Rising inflation is a matter of growing concern for most retailers as consumers cut their spending budgets, pulling down sales for the former.

However, retailers like Costco (NASDAQ: COST) and Walmart (NYSE: WMT) are on an upswing as more and more customers resume shopping at these stores post the rollout of vaccines and relaxation of COVID-19 curbs.

Tighter consumer budgets due to growing inflation have pushed more and more shoppers to these stores, which are offering deep discounts.

As a result, consumers continue to flock to these enormous stores augmenting sales for these retailers despite supply challenges-related container delays, increased labor and freight costs, and other constraints affecting deliveries.

Likewise, shares of Costco and Walmart have gained over 10% in the past month, outperforming the benchmark performance significantly.

Let us compare Walmart and Costco, and discuss what Wall Street analysts think about the prospects of these two retail behemoths.

Walmart

Walmart Inc. is an American multinational retailer that operates a chain of hypermarkets, discount department stores, grocery stores as well as Sam’s Club retail warehouses. As of January 31, 2022, Walmart had 10,593 stores and clubs across 24 countries.

Walmart posted upbeat fourth-quarter results in mid-Feb in the wake of a strong upsurge in demand leading to robust momentum across all three business segments, along with a 2% hike in its annual dividend for the 49th consecutive year to $2.24 per share, reflecting a quarterly dividend of $0.56 per share.

Similarly, through the shares worth $9.8 billion repurchased during the FY22, Walmart returned a whopping $16 billion to shareholders, including dividends, implying an impressive 3.9% return of the company’s current market capitalization to the shareholders in a span of 12 months. The company also announced share buybacks of at least $10 billion in the current fiscal year.

Recently, Morgan Stanley analyst Simeon Gutman reiterated a Buy rating on Walmart with a price target of 167 (11.43% upside potential).

Gutman guided investors’ attention to Walmart’s Fintech startup, ONE, which he believes is an “affordable and broadly accessible digital platform”. He forecast the “financial services super app” from ONE to potentially create a $1.6B revenue opportunity.

He further favors the impressive range of alternative revenue streams at Walmart including advertising, healthcare, fulfillment/delivery services, and its third-party marketplace.

The rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 17 Buys and seven Holds. The average Walmart price forecast of $163.48 implies 9.1% upside potential to current levels.

COSTCO

Costco Wholesale Corporation is an American retailer that operates membership-only, big-box retail discount stores including warehouse clubs or wholesale clubs.

Bulk quantities of merchandise are sold at deeply discounted prices to Costco club members who pay an annual membership fee. The company operates 829 warehouses in the United States.

Costco recently reported stronger-than-expected results for the fiscal second quarter ended February 13, 2022.

Coming out positive from a virtual call with COSTCO CFO Richard Galanti, Oppenheimer analyst Rupesh Parikh increased the price target on Costco Wholesale to $620 from $580. The price increase implies a 7.6% return to investors from current levels.

Costco remains a “top-pick” for Parikh as he favors the company’s “strong value proposition in a highly inflationary backdrop, a thriving fuel business, and reopening tailwinds in categories such as travel and apparel.”

The company known for deep discounts is offering gas at $3.87, much below the pricing at most stations at $4.15+, as noted by Parikh.

The analyst concurred that while the price gap can have a negative impact on Costco’s margins, “strong gallon growth and traffic gains at stores” will be able to offset the margin compression.

Another analyst, Scot Ciccarelli from Truist Securities, agrees and expects gasoline sales/mix to increase tremendously in the coming months based on higher gas prices and higher sales volume “as customers seek Costco’s rock-bottom pricing”.

Ciccarelli reiterated a Buy rating with a $603.00 price target on Costco Wholesale, implying a 4.6% upside potential.

Overall, the Street’s sentiment on Costco stock is bullish, with a Strong Buy consensus rating based on 12 Buys and four Holds. The average Costco price target of $583.73 suggests that the shares are fairly valued at current levels.

Conclusion

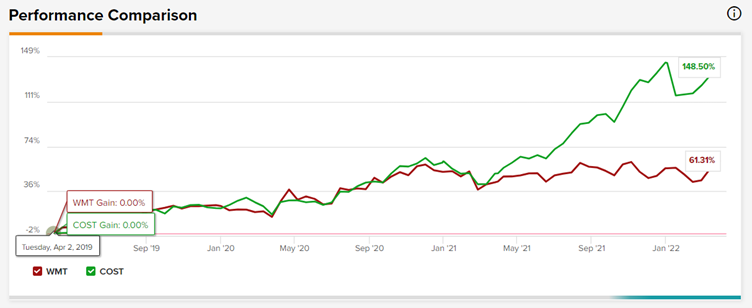

According to the TipRanks stock comparison tool, Costco shares have fared better than Walmart shares over the past year. In good times, consumers shop at Costo, and they shop even more during bad times.

Costo is the best place to get things at even cheaper prices as consumers look to cut their spending budgets, especially in these difficult times of rising inflation and other uncertainties.

Meanwhile, Walmart’s continued return of value to shareholders via dividends and increased buybacks, as well as its diversified business model remains attractive to investors.

Given its strong value-proposition provided to its members, especially in the ongoing inflationary environment and the Street’s bullish stance, Costco seems to be a better pick than Walmart in the retail space.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure