Investors love biotech stocks for the lottery ticket-like returns they can offer if a company strikes medical gold. Case in point: Curis Inc (CRIS) shares skyrocketed by an extraordinary 420%, in just two days, after the cancer drug maker reported encouraging data from its early-stage trial in patients with acute myeloid leukemia (AML) or high-risk myelodysplastic syndromes (MDS).

Specifically, in the Phase 1 trial evaluating monotherapy CA-4948, the orally administered protein kinase inhibitor’s data showed that marrow blast reductions were exhibited by all 6 evaluable patients, with 2 patients achieving marrow CR (complete response) – i.e. the blast count dropped by more than 50% from the baseline. Additionally, no dose-limiting toxicities were noted.

The study’s main objective is to determine the maximum tolerated dose (MTD) and recommended Phase 2 dose. More data from the Phase 1 trial is anticipated in 2H21.

For H.C. Wainwright analyst Edward White, the question going into this data was “whether the company has a drug in AML/MDS or not.” The 5-star analyst now believes “these data show that the company does with CA-4948.”

CA-4948 is also currently in a Phase 1 study for the treatment of relapsed or refractory (R/R) non-Hodgkin’s lymphoma (NHL). The company recently presented the study’s data at an American Society of Hematology (ASH) meeting.

in NHL, the analyst gives CA-4948 a 25% PoS (possibility of success) while applying a 35% POS rate for CA-4948 in AML/MDS.

White also estimates that for NHL, CA-4848 could achieve sales of $119 million in 2025 and $760 million by 2028. For AML/ MDS, the analyst expects CA-4848 sales of $259 million in 2028. Of course, these figures are dependent on the treatment making its way past all the FDA’s required regulatory hurdles.

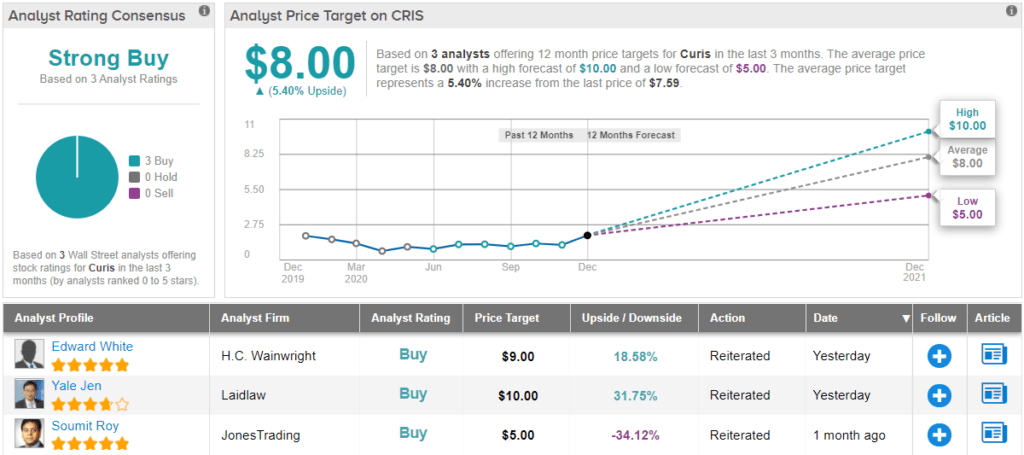

Therefore, due to “increased confidence in CA-4948 in both NHL and in AML/MDS,” White raised the price target from $5 to $9. Even after Tuesday’s moves, there is further potential upside of 17%. (To watch White’s track record, click here)

Over the past 3 months, 2 other analysts have reviewed Curis’ prospects; Both, like White, say Buy, which means the stock has a Strong Buy consensus rating. At $8, the average price target suggests a modest 5% upside from current levels. (See CRIS stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.