Costco Wholesale Corporation (NASDAQ:COST) is set to report its fourth quarter and full year Fiscal 2022 results after the market closes tomorrow. Costco is an American membership-only warehouse club offering groceries, appliances, toys, hardware, apparel, and other items.

The Street expects Costco to post diluted earnings of $4.17 per share in Q4, much better than its comparative prior year period’s diluted earnings of $3.76 per share. Meanwhile, revenue is pegged at $71.98 billion, representing year-over-year growth of 14.85%, as well as significantly higher than Q3FY22 revenue of $52.60 billion.

The retailer’s offerings are considered bargain buys, and despite the inflationary pressures, Costco seems to be benefiting from the growing sale of both groceries and non-food items.

Costco’s August Sales Numbers were Impressive

On August 31, Costco released its sales numbers for August 2022 along with the quarterly and annual numbers. For August, Costco reported net sales of $17.55 billion, up 11.4% compared to August 2021. Similarly, comparable sales for August jumped 10.1%, with e-commerce growing 3.9%.

For the quarter ending August 28, 2022, Costco posted net sales of $70.8 billion, up 15.3% year-over-year. Comparable sales for the quarter grew 13.7%, and excluding the impact of gas and foreign exchange, the figure rose 10.4%.

Moreover, for the full year of Fiscal 2022, the company reported net sales of $222.7 billion, growing 15.9% annually. Similarly, comparable sales for the fiscal rose 14.4% annually and 10.6%, excluding the impact of gas and foreign exchange.

The department store has made impressive progress in the final quarter of its current Fiscal year. The above numbers are more or less in sync with the analyst’s expectations. This indicates that Costco may report its final quarterly results in line with, if not above, analysts’ expectations.

Is Costco a Buy, Sell or Hold?

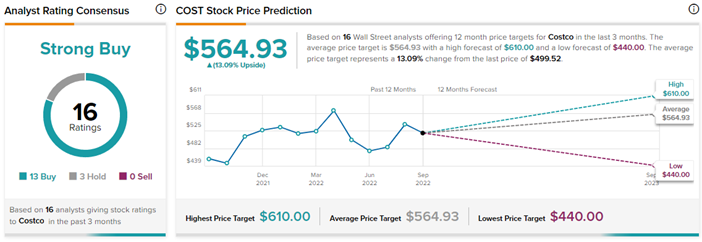

Wall Street analysts are highly optimistic about Costco’s future potential. On TipRanks, COST stock commands a Strong Buy consensus rating. This is based on 13 Buys versus three Holds. The average Costco Wholesale price forecast of $564.93 implies 13.1% upside potential to current levels.

Similarly, hedge funds have a high conviction in COST stock. TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Costco Wholesale is currently Very Positive. 35 hedge funds have increased their cumulative holdings of COST stock by 1.2 million shares in the last quarter.

Costco’s Website Traffic Infuse Optimism

TipRanks’ Website Traffic tool indicates that the total estimated global visits to costco.com grew 2.65% in Q4FY22 compared to the same period last year. Also, the number grew by 3.72% compared to the third quarter. These factors, coupled with the conviction of analysts and hedge funds, point to a positive quarter for Costco.