Amid the COVID-19 pandemic last year, Logitech (LOGI) was one of the tech firms that benefited greatly from the rapid move to the digital world.

This firm is a brand in the home computer peripheral industry, offering a wide range of external hardware tools.

Unfortunately, it would not be wrong to say say that Logitech’s stock has lost momentum in recent months. The stock has dropped about 12% in the previous six months and 9% in the last five days. (See Logitech stock charts on TipRanks)

Delivering her bearish hypothesis on the firm is Morgan Stanley analyst Katy Huberty, who believes that the company’s tailwinds are waning.

Logitech’s data, according to Huberty, shows that year-over-year growth comparisons will be difficult for the company. Furthermore, the five-star analyst anticipates a larger likelihood of negative estimate revisions and multiple compression, suggesting that the stock might fall further from current levels.

As a result, she downgraded Logitech’s stock rating to Sell from Neutral and reduced the price target to $82.00 from $119 (9.2% downside potential).

Also, TipRanks’ Stock Investors tool indicates that investors currently have a Very Negative outlook on Logitech stock, with 4% of investors who hold portfolios in TipRanks decreasing their exposure over the past month.

Nevertheless, Logitech’s solid fundamentals and broad product pipeline should propel Logitech forward. By pursuing innovation and increasing product lines, the company is strengthening its position in the high-potential market for accessories.

Furthermore, Logitech recorded strong results in the past quarter, owing to the growing trend of working online. Logitech’s first-quarter sales were $1.31 billion, up 66% year-over-year. The Gaming, Video Collaboration, and PC Webcams product categories, in particular, each saw sales increase by more than 80%. In addition, earnings of $1.22 per share jumped 90.6% year-over-year.

Not to mention that the firm just announced a 10% increase in its quarterly dividend rate. A healthy financial sheet, with enough cash on hand and no debt commitments, should also aid the firm in making smart acquisitions, investing in growth projects, and increasing dividends to shareholders.

In light of the foregoing, I retain a Neutral position on Logitech stock.

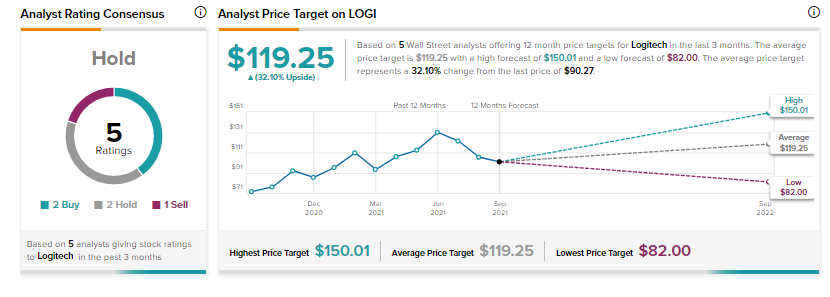

Logitech stock commands a Hold consensus rating based on 2 Buys, 2 Holds, and 1 Sell.

As for price targets, the average Logitech price target of $119.25 implies 30.2% upside potential to current levels.

Disclosure: On the date of publication, Shalu Saraf had no position in any of the companies discussed in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.