After a strong listing and briefly reaching a high of $69 per share, Coupang (CPNG) stock has fallen closer to its IPO price of $35. While the South Korean ecommerce company has been reporting healthy growth, it seems the markets are concerned about sustainability. (See Coupang stock chart on TipRanks)

With Chinese ecommerce stocks impacted by regulatory headwinds, it might be a good time to reconsider Coupang, given its potential to fill any void in the ecommerce space. Of course, that’s not the only reason as there are several business developments that can possibly serve as catalysts for additional upside.

It’s worth mentioning that Coupang reported cash and equivalents of $4.3 billion as of March 2021. That strong cash buffer gives the company ample financial headroom to pursue plans that ensure robust growth.

Aggressive International Expansion

Since inception, Coupang has remained focused on the South Korean ecommerce market. However, after the initial public offering, the company has been looking at aggressive expansion outside of Korea.

Japan was the first international market for Coupang, followed by Taiwan. The company also seems set to commence operations in Singapore. As the addressable market increases, the company seems positioned for revenue acceleration.

An important point to note here is that Coupang is targeting the high-potential Southeast Asian market. Reports suggest that Southeast Asia has 400 million internet users. Due to the pandemic, 40 million internet users were added last year. This creates a big ecommerce market opportunity.

It seems very likely that Coupang will also enter big markets like Indonesia, Malaysia, Vietnam and Philippines in the coming years. Even with growing competition, these markets are attractive for the next decade.

Sustainable Growth in South Korea

While international markets will help in accelerating growth, South Korea is likely to remain the biggest market for Coupang. Total ecommerce spend in South Korea was $128 billion in 2019. This is expected to rise to $206 billion by 2024. As a market leader, Coupang seems well positioned to benefit.

It should be noted that for Q1 2021, the company reported revenue growth of 74% to $4.2 billion on a year-on-year basis. For the same period, the company’s active customers increased by 21% to 16 million.

Cash burn does not seem to be a concern even as the company pursues aggressive sales and marketing efforts. EBITDA losses have narrowed in the last few years and CPNG is poised to deliver positive EBITDA margins in the next few quarters.

The net revenue per active customer was $182 in Q1 2020. This has increased to $262 in Q1 2021. Sustained growth in revenue per active customer is positive for long-term cash flows.

Further, in terms of growth, there are speculative reports that Coupang is likely to launch an online business that specializes in office supplies and other consumer products. “Coupang Biz” is set to be the brand that is dedicated to business-to-business transactions.

Wall Street’s Take

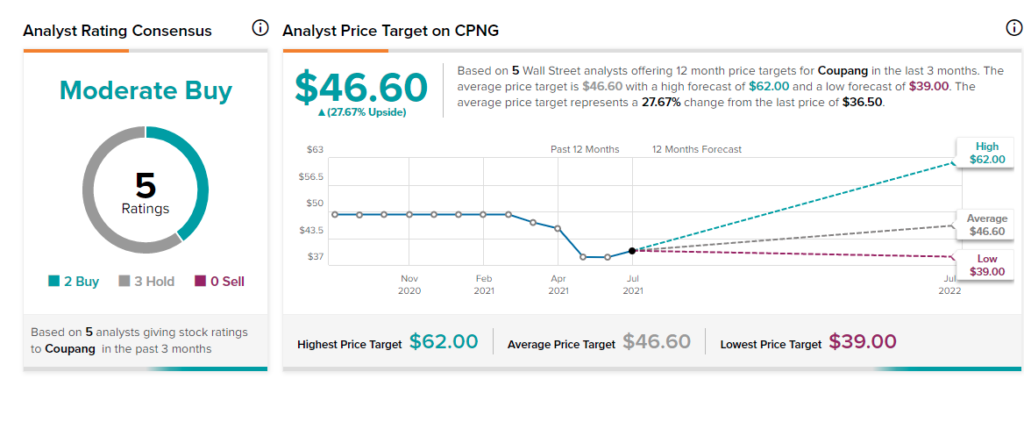

According to TipRanks, CPNG stock comes in as a Moderate Buy, with two Buy and three Hold ratings assigned in the last three months.

As for price targets, the average Coupang price target is $46.60 per share, implying around 27.7% upside potential from current levels.

Concluding Views

Coupang is the largest ecommerce player in South Korea, with a robust logistics network. The company is likely to maintain a leadership position in a market that continues to grow at a healthy pace.

At the same time, Coupang is well-positioned from a financial perspective to expand into new markets. Entry into Southeast Asia is likely to be a game changer.

After underperformance since the initial public offering, Coupang stock looks attractive. Once EBITDA margins turn positive and cash flows accelerate, the stock seems positioned to trend higher.

Disclosure: On the date of publication, Faisal Humayun owned shares of Coupang (CPNG).

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.