Sometimes a rising tide will indeed lift all boats. Some will rise farther than others, of course, and right now cybersecurity company CrowdStrike (CRWD) looks like it’s set to benefit therein.

An upgrade at Goldman Sachs gave CrowdStrike an extra 3.6% jump in premarket trading Tuesday, and those gains have held going into Tuesday morning trading.

Things look positive for CrowdStrike, so it’s hard not to be somewhat bullish. However, the gains are likely to be limited going forward and there are some negative signs in play for the company.

CrowdStrike is currently priced right around what it was this time last year. The company made substantial gains with the second half of 2021, but lost most of those gains going into 2022. Now, the company has settled into slightly better than what it was this time last year.

The latest news should help investor confidence, though. The company got an upgrade at Goldman Sachs, sending the company clear from “neutral” to Buy. The biggest reasons for the upgrade focus on the company’s current valuation, as well as an environment in which cybersecurity is more vital than ever.

Not only did Goldman Sachs raise its rating on CrowdStrike, but also, it raised the price target. Goldman analyst Brian Essex bolstered the price target from its original $241 per share to a new target of $285.

Wall Street’s Take

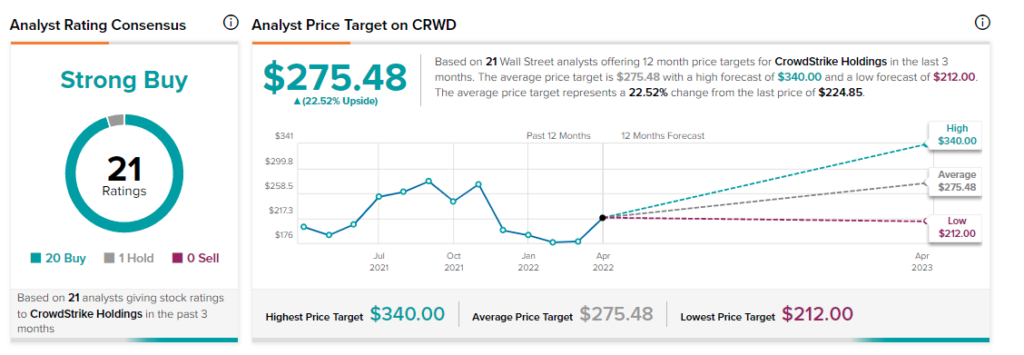

Turning to Wall Street, CrowdStrike has a Strong Buy consensus rating. That’s based on 20 Buys and one Hold assigned in the past three months. The average CrowdStrike price target of $275.48 implies 22.5% upside potential.

Analyst price targets range from a low of $212 per share to a high of $340 per share.

Hedge Funds Prove Doubtful

I mentioned previously some down sides to CrowdStrike, and one of these is hedge fund involvement. As bright as the picture looks for CrowdStrike in terms of numbers, the TipRanks 13-F Tracker shows an unsettling lack of faith from hedge funds.

Hedge fund involvement with CrowdStrike has been down for each of the last five quarters. Starting in September 2020, the total stake in CrowdStrike has declined each quarter up until January 2022.

That’s not the only problem, either. Insiders sold $17.9 million in CrowdStrike shares over the last three months as well.

An Indispensable Company?

Goldman’s central premise is sound. CrowdStrike is trading much closer to its lowest price targets right now than it is its highest, or even its average. That leaves plenty of upside potential available to access. Moreover, CrowdStrike’s market is likely to benefit from ongoing, regular demand.

Despite the growing numbers of businesses that are clamoring to get their workers back into the office where they can be properly watched, measured, and managed, workers aren’t having it. Telecommuting has appealed to many workers who never thought they’d be able to try it.

They’re not likely to give up this new perk without a fight and threats of joining the Great Resignation. That, in turn, bolsters demand for cybersecurity products as businesses find it harder to keep people without allowing at least some telecommuting to take place.

Plus, there’s the matter of increased geopolitical instability. CrowdStrike itself noted that Russia has yet to launch any large-scale cyberattack against Western nations. That may well be on the menu to come.

Wars between Ukraine and Russia and the possibility of China taking aim at Taiwan play a part here. The United States being seen as weaker than normal doesn’t help matters. When Saudi state television is willing to spoof a sitting president, you know things are farther along than normal.

The only downside here is that CrowdStrike has its share of competitors who will all want a piece of this rapidly expanding market. CrowdStrike has established itself well as a premium provider, which should help differentiate itself from that growing crowd.

CrowdStrike’s focus on cloud-based operations should be especially helpful here as well. That’s especially true among businesses that need more cloud access for telecommuting employees.

Concluding Views

CrowdStrike will certainly have to work to keep ahead of the competition. However, there’s no doubt the time is right for cybersecurity companies in general. The world is badly unsettled, and cyber threats will be among the biggest any person, company, or nation must address.

CrowdStrike has some upside potential to it, though only so much. Its valuation is already in the three-digit range. That makes looking for this one to end up a two- or three-bagger probably out of line. The fact that it has no dividend also limits its use cases for investors. Finally, the sell-off from hedge funds and insiders is a bit unsettling as well.

Still, for a chance at some solid gains and a chance to own part of a growth industry, CrowdStrike will certainly provide reason to be bullish.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure