Shares of steel producers, including Nucor and Steel Dynamics, have outperformed the broader market averages over the past year. For instance, NUE and STLD stocks surged about 106% and 71%, respectively.

Higher price realizations and a recovery in demand amid the economic reopening supported the uptrend in these stocks.

However, significant uncertainty that steel producers often face is the volatility in the prices of raw materials. Notably, the supply shock amid the Russia/Ukraine conflict and strong demand has increased input costs, including pig iron prices (a key raw material to produce steel).

In response to the higher pig iron prices, J.P. Morgan analyst Michael Glick stated, “Pig iron is likely a major problem for U.S. mills for the foreseeable future.” The analyst added, “We think there is a much greater likelihood that prices for steelmaking raw materials stay higher for the foreseeable future.”

While higher input costs could hurt profit margins, let’s discuss what the future holds for Nucor and Steel Dynamics.

Nucor (NYSE: NUE)

Nucor is a major producer of steel and steel products. It produces steel by recycling scrap metal. Since the majority of scrap substitutes come from Russia, Ukraine, and Brazil (the regions that have historically experienced greater geopolitical turmoil), Nucor invested in DRI (Directed Reduced Iron – a substitute for high-grade scrap and pig iron) production facilities. Further, its scrap broking and procession services help counter the volatility in raw material costs.

Notably, Nucor operates two DRI plants with an annual capacity (combined) of about 4,500,000 metric tons. DRI production and its brokering capabilities help Nucor maintain cost competitiveness during volatile times.

While these measures optimize Nucor’s control over the supply chain, a favorable mix (including expansion of higher value-added offerings with lower vulnerability from imports), a focus on cost structures, and channel expansions cushion its margins.

As Nucor stock has appreciated quite a lot, most Wall Street analysts remain sidelined. One among them is Glick, who has rated NUE stock Hold with a price target of $129 (21% downside potential).

The analyst highlighted Nucor’s high-quality assets, strong management, and prudent capital allocation strategy. However, Glick added, “Versus peers, Nucor trades at a premium.”

Overall, NUE stock has received six Hold and one Sell recommendations for a Hold consensus rating. Further, the average Nucor price target of $121.29 indicates 25.7% downside potential to current levels.

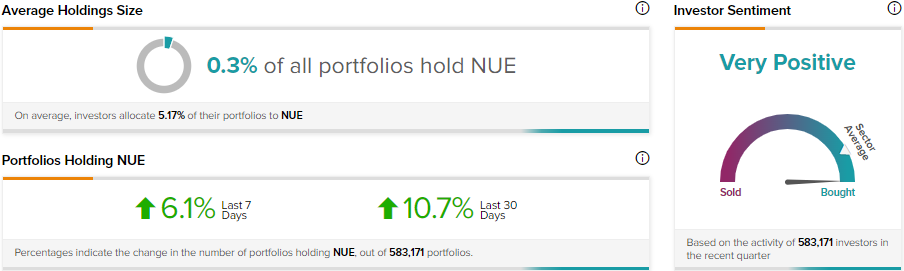

Nevertheless, TipRanks’ Investor Sentiment tool indicates that investors remain Very Positive on NUE stock. 10.7% of investors holding portfolios on TipRanks have added NUE shares to their portfolios in the last 30 days. Further, 6.1% of these investors have raised their stakes in the last seven days.

Steel Dynamics (NASDAQ: STLD)

Steel Dynamics is among the largest steel producers and metal recyclers in the U.S.

With raw material prices being so volatile and domestic ferrous scrap prices being highly correlated to global pig iron pricing (which is trending higher), Steel Dynamics has diversified its value-added product offerings and supply-chain solutions.

Steel Dynamic’s diversified and high-margin product offerings help it deliver strong volume and profitability through all market conditions. It develops premium and value-added steel products that cushion its margins.

Further, its technically advanced steel operations, low operating costs, and high productivity rate augur well for growth.

Steel Dynamics recently provided its Q1 profitability outlook. It expects Q1 profitability from steel operations to be historically strong. However, it is likely to remain lower than Q4 of the previous year due to the anticipated decline in flat roll pricing.

Nevertheless, the company expects flat roll steel prices to improve amid a higher input cost environment, supply disruptions, and strong demand from the automotive, industrial, and construction sectors.

Glick is bullish on STLD stock and expects it to benefit from solid backlogs in its fabrication business and higher pricing. Further, the analyst highlighted its strong balance sheet and free cash flows that could allow it to bolster shareholder returns.

Glick has a price target of $117 on STLD, representing 34% upside potential. Overall, Steel Dynamics stock has received three Buy, one Hold, and one Sell recommendations for a Moderate Buy consensus rating. Meanwhile, due to the recent appreciation in its price, the average Steel Dynamics price target of $84.20 indicates 3.6% downside potential to current levels.

However, TipRanks’ Investor Sentiment tool shows that investors remain Very Positive about STLD stock. 14.4% of investors holding portfolios on TipRanks have added STLD shares to their portfolios in the last 30 days. Further, 1.2% of these investors have raised their stakes in the last seven days.

Bottom Line

While higher input costs pose challenges, sustained demand, the raw material strategies of these companies, expansion of higher-value product offerings, and increased average selling prices could continue to cushion their margins. Further, their ability to pass higher costs to customers could help offset the input cost headwinds.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure