PEG trading 5.88x below its value threshold, suggesting that investors haven’t priced the company’s earnings growth potential in just yet.

Furthermore, the Agri powerhouse is producing stellar cash flows; its price to cash flow multiple is undervalued by 25.40% relative to its 5-year average, suggesting that intrinsic value-seeking investors have missed a trick up to now.

The stock has also formed an attractive momentum pattern of late, by trading above its 10-, 50-, 100-, and 200-day moving averages after breaking above its mid-range RSI at the turn of the year.

Wall Street’s Take

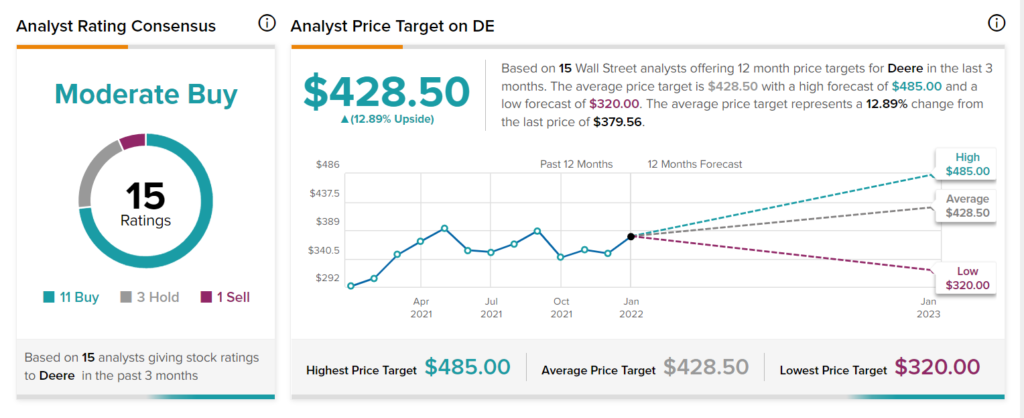

Turning to Wall Street, Deere has a Moderate Buy consensus rating, based on eleven Buys, three Holds, and 1 Sell assigned in the past year. The average Deere price target of $428.50 implies 12.9% upside potential.

Concluding Thoughts

Deere has been a solid stock for many years, and this may well continue amid the release of its new autonomous tractor. The stock is still undervalued relative to historical averages, leaving me with no doubt that value is on offer.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure