Shares of alternative accommodations platform Airbnb (NASDAQ: ABNB) have been clobbered, down significantly from their highs just north of $200 per share. From peak to trough, the stock fell 55%. Such a decline is indicative of a looming recession and waning demand. While there are potentially harsh headwinds in the firm’s future, recent quarters suggest demand is still holding strong.

Peak summer travel season and tremendous pent-up vacation demand could pave the way for more promising quarters up ahead. Still, many pundits agree that a recession (hopefully a mild one) could be in store in less than a year. Undoubtedly, resilient demand can go bust in a hurry as the magnitude of stress on consumer balance sheets intensifies from ongoing inflation and layoffs concentrated in the tech sector.

Indeed, Airbnb had to lay off 1,900 employees (25% of its workforce) in the second quarter. As the company braces itself for one of the worst economic contractions in its history, questions linger as to what the recovery trajectory will look like and when it will happen.

Airbnb Faces a Hurricane of Headwinds as 2023 Recession Looms

The business of hotels, vacations, and bookings is economically sensitive. Ultimately, the timing of Airbnb’s recovery will be tied to the severity of the looming recession. If it’s mild, Airbnb may already have ripped the band-aid off in anticipation of waning demand. However, if the rate-driven recession proves harsher than many on Wall Street expect, it’s tough to draw a line in the land with Airbnb stock or any of its peers in the leisure space.

At writing, shares of ABNB trade at 9.8x sales, 58x trailing earnings (around 46.7x forward earnings), and 46.7x cash flow. Airbnb has a wonderful platform, but I’d not be comfortable paying up such multiples for a firm in the face of a recession whose severity remains a major question mark.

Following the Fed’s latest Jackson Hole comments, rate cuts next year seem to be off the table. This doesn’t bode well for high-multiple tech or for hopes that we can steer clear of a recession in the new year. Further, the “soft-landing” that the Fed once wished to engineer may be far harder to achieve.

Given such dire economic storm clouds, I am neutral on Airbnb stock. I’m a massive fan of the asset-light platform and its dominance in vacation stays and experiences.

However, the recession risks seem a tad too high versus the potential rewards at today’s valuations. As such, I’d wait for a more opportune time before jumping into a name that’s sure to come roaring out of the gate once storm clouds dissipate.

Airbnb Could Continue to Snowball, Even in a Recession

Though it may be difficult for Airbnb to take share as the travel and leisure market takes a hit in an economic downturn, I expect it will look to make the most of a bad situation. It’s the firms that play their bad hands well that investors should strive to buy during times of economic turmoil. Though Airbnb has reduced its workforce by a quarter, the firm still seems to be staying on its toes to stay ahead of its big-league rivals in the vacation space.

Stays and experiences are a lucrative market that has drawn in rivals from the hotel and booking industries. Airbnb’s offering may be replicable, but its network is tough to stack up against. It’s not just a depth of offerings that puts Airbnb head and shoulders above its peers (like Vrbo); the firm is constantly looking to improve the experiential factor for guests and hosts.

At the end of the day, many hosts will draw in guests and vice-versa. In that regard, Airbnb remains a king among men in its niche corner of the travel and leisure space.

Recently, Airbnb shed light on its “anti-party” technology to draw in more hosts. A significant issue with “Airbnb-ing” your property is the potential for damages, unreasonable noise, and excessive clean-up in the event of parties.

Airbnb aims to solve partying risks hosts take with screening technology rolling out in Canada and the U.S. The tech uses new algorithms to discover and prevent people who use its platform from throwing parties.

Indeed, the anti-party tech seems pretty straightforward. If a guest looks to throw any sort of festivities, they run the risk of being banned from the platform. Though it’s not cutting-edge tech by any stretch of the imagination, I view such initiatives as a potential boon to the number of experiences over time.

Airbnb is already the go-to place for hosts and guests. Its sheer size can allow it to snowball rapidly and increase the gap between it and its peers.

Looking ahead, I’d look for Airbnb to implement more features to increase the experience for hosts and guests. As it does, it could prove challenging to dethrone Airbnb — the Uber (NYSE: UBER) of the alternative accommodations space.

What is the Target Price for ABNB Stock?

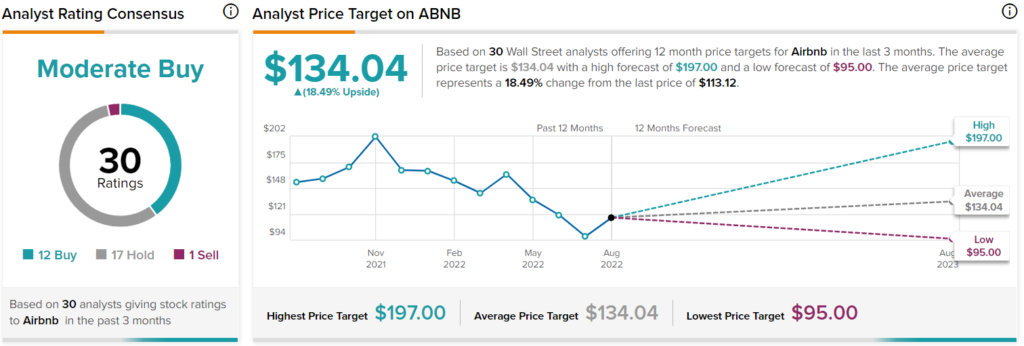

Turning to Wall Street, ABNB stock comes in as a Moderate Buy. Out of 30 analyst ratings, there are 12 Buys, 17 Holds, and one Sell.

The average Airbnb price target is $134.04, implying upside potential of 19.1%. Analyst price targets range from a low of $95.00 per share to a high of $197.00 per share.

Conclusion: Wonderful Company, Suspect Valuation

Airbnb can’t seem to do any wrong. The firm will rise out of the 2023 recession. In the meantime, all eyes will be on the trajectory of demand as consumer sentiment looks to take a sharp turn lower. Airbnb stock has crumbled quite a bit already. That said, it may have another leg lower before it can bottom out and be constructive again. While I wouldn’t bet against the dominant play, I’d be extra cautious as the multiple leaves the stock vulnerable if rates settle at a much higher level.