Crowdstrike (CRWD) is an American Cybersecurity company predominantly focusing on endpoint protection, threat intelligence, and cyberattack response services. I am bullish on the stock.

Stock Gains Recently Decelerated

After a year of exquisite growth, Crowdstrike’s stock hit a snag over the recent month. The company blasted past earnings expectations, beating revenue by $14.16 million, but the stock lost 3.88% of its value that very day.

Investors should think long-term and not worry about temporary frictions. In Crowdstrike’s case, it’s just a matter of an overcooked valuation, but the rate at which earnings are growing means that it will be a temporary concern to investors. (See CrowdStrike stock charts on TipRanks)

Current Valuation Metrics

CrowdStrike’s stock can be summarized by its PEG ratio, which measures company growth relative to stock price growth. A PEG of 1.00 means that the stock price is justified at historical growth rates. CrowdStrike is trading at a PEG ratio of 11.21, which is clearly out of range.

Yet when we consider the company’s profitability & growth ratios along with a stagnant stock price, we could argue that matters are about to take a turn for the best.

We will start off with revenue. Total revenue increased by 70% year-over-year, with subscriptions accounting for more than half, with a 71% year-over-year increase for the segment. In addition, the company’s ARR has grown 70% year over year, meaning that the sustainability of its earnings is growing exponentially.

Furthermore, Crowdstrike has an operating cash flow growth of 77.66%, subsequently translating into a cost of capital decrease of 7.1% (year-over-year). Furthermore, an increase in working capital of 56.48% ensures that the company has enough capital to expand without a share offering that might dilute shareholders.

Driving Factors Looking Forward

It’s clear that growth in core business will justify higher valuations moving forward, but to provide substance to the bullish argument, I’d like to highlight its growth through acquisitions.

Tech stocks’ growth can largely be attributed to acquisitions of value-added solutions from smaller companies.

Crowdstrike recently acquired Humio to fortify its detection and response capabilities. Prior to this, In September 2020 the company completed the acquisition of Preempt Security to add to the protection of identity theft and insider threats. Another significant acquisition is the Payload deal; CrowdStrike acquired Payload Security for its automated malware analysis systems catering to universities, governments, and enterprises.

These acquisitions haven’t only strengthened CrowdStrike’s data protection capabilities but also its customer base, which will most probably lead to further strength in earnings.

Wall Street’s Take

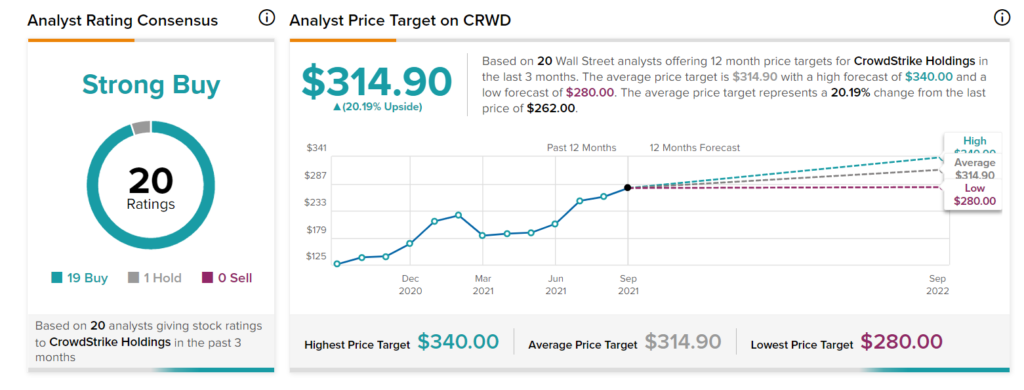

Wall Street thinks the stock is a strong buy for the next 12 months. There are 19 Buy ratings, 1 Hold rating, and no Sell ratings, with Alex Henderson of Needham coming in with the highest price target of $140.

The average CrowdStrike price target is $314.90, implying an upside of 20.2%.

Disclosure: At the time of publication, Steve Gray Booyens did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.